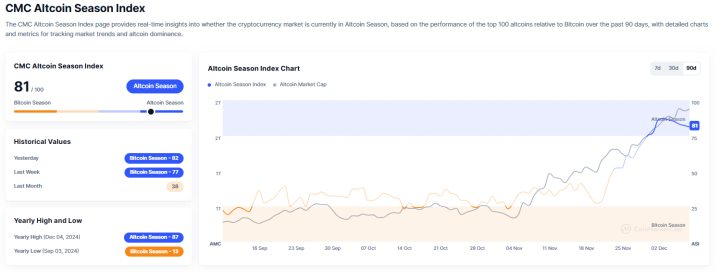

In the volatile realm of cryptocurrency markets, metrics such as the Altcoin Season Index serve as essential tools for gauging market sentiment and performance trends. On December 9, 2024, at 00:56 UTC, the Altcoin Season Index, monitored by CoinMarketCap (CMC), decreased by one point to reach 81. Despite this slight drop, the index firmly places the market within an Altcoin Season, indicating that the majority of altcoins are outperforming Bitcoin. This analysis delves into the implications of this metric, the factors driving current market trends, and what it means for investors and the broader cryptocurrency ecosystem.

Understanding the Altcoin Season Index

The Altcoin Season Index is a specialized metric designed to measure the performance of altcoins relative to Bitcoin. By excluding stablecoins and wrapped tokens, the index focuses on the top 100 cryptocurrencies by market capitalization as listed on CoinMarketCap. It evaluates their performance over the past 90 days, comparing it to Bitcoin’s performance. The index ranges from 1 to 100, with the following key indicators:

- Altcoin Season: When the index is above 75, indicating that at least 75% of the top 100 altcoins have outperformed Bitcoin.

- Bitcoin Season: When the index is 25 or below, meaning that 75% or more of the top 100 altcoins have underperformed Bitcoin.

Currently, with an index score of 81, the market is in a strong Altcoin Season, signifying robust performance by the majority of altcoins compared to Bitcoin.

Implications of the Altcoin Season Index at 81

1. Market Sentiment Shift

An index of 81 reflects a significant shift in market sentiment towards altcoins. Investors are showing increased confidence in a diverse range of cryptocurrencies beyond Bitcoin, indicating a broader belief in the potential of these digital assets. This shift suggests a maturation of the cryptocurrency market, where investors are looking to diversify their holdings rather than relying solely on Bitcoin as a store of value.

2. Investment Diversification

The high Altcoin Season Index encourages investors to diversify their portfolios by allocating more funds to altcoins. Diversification is a fundamental investment strategy aimed at reducing risk by spreading investments across various assets. In the context of cryptocurrencies, this means holding a mix of Bitcoin and altcoins, each with different use cases, technological innovations, and market potentials. By doing so, investors can capitalize on the growth of multiple projects and mitigate the impact of volatility in any single asset.

3. Altcoin Development and Innovation

A favorable Altcoin Season Index can act as a catalyst for further development and innovation within the altcoin space. Developers and project teams are incentivized to introduce new features, improve scalability, and enhance security to attract and retain investors. This competitive environment fosters innovation, leading to the creation of more robust and versatile cryptocurrencies that can address a wider range of use cases and challenges.

4. Impact on Bitcoin

While Bitcoin remains the leading cryptocurrency by market capitalization, its relative performance may be subdued during an Altcoin Season. Investors might seek higher returns from altcoins, leading to short-term price corrections for Bitcoin. However, Bitcoin’s fundamental value as a decentralized store of value and its dominance in the market may continue to support its long-term stability and growth.

Key Players Driving the Altcoin Season

Several altcoins are likely contributing to the strong performance indicated by the Altcoin Season Index. These include established projects as well as emerging ones that have gained significant traction.

1. Ethereum (ETH)

Ethereum continues to be a dominant force in the cryptocurrency space, driven by its robust smart contract platform and the expansion of decentralized applications (dApps). The successful rollout of Ethereum 2.0, aimed at improving scalability and reducing energy consumption, has bolstered investor confidence. Additionally, the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) on the Ethereum network has contributed to its strong performance.

