Winklevoss Twins Explain Why Bitcoin’s Current Bull Run is Different from 2017

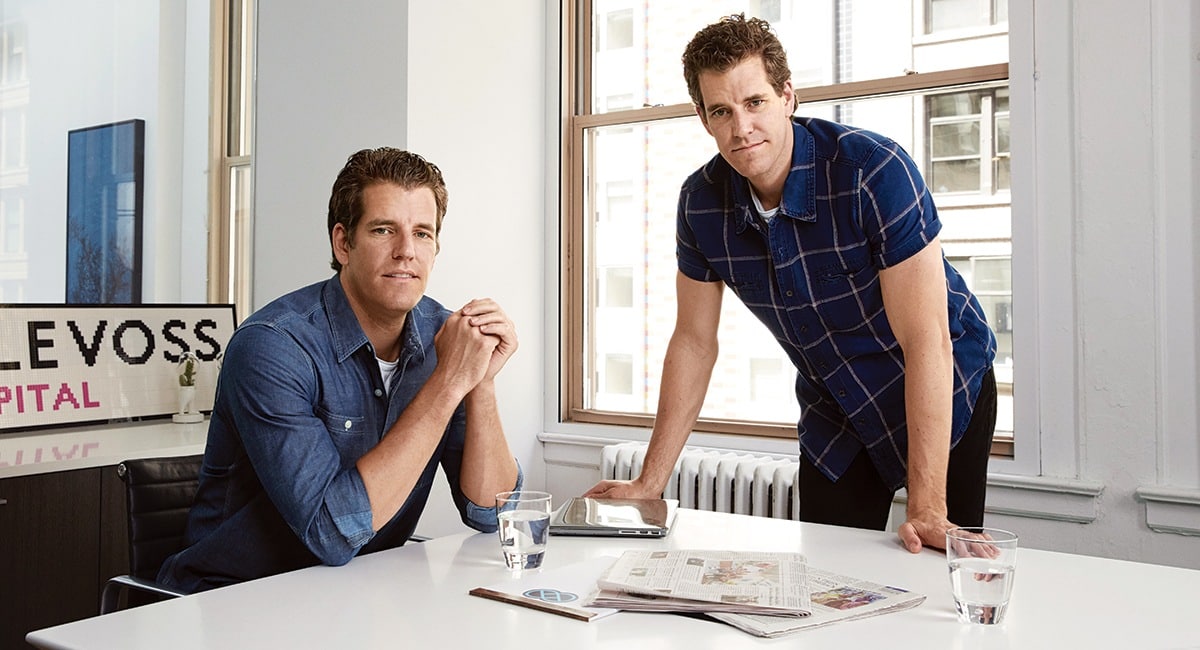

The Winklevoss twins, Tyler and Cameron, have shared their insights into why Bitcoin’s current bull run is fundamentally different from the 2017 cryptocurrency boom. As co-founders of Gemini, one of the leading cryptocurrency exchanges, the Winklevoss twins are well-positioned to analyze the evolution of Bitcoin’s price trajectory and its market dynamics. According to them, institutional investors, including tech-savvy hedge fund managers and large companies, are driving the recent surge, making this rally more sustainable compared to the previous market peaks.

The twins also highlighted the role of increased money supply and institutional adoption as key factors behind the recent rally. They argue that Bitcoin’s recent surge in value is not a short-term speculative bubble but a long-term trend driven by sophisticated investors.

Institutional Investors Driving Bitcoin’s Current Bull Run

The Winklevoss twins believe that institutional investors—ranging from hedge fund managers to publicly traded companies—have played a critical role in the current Bitcoin bull run. Unlike the 2017 rally, which was primarily driven by retail investors and speculators, this year’s rally is fundamentally different because of the increased involvement of tech-savvy investors. These institutional players are purchasing Bitcoin in large amounts, not just as a speculative asset but as a hedge against inflation and currency devaluation.

According to Tyler Winklevoss, CEO of Gemini, these investors are some of the “most intelligent people in the room” and are quietly amassing millions of Bitcoin. The Winklevoss twins emphasized that these sophisticated players operate very differently from individual crypto traders. They don’t drive the market through emotional trading or short-term speculation, but rather approach Bitcoin as part of a long-term investment strategy.

Tyler elaborated on this point, stating that these investors are not driven by the same impulses that characterized the 2017 boom. Instead, they are making substantial purchases of Bitcoin to store value and diversify their portfolios. This shift in the market’s buyer base has been a significant factor in the sustainability of this current bull run.

