WisdomTree, one of the world’s largest Exchange Traded Fund (ETF) managers with $94B in assets, is the first to include Bitcoin in a commodity ETF.

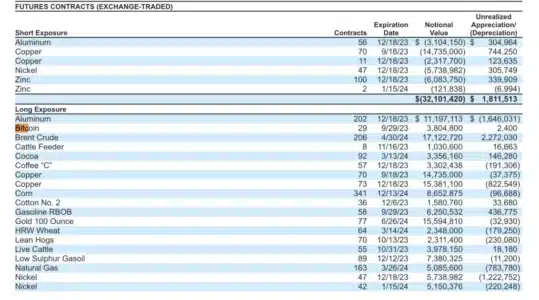

The WisdomTree Enhanced Commodity Strategy Fund (GCC) previously concentrated its investments on only four commodity sectors: energy, agriculture, industrial metals, and precious metals.

However, it now accepts Bitcoin. Only Bitcoin, accounting for 5% of the fund’s assets, is invested in.

The fund has around $200M in assets and $4M in bitcoin, making it the first commodity ETF that, as far as we know, includes cattle and copper with crypto.

WisdomTree’s Managed Futures Strategy Fund (WTMF) now includes Bitcoin. This is a diverse fund that invests in stocks, commodities, currencies, and interest rates, and it now has approximately $4M in Bitcoin.

Read Also: Bitrace Highlights Risks Associated With Telegram Exchange Bots

At the beginning of this year, BlackRock included bitcoin in their Global Allocation Fund, Morgan Stanley in their Europe Opportunity Fund, and Saba Capital in their Income & Opportunities Fund.

These funds generally tend to mirror global expansion, investing in almost everything with the goal of diversification.

Bitcoin’s inclusion in even these diverse funds, however, remains minimal because fund managers have just recently begun allocating it, with academic research indicating that at least 1% must be invested.

The advent of commodity ETFs suggests that the market for this passive exposure is much larger, with commodity ETFs estimated to be worth around $200B.

At 1%, that equates to $2B in Bitcoin. WisdomTree has chosen 5%, whereas the others indicated above have chosen 1%. That’s halfway between the 1% advised by academic research when they first started looking into bitcoin’s function in risk adjusted returns and the 10% they now propose.

At 5%, Bitcoin can expect $10B inflows from commodity ETFs alone. Gradually, of course, with WisdomTree using cash settled futures. It says:

“The Enhanced Commodity Strategy Fund (“GCC”) and Managed Futures Strategy Fund (“WTMF”) each invest up to 5% of its net assets in bitcoin futures contracts.

GCC and WTMF only invest in cash-settled bitcoin futures traded on the Chicago Mercantile Exchange, which is a futures exchange registered with the Commodity Futures Trading Commission.”

The Morgan Stanley Europe Opportunity Fund invests in GBTC, or spot bitcoin, whereas the BlackRock Global Fund invests in cash futures.

Accredited investors limited GBTC has applied to convert to a freely traded exchange fund, and BlackRock has applied to provide a bitcoin spot ETF.

As a result, some fund managers may be waiting for a freely traded bearer asset in stock form before deploying BTC to diversified or commodities funds.

Not least because Bitcoin allocation in passive funds is a new trend in any case, and it is likely that it will be incorporated in all of them where diversity or commodities is the focus when institutional investors begin to enter the stage.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.