2. Binance Coin (BNB)

Binance Coin, the native cryptocurrency of the Binance exchange, remains a key player in the market. BNB’s utility extends beyond the Binance ecosystem, including transaction fee discounts, participation in token sales, and use in various dApps. Its strong performance is supported by Binance’s continuous expansion and the growing adoption of its decentralized exchange (DEX).

3. Cardano (ADA)

Cardano’s focus on academic research and peer-reviewed protocols has positioned it as a strong contender in the smart contract space. Recent developments, such as partnerships with educational institutions and the launch of new decentralized applications, have enhanced its appeal to investors seeking long-term value.

4. Solana (SOL)

Solana’s high-performance blockchain, known for its scalability and low transaction costs, attracts projects and developers aiming to build efficient dApps. Solana’s growing ecosystem, driven by initiatives in DeFi, NFTs, and Web3, contributes to its robust market performance.

5. Polkadot (DOT)

Polkadot’s interoperability features, enabling different blockchains to communicate and share information, have made it a valuable asset in the multi-chain future of blockchain technology. Its parachain auctions and growing ecosystem of projects add to its strong performance in the market.

6. Avalanche (AVAX)

Avalanche’s consensus mechanism, which offers high throughput and low latency, has attracted numerous projects looking for scalable and efficient blockchain solutions. The platform’s focus on DeFi and institutional adoption further supports its market performance.

Market Trends and Analysis

Increased Participation in DeFi and NFTs

The surge in decentralized finance (DeFi) and non-fungible tokens (NFTs) has significantly boosted altcoin performance. Platforms enabling DeFi services and NFT marketplaces attract substantial investment, driving demand for their native tokens. The continued innovation in these sectors, including the development of more sophisticated financial instruments and digital art platforms, fuels investor interest and capital inflows.

Regulatory Developments

Positive regulatory developments play a crucial role in enhancing investor confidence. Clearer regulations and favorable policies in key markets reduce uncertainty, encouraging more participation from institutional and retail investors. For instance, the approval of Bitcoin ETFs and the establishment of regulatory frameworks for DeFi projects contribute to the overall bullish sentiment in the altcoin market.

Technological Advancements

Continuous technological advancements and the introduction of innovative features by altcoin projects enhance their utility and attractiveness. Improvements in scalability, security, and interoperability drive their adoption and market performance. Projects that successfully implement cutting-edge technologies and address existing limitations of blockchain systems are more likely to outperform, contributing to the Altcoin Season Index.

Macro-Economic Factors

Global economic conditions, including inflation rates, interest rates, and geopolitical tensions, influence cryptocurrency markets. In times of economic uncertainty, investors may turn to cryptocurrencies as a hedge against traditional financial risks. The decentralized and limited-supply nature of many altcoins positions them as attractive alternatives to fiat currencies and traditional investment vehicles.

Community and Ecosystem Growth

A strong and active community is essential for the success of any cryptocurrency project. Projects with vibrant developer communities, active social media engagement, and continuous ecosystem development are better positioned to sustain their growth and performance. The growth of partnerships, collaborations, and integrations with other blockchain projects also contributes to the overall strength of the altcoin market.

Potential Risks and Considerations

Market Volatility

While Altcoin Seasons can offer lucrative opportunities, they also come with heightened volatility. Rapid price movements can lead to significant gains but also substantial losses, particularly for newer or less established projects. Investors must navigate these fluctuations with a strategic approach, emphasizing diversification, risk management, and a long-term perspective.

Regulatory Uncertainty

Despite recent positive regulatory developments, uncertainty remains a key risk factor. Regulatory crackdowns or unfavorable policies in major markets can negatively impact altcoin performance and investor sentiment. Projects operating in regions with stringent regulations may face operational challenges, limiting their growth potential.

Project Sustainability

The long-term success of altcoins depends on their ability to deliver on promises, maintain active development, and adapt to market changes. Projects lacking in sustainability or failing to innovate may underperform or collapse, affecting the overall index. Investors should conduct thorough due diligence, assessing the fundamentals, development roadmap, and community support of each project.

Technological Risks

Blockchain technology, while revolutionary, is not without its challenges. Issues such as scalability, security vulnerabilities, and interoperability limitations can hinder the growth and adoption of altcoin projects. Projects must continuously address these technological challenges to remain competitive and attractive to investors.

