Imagine finding a treasure chest you buried over a decade ago, only to discover it’s now worth millions! That’s essentially what happened in the Bitcoin world recently. A Bitcoin wallet, untouched since the early days of crypto in April 2010, suddenly sprung to life, moving a substantial amount of Bitcoin. Let’s dive into this intriguing on-chain event and explore what it means.

Sleeping Giant Awakens: 50 BTC on the Move After 14 Years

Thanks to the eagle-eyed analysis of Lookonchain, a prominent on-chain analytics platform, we learned about this fascinating transaction. A wallet that had been dormant for over 14 years, dating back to the nascent days of Bitcoin mining, decided to stir. It transferred a whopping 50 BTC – that’s Bitcoin mined when the block reward was a generous 50 BTC per block! In today’s market, this stash is worth a staggering $3.328 million.

A dormant address that received 50 $BTC in April 2010 transferred all 50 $BTC ($3.32M) out today.https://twitter.com/lookonchain/status/1779772457622388937#Bitcoin pic.twitter.com/Gvjumt7S6a

— Lookonchain (@lookonchain) April 15, 2024

Decoding the Transaction: Where Did the Bitcoin Go?

So, where did this treasure trove of Bitcoin end up? Lookonchain’s analysis reveals that the 50 BTC was split into two transactions:

- 17 BTC (Valued at $1.1 million): Sent to a wallet exhibiting frequent transaction patterns. This activity strongly suggests it’s linked to a cryptocurrency exchange, with Coinbase being a likely candidate. Further analysis points towards these funds being merged with other wallets associated with Coinbase, hinting at a deposit into the exchange.

- 33 BTC (Valued at $2.2 million): Transferred to a brand new wallet. This move is more cryptic. It could mean the original owner is simply shifting their funds to a new address for enhanced privacy, a common practice in the crypto world. Essentially, the Bitcoin might still be under the original miner’s control, just with a fresh address.

See Also: Solana Faces Decline in Open Interest as Longs Liquidated Amid Price Downturn

Why Now? Bitcoin’s Price Rebound and the Halving Hype

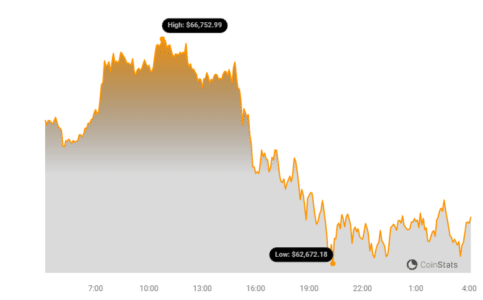

The timing of this dormant wallet’s activity is quite interesting. It coincides with Bitcoin’s recent recovery after a price dip. Bitcoin had briefly fallen from over $70,000 to around $62,000 over a weekend, but it’s since bounced back. As of now, Bitcoin is trading at approximately $64,109, showing a 0.5% increase in the last 24 hours.

Adding to the intrigue is the highly anticipated Bitcoin Halving, just around the corner in about 5 days on April 20th. But what exactly is the Halving, and why does it matter?

Bitcoin Halving: A Game Changer Explained

The Bitcoin Halving is a pre-programmed event that occurs roughly every four years, or after every 210,000 blocks are mined. Think of it as Bitcoin’s built-in mechanism to control its supply and maintain its scarcity. Here’s the gist:

- Reward Reduction: Bitcoin miners, who validate transactions and keep the network secure, receive a reward in BTC for each block they mine. The Halving cuts this reward in half.

- Controlled Supply: When Bitcoin launched in 2009, the block reward was 50 BTC. Thanks to previous halvings, it’s now much lower, and after the upcoming halving, it will be reduced again. This decreasing reward slows down the creation of new Bitcoin.

- Deflationary Nature: By reducing the rate at which new Bitcoin enters circulation, the Halving reinforces Bitcoin’s deflationary nature. Over time, this scarcity is expected to potentially drive up its value.

Halving Headwinds: Miners Facing Potential Billion-Dollar Losses

While the Halving is generally seen as positive for Bitcoin’s long-term value, it presents immediate challenges for Bitcoin miners. Recent reports suggest that BTC miners could face significant losses, potentially exceeding $10 billion, due to the upcoming event.

According to a Bloomberg report, several factors contribute to this pressure on miners:

- Increased Competition: Miners are facing growing competition, not just amongst themselves, but also from resource-intensive industries like AI.

- Power Constraints: Adam Sullivan, CEO of Core Scientific, highlights the increasing scarcity of affordable power in the US. Tech giants like Amazon are investing heavily in data centers, further straining power availability and driving up costs for miners.

- Profitability Squeeze: With the block reward halved, miners will earn less BTC for the same amount of work. Combined with rising energy costs and competition, this could significantly impact their profitability.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.