Is the crypto winter driving investors to seek safer harbors? While digital assets are generally retreating from exchanges to cold wallets amidst bearish market conditions, Bitfinex is experiencing a notable exception. Recent data paints a fascinating picture of stablecoin movement, and Bitfinex is standing out from the crowd. Let’s dive into what’s happening.

Record USDT Holdings for Bitfinex: What Does It Mean?

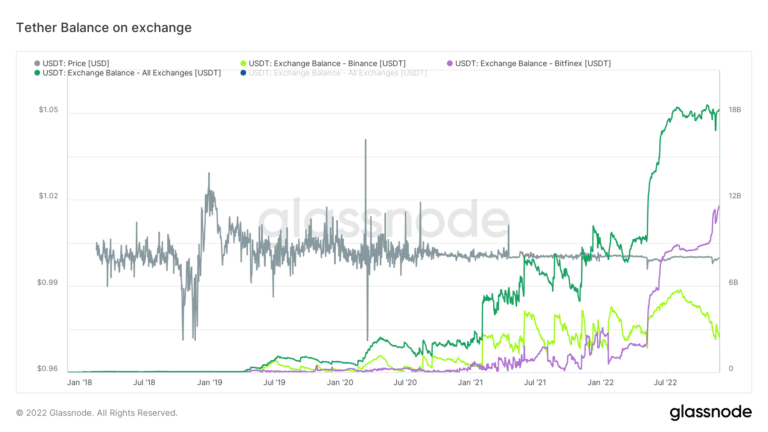

According to Glassnode, a leading on-chain data provider, Bitfinex’s Tether (USDT) holdings reached an all-time high on November 29th, soaring past the $11 billion mark. This is a significant development, especially when you consider the broader context of stablecoin movement in the crypto space.

To put this into perspective:

- Sizeable Share: Bitfinex now holds a considerable chunk of the total USDT on major exchanges, estimated at around $18 billion.

- Overall Exchange Holdings: Exchanges collectively hold about 60% of the total USDT supply.

- Cold Wallet Dominance: Despite exchange holdings, a substantial $30 billion worth of Tether is currently stored in cold wallets, indicating a general trend of moving assets off exchanges.

So, while the overall trend suggests a move away from exchanges, Bitfinex is witnessing a surge in USDT. Why is this happening?

Binance’s Stablecoin Strategy: A Different Approach

Interestingly, Binance, another major player in the crypto exchange arena, held over $5.5 billion in USDT. However, Binance made a strategic move to diversify its stablecoin portfolio, opting to convert half of its USDT holdings into its own stablecoin, Binance USD (BUSD). This highlights a contrasting strategy compared to Bitfinex’s increasing USDT accumulation.

Stablecoin Stability Under Scrutiny?

The recent market turmoil has undeniably impacted stablecoins. With the exception of Binance USD (BUSD), most stablecoins, including USDT, USDC, GUSD, and DAI, experienced slight de-pegging from the dollar, dipping by 1-2%. This minor fluctuation reflects the anxiety and uncertainty gripping the cryptocurrency market.

Here’s a quick look at stablecoin distribution across exchanges:

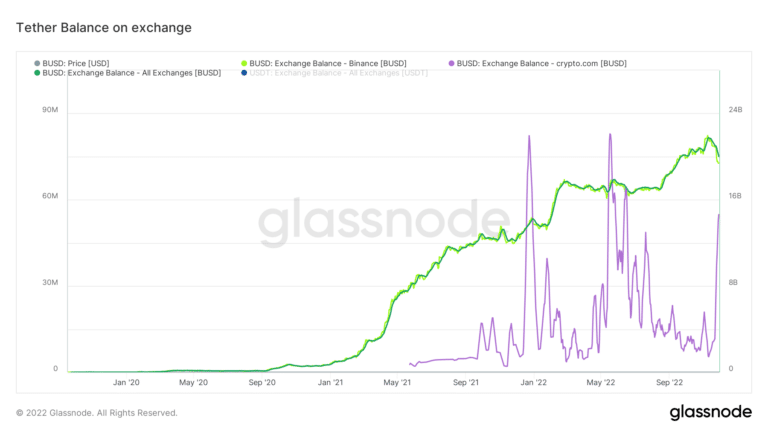

- BUSD Dominance on Binance: A whopping $20 billion in Binance USD (BUSD) is held across all exchanges, almost entirely concentrated on Binance itself. BUSD has notably maintained its dollar peg amidst the turbulence.

- Crypto.com’s BUSD Stake: Crypto.com holds a smaller portion of BUSD, around $50 million of the total supply.

Why Are Stablecoin Inflows Important?

Analysts often view stablecoin inflows as a potential catalyst for short-term cryptocurrency price increases. Think of it this way: stablecoins are the fuel for crypto trading. Increased stablecoin holdings on exchanges can indicate:

- Increased Purchasing Power: A higher volume of stablecoins means users have more funds readily available to buy digital assets.

- Potential Market Stimulus: These inflows can signal an upcoming wave of buying activity, potentially driving up cryptocurrency prices.

Bitfinex’s USDT Surge: A Flight to Safety or a Bullish Signal?

Bitfinex’s significant spike in stablecoin inflows could be interpreted in a couple of ways:

- Seeking a Secure Exchange: In a turbulent market, users might be seeking out established exchanges perceived as more secure to park their funds. Bitfinex, with its long history in the crypto space, could be seen as such a haven.

- Anticipating Market Opportunities: Alternatively, the inflow could suggest that users are positioning themselves to capitalize on potential buying opportunities in the cryptocurrency market, viewing Bitfinex as a platform to execute these trades.

Crypto.com’s BUSD Growth: Building for the Future?

Glassnode data also reveals a sharp increase in BUSD holdings on Crypto.com in November. This is noteworthy, especially in the aftermath of the FTX collapse. It suggests that Crypto.com is actively working to strengthen its platform and attract users, focusing on growing its order books despite the recent market setbacks.

Key Takeaways: What Does This Mean for You?

The diverging stablecoin strategies of major exchanges like Bitfinex and Binance, coupled with Crypto.com’s BUSD growth, offer valuable insights into the current crypto landscape. Here’s what you should consider:

- Monitor Stablecoin Flows: Keep an eye on stablecoin movements across different exchanges. These flows can provide clues about market sentiment and potential future price action.

- Exchange Security Matters: In times of uncertainty, exchange security and reputation become paramount. Bitfinex’s USDT inflow might reflect a preference for established platforms.

- BUSD’s Resilience: Binance USD’s ability to maintain its peg during market turbulence highlights the importance of stablecoin stability and diversification.

- Crypto.com’s Commitment: Crypto.com’s BUSD growth suggests a continued commitment to expansion and user acquisition, even amidst market challenges.

In Conclusion: Navigating the Crypto Currents

The cryptocurrency market remains dynamic and full of surprises. While the overall trend might point towards caution and movement to cold wallets, specific exchanges like Bitfinex are showing unique trends. By analyzing on-chain data, like that provided by Glassnode, and understanding stablecoin dynamics, we can gain a deeper understanding of the market’s undercurrents and make more informed decisions in this ever-evolving digital asset space. Keep learning, stay informed, and navigate the crypto currents wisely!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.