Liquidity Constraints

Liquidity is a crucial factor for the smooth functioning of cryptocurrency markets. Low liquidity can lead to significant price swings and increased volatility, making it difficult for investors to enter or exit positions without impacting the market. Projects with limited trading volumes may struggle to sustain their price levels during periods of high volatility.

Future Outlook

As the cryptocurrency market continues to mature, the dynamics between Bitcoin and altcoins are likely to evolve. The current Altcoin Season, indicated by an index of 81, suggests a period of growth and opportunity for altcoins. However, maintaining this momentum requires continued innovation, effective risk management, and favorable market conditions.

Potential Developments

- Enhanced Interoperability: Projects focused on improving interoperability between different blockchains can drive the adoption of altcoins by facilitating seamless asset transfers and communication across networks.

- Integration with Traditional Finance: Bridging the gap between decentralized finance and traditional financial systems can enhance the utility and acceptance of altcoins. Partnerships with financial institutions, the introduction of crypto-backed financial products, and regulatory clarity can foster greater integration.

- Sustainability Initiatives: Addressing environmental concerns through energy-efficient consensus mechanisms and sustainable practices can enhance the appeal of altcoins, particularly among environmentally conscious investors.

Technological Innovations

The ongoing advancements in blockchain technology will continue to shape the future of altcoins. Innovations such as layer-two scaling solutions, decentralized governance models, and advanced smart contract capabilities can address existing limitations and unlock new use cases. Projects that successfully implement these innovations are likely to outperform, contributing to the sustained growth of the Altcoin Season Index.

Market Consolidation

As the market evolves, we may witness a consolidation of altcoins, where only the strongest projects survive and thrive. This process can lead to the elimination of weaker projects, thereby strengthening the overall quality and reliability of the altcoin market. Investors should remain vigilant, focusing on projects with strong fundamentals, active development, and supportive communities.

Institutional Involvement

Increased involvement from institutional investors can further drive the growth of altcoins. Institutions bring significant capital, expertise, and credibility to the market, contributing to the stability and maturity of the cryptocurrency ecosystem. As more institutions allocate funds to altcoins, the market may experience enhanced liquidity, reduced volatility, and sustained upward momentum.

Strategic Recommendations for Investors

Given the current market dynamics, investors looking to capitalize on the Altcoin Season should consider the following strategies:

1. Diversify Holdings

Diversification is a fundamental investment strategy aimed at reducing risk by spreading investments across various assets. In the context of cryptocurrencies, this means holding a mix of Bitcoin and altcoins, each with different use cases, technological innovations, and market potentials. By diversifying, investors can capitalize on the growth of multiple projects and mitigate the impact of volatility in any single asset.

2. Conduct Thorough Due Diligence

Before investing in any altcoin, investors should conduct thorough due diligence. This involves assessing the project’s fundamentals, including its use case, development roadmap, team expertise, community support, and partnerships. Understanding the project’s value proposition and its potential to address real-world problems can help investors make informed decisions.

3. Implement Risk Management Practices

Effective risk management is crucial in navigating the high volatility of cryptocurrency markets. Investors should set clear investment goals, define their risk tolerance levels, and implement strategies such as stop-loss orders and position sizing to protect against significant losses. Diversifying investments across different assets can also help manage risk.

4. Stay Informed and Adaptive

The cryptocurrency market is highly dynamic, with frequent technological advancements, regulatory changes, and market developments. Investors should stay informed about the latest news, trends, and updates in the market. This can involve following reputable news sources, engaging with the crypto community, and monitoring key metrics and indicators that influence market performance.

5. Adopt a Long-Term Perspective

Adopting a long-term investment perspective can help investors weather short-term volatility and capitalize on Bitcoin’s potential for substantial long-term gains. Focusing on the fundamental value and future prospects of cryptocurrencies can lead to more resilient investment strategies.

6. Leverage Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount of money into Bitcoin or altcoins at regular intervals, regardless of their price. This strategy reduces the impact of volatility and lowers the average cost per unit over time, making it a disciplined approach to building a diversified cryptocurrency portfolio.

7. Explore Hedging Strategies

Hedging strategies, such as using derivatives or holding stablecoins, can provide a buffer against Bitcoin’s price volatility. These strategies allow investors to manage risk and stabilize returns, even in volatile market conditions.

