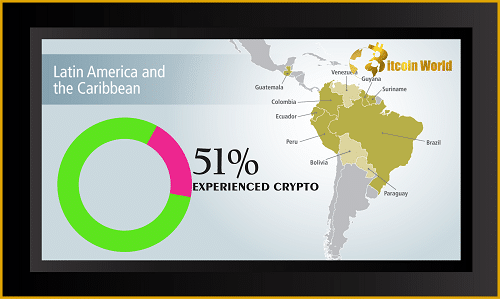

Over fifty percent of “consumers” in Latin America and the Caribbean (LAC), according to payments giant Mastercard, have already interacted with cryptocurrencies.

As part of its New Payments Index poll, the company claimed to have interviewed “more than 35,000 people “; with 51% of Latin American and Caribbean respondents claiming to have engaged in “at least one crypto-related activity in the past 12 months.”

In addition, “more than a third” of Latin American/Caribbean respondents had “made a payment ” using a stablecoin.

The survey also revealed that 54 percent of Latino and Caribbean consumers are “optimistic” regarding digital assets.

Sixty-six percent of respondents from Latin America and the Caribbean desired — more flexibility to use crypto and traditional payment methods interchangeably.

Moreover, 77% of those surveyed claimed they would be willing to utilise crypto more if they understood it better.

And 67% stated they would be willing to make or receive payments in cryptoassets provided tokens were backed by tradfi.

The poll suggests, however, that the region is an outlier. Globally, little more than a third of respondents indicated; they were “somewhat or very likely to attempt paying with crypto” in the next year. While fewer than six in ten said they “would feel more secure about crypto if it was issued or backed by a respected organization.”

Mastercard’s survey also revealed that digital payments are on the rise in Latin America, with 95% of respondents intending to utilise digital payment methods in the coming year. Almost one-third of respondents indicated that they have reduced their cash usage over the past year.

Digital payments

The survey’s results follow a flurry of investment in the region by Mastercard’s competitor Visa. This month, the latter launched a variety of crypto cards in Brazil and Argentina; in collaboration with significant local blockchain industry firms. More and more Latin Americans are interested in cryptocurrencies and want solutions that ease access to the crypto world.

He noted that Mastercard was currently developing “technologies to increase digital inclusion and relationships that assure operability and support.”