Solana (SOL) experienced a decline in open interest (OI) since April 12, as over $85 million in long positions were liquidated amid a sharp market downturn.

Solana (SOL) experienced a decline in open interest (OI) since April 12, as over $85 million in long positions were liquidated amid a sharp market downturn.

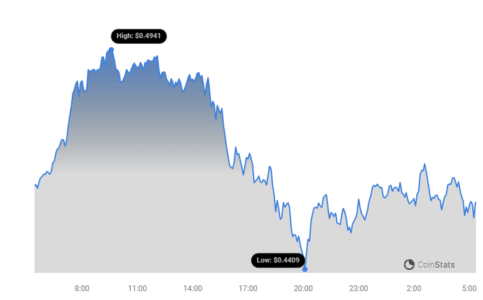

According to CoinGlass data, Solana’s OI stood at $1.62 billion on April 14, down approximately 21% from the previous day.

This came after SOL fell sharply from $172 to $117, losing over 30% in value on April 12 and 13.

OI measures the total value of all outstanding Solana futures contracts that remain unsettled across various exchanges.

See Also: Will Solana Update Fix The Current Network Congestion? Here’s What It Relies On

At the time of writing, the OI has since risen slightly to $2.04 billion, as Solana’s price recovered to $134.648, a 12% gain over the past 24 hours, as per Coinstats data.

Similar declines have been observed across the top 10 cryptocurrencies.

XRP experienced the most significant drop, losing 12.12% in the past 24 hours, followed closely by Dogecoin with a 10.86% decrease.

Cardano trailed slightly behind with a 10.20% decline.

These developments occur against the backdrop of ongoing network issues with Solana.

On April 9, intermittent congestion on the Solana blockchain led to the postponement of several crypto projects’ launches.

Solana developers are actively working on resolving these technical difficulties by April 15.

Users of the Solana blockchain have reported increasing concerns regarding network congestion and transaction errors in recent weeks.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN