Another day, another DeFi exploit shaking the crypto world. This time, Web3 lending app Wise Lending is reeling from a significant security breach. Just as the new year kicks off, bad actors continue to target decentralized finance protocols, and Wise Lending is the latest victim to lose a substantial amount of funds. In a flash loan attack that unfolded on January 12th, the platform was drained of a hefty 170 Ether (ETH), translating to approximately $440,000 at current market prices. Let’s dive into the details of this latest crypto heist and understand what went wrong.

What Happened to Wise Lending? The Anatomy of the Attack

Initial reports suggest that the exploit leveraged a classic DeFi vulnerability: oracle price manipulation. It appears the attacker skillfully manipulated price feeds using a flash loan to execute the exploit. But what exactly does this mean?

- Flash Loans: Imagine borrowing a massive amount of cryptocurrency without any collateral, as long as you return it within the same transaction block. That’s a flash loan. They are legitimate tools in DeFi, but in the wrong hands, they can be weapons.

- Oracle Price Manipulation: DeFi protocols rely on oracles to get real-world price data. If an attacker can manipulate these price feeds, they can trick the protocol into making unfavorable decisions, like lending out more assets than they should.

- The Wise Lending Exploit: In this case, it’s suspected the attacker used a flash loan to temporarily inflate or deflate the price of an asset within Wise Lending’s system. This allowed them to borrow assets at an artificially low valuation and then drain funds.

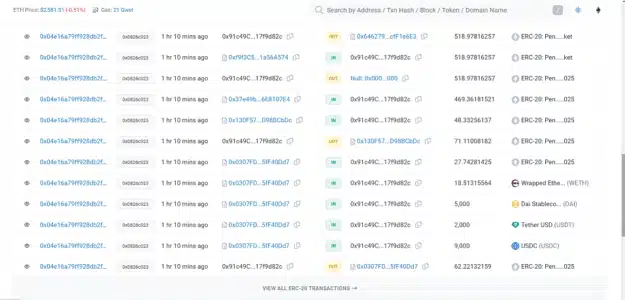

Blockchain data confirms the attack occurred at 7:29 pm UTC. The attacker utilized an unverified smart contract, identified by an address ending in ‘d82c’, to execute the fund drainage. You can see the transaction details here on Etherscan.

See Also: Zurich-based Bank, UBS, Steps Into Cryptocurrency, Trades Bitcoin ETFs

Before the main exploit, the attacker’s contract address received a variety of tokens, including:

- $9,000 USD Coin (USDC)

- $2,000 Tether (USDT)

- $5,000 Dai (DAI)

- 18.51 Wrapped Ether (WETH)

- Various Pendle Finance-related tokens

You can explore the token transfers to the attacker’s contract address on Etherscan to get a clearer picture of the asset movements.

Further investigation reveals that the attacker borrowed a significant 1,110 Lido Staked Ether (stETH) tokens, valued at approximately $2.9 million, from the Aave lending protocol as part of this elaborate scheme. This large flash loan from Aave is a common tactic used by exploiters to amplify their manipulation capabilities.

Community Reacts: What Security Experts are Saying

The crypto security community was quick to respond to the Wise Lending exploit. Pseudonymous blockchain security researcher Spreek was among the first to raise the alarm, tweeting: “Looks like Wise Lending exploited for ~170 eth.”

Looks like Wise Lending exploited for ~170 eth https://t.co/j5yRzfm5gq

— Spreek (@spreekaway) January 12, 2024

Spreek further speculated that a vulnerability related to a new Pendle Finance derivative token might be at the heart of the exploit. This highlights the risks associated with complex DeFi instruments and their potential attack surfaces.

Officer’s Notes, another respected security researcher, echoed the sentiment of growing concern in the DeFi space, simply commenting, “Another day, another exploit.” This highlights the unfortunately frequent nature of these incidents in the current crypto landscape.

Another day, another exploit https://t.co/ogYw4o35nT

— Officer's Notes 📝 (@officer_cia) January 12, 2024

Officer’s Notes elaborated, suggesting the vulnerability might stem from a 7% price fluctuation between stETH and ETH within a specific pool, triggered by the “b/c of AAVE v2 stETH flashloan.” This points to the intricate dependencies and potential cascading effects within DeFi ecosystems.

Likely b/c of AAVE v2 stETH flashloan that made stETH/ETH pool on @Pendle_fi swing 7% https://t.co/ogYw4o35nT

— Officer's Notes 📝 (@officer_cia) January 12, 2024

DeFi Exploits in 2024: A Troubling Trend

Unfortunately, the Wise Lending exploit is not an isolated incident. The year 2024 has barely begun, but decentralized finance protocols have already suffered losses of at least $5 million due to exploits. This alarming trend underscores the persistent security challenges within the DeFi space.

Just days prior, on January 3rd, Radiant Capital experienced a significant blow, losing over $4.5 million in an exploit. The very next day, liquidity manager Gamma Protocol also fell victim, losing over $400,000. These back-to-back incidents paint a concerning picture of the current DeFi security landscape.

See Also: Argentina Registers First Lease Agreement Denominated In Bitcoin

Looking back, 2023 was a year plagued by crypto crime, with over $1.8 billion lost to hacks, scams, and exploits, according to blockchain security platform Certik. While the industry is constantly evolving and security measures are improving, these recent events serve as a stark reminder that vulnerabilities still exist and attackers are becoming increasingly sophisticated.

Key Takeaways and Looking Ahead

The Wise Lending exploit, along with other recent DeFi attacks, highlights some crucial points:

- Oracle Security is Paramount: DeFi protocols must prioritize robust oracle security measures to prevent price manipulation attacks.

- Flash Loan Risks Persist: While flash loans are innovative tools, their potential for exploitation needs to be carefully managed through risk controls and monitoring.

- Complexity Introduces Vulnerabilities: The increasing complexity of DeFi protocols, especially with derivative tokens and interconnected systems, can create new and unforeseen attack vectors.

- Continuous Vigilance is Essential: Both DeFi developers and users must remain vigilant and proactive in identifying and mitigating security risks. Regular audits, security monitoring, and community awareness are crucial.

The DeFi space is still nascent and rapidly evolving. While exploits like the one targeting Wise Lending are undoubtedly setbacks, they also serve as valuable learning experiences. The industry must learn from these incidents, strengthen security practices, and work towards building a more resilient and secure decentralized financial future. As 2024 unfolds, expect to see an increased focus on DeFi security and ongoing efforts to protect users and their assets from these evolving threats.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.