The Influence of Increased Money Supply on Bitcoin’s Appeal

One of the driving forces behind the growing adoption of Bitcoin by institutional investors is the increase in the U.S. dollar money supply. As governments around the world, particularly the United States, print more money to combat the economic impact of the COVID-19 pandemic, many investors are seeking refuge in assets that are less susceptible to inflation.

Tyler Winklevoss pointed out that Bitcoin has become an appealing asset for investors concerned about the future value of the dollar. With the U.S. government’s massive stimulus packages and rising debt levels, many people are uncertain about the dollar’s long-term stability. This uncertainty has led a growing number of investors to turn to Bitcoin as a store of value.

Tyler’s comments reflected a broader sentiment among investors who view Bitcoin as a safe haven asset, much like gold. He further stated, “That’s why a lot of people have fled to Bitcoin… because it’s unclear how the dollar gets off this track of debt and printing, and what it’s actually going to be worth in the future, if anything at all.”

This view is shared by many high-profile investors, such as Stanley Druckenmiller and Paul Tudor Jones, who have publicly endorsed Bitcoin as a hedge against fiat currency inflation. Square and MicroStrategy—two major companies—have also allocated significant portions of their treasury cash into Bitcoin, further validating the cryptocurrency’s appeal among institutional players.

The Role of Publicly Traded Companies in the Bitcoin Bull Run

One of the most notable aspects of the current Bitcoin rally is the involvement of publicly traded companies. Companies like Square and MicroStrategy have made substantial investments in Bitcoin, signaling a growing shift toward the institutional adoption of digital assets.

For example, MicroStrategy, a business intelligence firm, has purchased 38,250 BTC as part of its treasury strategy. This is a clear indication that Bitcoin is now being viewed as a legitimate asset by publicly traded companies, especially those seeking to diversify their portfolios away from traditional fiat currencies. Square, the mobile payments company led by Jack Dorsey, has also joined the ranks of large companies investing in Bitcoin, purchasing 4,709 BTC earlier this year.

These companies are not simply speculating on Bitcoin’s price movements; instead, they are taking a strategic approach to Bitcoin’s potential as a long-term store of value. This shift toward Bitcoin as a corporate treasury asset marks a significant departure from the retail-driven rally seen in 2017, making the current bull run more resilient and sustainable.

Why the 2020 Bitcoin Rally is Different from 2017

The Winklevoss twins emphasize that the current Bitcoin bull run is fundamentally different from the 2017 bubble. The previous rally, which saw Bitcoin’s price surge to an all-time high of nearly $20,000, was largely driven by speculative retail traders who were quick to sell once the market started to show signs of overheating. This led to a rapid decline in Bitcoin’s price in the following months.

In contrast, the current rally is underpinned by a solid foundation of institutional interest, with companies, hedge funds, and sophisticated investors increasingly viewing Bitcoin as a serious asset class. The increased involvement of these investors suggests that the current rally is sustainable and that Bitcoin is becoming more widely accepted as a store of value and hedge against traditional financial systems.

The Future of Bitcoin and Institutional Involvement

Looking ahead, the Winklevoss twins remain optimistic about Bitcoin’s future, highlighting that institutional adoption is still in its early stages. As more companies and hedge funds turn to Bitcoin as a store of value and inflation hedge, the cryptocurrency could become a mainstream asset class.

Furthermore, the growing regulatory clarity surrounding digital assets is likely to further bolster institutional participation. As governments and regulators develop clearer frameworks for cryptocurrencies, it is expected that more large institutions will feel comfortable allocating capital into Bitcoin and other digital assets.

Conclusion: The Institutional-Driven Bitcoin Bull Run

The 2020 Bitcoin bull run is significantly different from the 2017 rally, thanks to the involvement of institutional investors and sophisticated players who are approaching Bitcoin as a long-term investment and hedge against inflation. As companies like Square and MicroStrategy continue to allocate treasury cash into Bitcoin, the cryptocurrency is gaining recognition as a legitimate asset class. The Winklevoss twins believe that the current rally is more sustainable and marks the beginning of a new era for Bitcoin in the broader financial ecosystem.

With increasing institutional adoption, growing regulatory clarity, and a growing belief in Bitcoin’s long-term potential, the future looks bright for Bitcoin and the cryptocurrency market as a whole.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.