Historical Context: Growth of Bitcoin and Altcoins

To fully appreciate the current Altcoin Season, it’s essential to revisit the historical growth of Bitcoin and altcoins and their impact on the cryptocurrency market.

Early Developments

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency to successfully implement decentralized digital currency. It laid the foundation for the entire cryptocurrency ecosystem, demonstrating the feasibility of peer-to-peer digital transactions without the need for intermediaries.

The introduction of Bitcoin spurred the creation of numerous altcoins, each aiming to address perceived limitations of Bitcoin or to serve specific use cases. Early altcoins like Litecoin (LTC) focused on improving transaction speeds, while others like Ethereum (ETH) introduced smart contract functionality, enabling the development of decentralized applications (dApps) and the proliferation of decentralized finance (DeFi) platforms.

Milestones in ETF Growth

Over the past few years, Bitcoin ETFs have been a significant milestone in the mainstream acceptance of cryptocurrencies. An ETF, or Exchange-Traded Fund, allows investors to gain exposure to Bitcoin without directly holding the cryptocurrency. This financial instrument bridges the gap between traditional finance and the crypto market, making it easier for institutional and retail investors to participate.

The approval and launch of Bitcoin ETFs by major financial institutions have been pivotal in enhancing Bitcoin’s liquidity and legitimizing its status as a financial asset. These developments have contributed to the growing investor confidence in Bitcoin, supporting its price growth and adoption.

Current Position in the Market

Today, Bitcoin remains the leading cryptocurrency by market capitalization, serving as a benchmark for the broader crypto market. Its influence extends beyond its price movements, impacting the development and performance of altcoins. The continued growth and adoption of Bitcoin provide a solid foundation for the expansion of the entire cryptocurrency ecosystem.

The current Altcoin Season, with an index of 81, reflects a robust performance by altcoins, signaling a period of diversification and growth in the cryptocurrency market. This trend underscores the maturation of the market, where investors are increasingly looking beyond Bitcoin to explore the potential of a diverse range of digital assets.

The Role of Institutional and Retail Investors

Institutional Investors

Institutional investors, including hedge funds, asset managers, and publicly traded companies, have become increasingly significant players in the cryptocurrency market. Their involvement brings substantial capital, stability, and credibility to the market, influencing price dynamics and driving adoption.

Institutions view cryptocurrencies, particularly Bitcoin and select altcoins, as viable investment assets that offer diversification and potential hedging against traditional financial risks. Their strategic investments contribute to increased liquidity and market depth, supporting sustained growth and stability.

Retail Investors

Retail investors continue to play a crucial role in the cryptocurrency market, driven by the accessibility and potential for high returns. The proliferation of user-friendly trading platforms and mobile applications has made it easier for individual investors to participate in the market.

Retail investors contribute to market liquidity and volatility, often driving short-term price movements through trading activities. Their sentiment and behavior, influenced by news, social media, and market trends, significantly impact the performance of cryptocurrencies.

Balancing Institutional and Retail Interests

The interplay between institutional and retail investors shapes the dynamics of the cryptocurrency market. While institutions bring stability and long-term investment perspectives, retail investors add liquidity and contribute to the market’s vibrancy. Understanding the motivations and behaviors of both groups is essential for comprehending market trends and predicting future performance.

Comparative Analysis: Altcoin Season Index vs. Other Market Indicators

Altcoin Season Index vs. Bitcoin Dominance

The Altcoin Season Index and Bitcoin Dominance are two key metrics used to assess the cryptocurrency market’s health and performance trends.

- Altcoin Season Index: Measures the percentage of top 100 altcoins outperforming Bitcoin over the past 90 days. An index above 75 indicates an Altcoin Season, while an index below 25 signifies a Bitcoin Season.

- Bitcoin Dominance: Represents Bitcoin’s market capitalization relative to the total cryptocurrency market cap. A high Bitcoin Dominance indicates that Bitcoin is the leading force in the market, while a lower dominance suggests increased altcoin activity.

Both metrics offer valuable insights, but they focus on different aspects of the market. The Altcoin Season Index provides a more granular view of altcoin performance relative to Bitcoin, while Bitcoin Dominance offers a broader perspective on Bitcoin’s influence within the entire cryptocurrency ecosystem.

