Cryptocurrency investors Tyler and Cameron Winklevoss state savvy investors constitute a vital part of bitcoin’s bull run this year. Thus, rupturing this rally from the early growth and failure of bitcoin. According to the Winklevoss twins, Bitcoin’s current bull run is distinct from the last one (2017 boom); the twins highlighted the reasons behind it. The twins consider that this recent bitcoin rally is sustainable. The crypto world experienced a new craze level following the bitcoin’s rally crossing its previous all-time high.

The wave that saw bitcoin surpassing a new milestone facing differing views on how the digital coin was urged to accomplish that. Crypto experts didn’t notice any error with Bitcoin’s surge as characteristics of the digital coin came into play. Current reports state that the recent bull run is certainly distinct from the last one; besides that, the difference mentioned is not the same as the one from the Winklevoss twins.

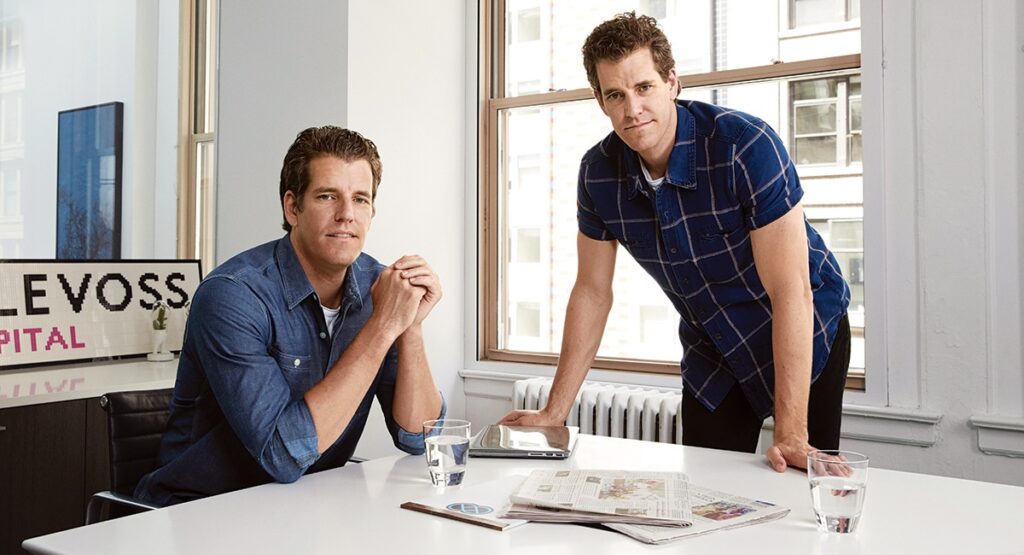

Winklevoss Twins: Institutional Investors are tech-savvy investors

The twins understand that this current rally is sustainable in contrast to that of the last one. The earlier one witnessed the price experience series of falls. The Winklevosses state that institutional investors are fairly tech-savvy investors. They purchase millions of Bitcoin and utilize them in a completely distinct way from the average cryptocurrency investor.

Tyler Winklevoss, CEO of cryptocurrency exchange Gemini, declared that these investors performed a crucial part in the bitcoin bull run. He further states that they are the most intelligent people in the room, the most advanced investors that no one’s learned about, purchasing millions of Bitcoin quietly.

Besides, Tyler also pointed out the increased money supply concerning US dollars.

“That’s why a lot of people have fled to bitcoin … because it’s unclear how the dollar gets off this track of debt and printing, and what it’s actually going to be worth in the future, if anything at all,”

Further, Tyler mentioned billionaire hedge fund managers like Stanley Druckenmiller and Paul Tudor Jones and publicly traded companies like Square and MicroStrategy as a sophisticated investor component. He revealed that these personalities were absent through the 2017 bitcoin growth and constitute the cause why prevailing Bitcoin rally isn’t retail-driven.

Tyler unveiled that Square and MicroStrategy are amongst million dollar companies transforming their treasury cash into bitcoin. MicroStrategy purchased 38,250 BTC this year. This was following the acquisition of 4,709 BTC by an American mobile payment and financial services company, Square.

Follow BitcoinWorld for latest updates.