The world of stablecoins, once seen as the calm harbor in the often turbulent crypto seas, has recently experienced some significant ripples. Specifically, USD Coin (USDC), a leading stablecoin issued by Circle, has seen a noticeable dip in its market valuation. What’s behind this shift, and what does it signal for the broader crypto landscape? Let’s dive in.

The Numbers Don’t Lie: A Look at USDC’s Market Cap Decline

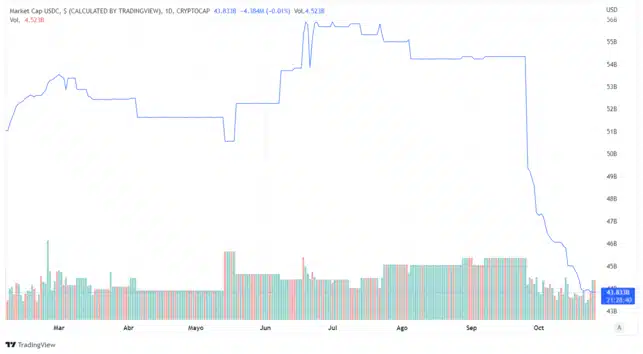

Over the past month, USDC’s market capitalization has shrunk considerably. We’re talking about a drop from a high of $53.3 billion to just under $43.9 billion. That’s almost a 20% decrease! And the impact of this was particularly felt on September 26th, when nearly $5 billion flowed out in a single day, representing a staggering 9.2% loss of its total capitalization.

To put this into perspective, this single-day outflow could represent USDC’s most significant shrinkage to date. The stablecoin reached its peak market cap in July, hitting a comfortable $55.8 billion. So, what triggered this downturn?

USDC market capitalization, Source: Tradingview

The Tornado Cash Effect: A Turning Point for USDC?

While the decline began in July, a pivotal moment appears to be the decision to freeze over 75,000 USDC linked to 44 addresses associated with the controversial crypto mixer, Tornado Cash. This move sparked considerable debate and seems to have triggered a wave of withdrawals.

Circle blacklisting ethereum addresses is an attack on open, permissionless blockchains. https://t.co/Rz92EY2Nyd

— banteg (@bantg) August 8, 2022

Why Did Freezing Tornado Cash Addresses Cause Such a Stir?

The freezing of these funds raised concerns about centralization and censorship within the decentralized finance (DeFi) space. Here’s why:

- Centralized Control: Circle’s ability to freeze funds highlights the inherent centralization of USDC. Unlike truly decentralized cryptocurrencies, USDC’s value is pegged to the US dollar and is managed by a central entity.

- Privacy Concerns: The action was viewed by some as an infringement on privacy rights. While the intention may have been to combat illicit activities, the broad sweep raised questions about due process and the potential for overreach.

- Impact on DeFi: The incident underscored the potential vulnerabilities of DeFi protocols that rely heavily on centralized stablecoins like USDC.

MakerDAO’s Response: A Case Study in Decentralization Concerns

The implications of Circle’s actions resonated deeply within the DeFi community, particularly with projects like MakerDAO. MakerDAO, a prominent decentralized autonomous organization (DAO), held a significant portion of its reserves in USDC. They viewed the freezing of funds as a concerning precedent, highlighting the risks associated with relying on centralized stablecoins.

This led to serious discussions within MakerDAO about reducing or even eliminating their reliance on USDC. The core argument was that the inherent centralization of USDC meant it could be subject to external pressures and regulatory actions, potentially mirroring the fate of the Tornado Cash-linked wallets.

A Twist in the Tale: MakerDAO’s Strategic Move with Coinbase

However, the story doesn’t end there. In a somewhat surprising turn of events, MakerDAO recently approved a new plan involving Coinbase’s institutional custody platform. The DAO will deposit up to $1.6 billion of its USDC reserves on Coinbase Prime, earning a 1.5% reward in the process.

What Does MakerDAO’s Coinbase Decision Signify?

This move suggests a nuanced approach from MakerDAO. While concerns about centralization remain, the potential benefits of partnering with a reputable institution like Coinbase seem to have outweighed the immediate desire to completely divest from USDC. This could indicate:

- Seeking Yield: The 1.5% reward offered by Coinbase is an attractive incentive, especially in the current market climate.

- Strategic Partnership: Collaborating with Coinbase could offer MakerDAO increased security and regulatory compliance.

- Continued Belief in USDC’s Utility: Despite the concerns, MakerDAO likely still recognizes the widespread adoption and utility of USDC within the crypto ecosystem.

Looking Ahead: What’s Next for USDC?

Despite the recent market cap decline and the controversies surrounding the Tornado Cash sanctions, it’s clear that significant players in the crypto space are still placing bets on USDC’s future. While the event served as a stark reminder of the complexities and potential pitfalls of centralized stablecoins, USDC remains a dominant force in the market.

Key Takeaways:

- The freezing of USDC linked to Tornado Cash addresses triggered a significant drop in USDC’s market capitalization.

- This event highlighted the ongoing debate about centralization versus decentralization in the crypto space.

- Major DeFi protocols like MakerDAO are actively considering the implications of relying on centralized stablecoins.

- Despite concerns, strategic partnerships and yield opportunities are keeping USDC relevant.

In Conclusion: Navigating the Evolving Stablecoin Landscape

The recent fluctuations in USDC’s market capitalization serve as a crucial reminder of the dynamic and ever-evolving nature of the cryptocurrency market. The interplay between regulation, decentralization, and market forces continues to shape the future of stablecoins. While challenges remain, the resilience and adaptability of projects like MakerDAO, alongside the continued utility of USDC, suggest that stablecoins will remain a vital component of the digital asset ecosystem. The key lies in finding the right balance between stability, security, and the core principles of decentralization that underpin the crypto revolution.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.