Altcoin Season Index vs. Market Capitalization Trends

While the Altcoin Season Index focuses on performance relative to Bitcoin, Market Capitalization Trends track the total value of all cryptocurrencies in the market. An increasing market cap generally indicates growing investor interest and adoption, while a declining market cap can signal waning confidence or market corrections.

Combining insights from both the Altcoin Season Index and market capitalization trends can provide a comprehensive understanding of market dynamics, helping investors make more informed decisions.

Altcoin Season Index vs. On-Chain Metrics

On-Chain Metrics such as transaction volume, active addresses, and network hash rate offer insights into the underlying activity and health of blockchain networks. While the Altcoin Season Index measures performance relative to Bitcoin, on-chain metrics assess the actual usage and engagement with cryptocurrencies.

Integrating data from the Altcoin Season Index with on-chain metrics can provide a holistic view of both market performance and network activity, enhancing the accuracy of market assessments and predictions.

Community and Ecosystem Growth

A strong and active community is essential for the success of any cryptocurrency project. Projects with vibrant developer communities, active social media engagement, and continuous ecosystem development are better positioned to sustain their growth and performance.

Developer Engagement

Active developer communities contribute to the continuous improvement and innovation of cryptocurrency projects. Regular updates, new feature releases, and the development of dApps and other tools enhance the utility and attractiveness of altcoins, driving their performance and adoption.

Social Media and Community Support

Social media platforms, forums, and online communities play a crucial role in fostering engagement and support for cryptocurrency projects. Positive community sentiment can drive investor confidence, while active discussions and collaborations can lead to the discovery of new opportunities and use cases.

Partnerships and Collaborations

Strategic partnerships and collaborations with other blockchain projects, financial institutions, and technology companies can enhance the credibility and reach of altcoins. These alliances facilitate the integration of new technologies, expand market access, and create synergistic opportunities for growth.

Case Studies: Altcoin Performances in Previous Seasons

To better understand the dynamics of the current Altcoin Season, it’s insightful to examine the performances of key altcoins during previous seasons and the factors that influenced their growth.

Ethereum (ETH) During Altcoin Seasons

Ethereum has historically been a leading performer during Altcoin Seasons, driven by its smart contract capabilities and the expansion of the DeFi ecosystem. During previous Altcoin Seasons, Ethereum’s price surged significantly as more projects and applications were built on its platform, attracting investment and driving demand for ETH.

Binance Coin (BNB) and the Rise of Exchange Tokens

Binance Coin has consistently performed well during Altcoin Seasons, supported by its utility within the Binance ecosystem. The launch of Binance Smart Chain (BSC) and the proliferation of projects and dApps on BSC have driven demand for BNB, contributing to its strong performance.

Cardano (ADA) and Sustainable Growth

Cardano’s performance during Altcoin Seasons has been marked by steady growth, driven by its focus on academic research, peer-reviewed protocols, and the development of a robust ecosystem. The successful rollout of upgrades and the launch of new dApps have sustained investor interest and supported ADA’s market performance.

Solana (SOL) and High-Performance Blockchain Adoption

Solana’s high-performance blockchain has attracted numerous projects and developers seeking scalable and efficient solutions. During Altcoin Seasons, SOL has benefited from the growing adoption of its network, driving its price and market cap.

Polkadot (DOT) and Interoperability Initiatives

Polkadot’s emphasis on interoperability and the development of parachains have positioned it as a key player in the blockchain ecosystem. During Altcoin Seasons, DOT has seen significant price appreciation as more projects seek to leverage its interoperability features.

Future Implications for the Cryptocurrency Ecosystem

The current Altcoin Season has broader implications for the cryptocurrency ecosystem, influencing everything from market dynamics to technological innovation and regulatory developments.

Market Maturation

The growing dominance of altcoins during Altcoin Seasons signifies the maturation of the cryptocurrency market. Investors are increasingly recognizing the value and potential of diverse digital assets, leading to more sophisticated investment strategies and market behaviors.

Technological Innovation

Altcoin Seasons drive technological innovation as projects compete to offer unique features, improved scalability, and enhanced security. This competition fosters continuous advancements, pushing the boundaries of what blockchain technology can achieve.

Regulatory Evolution

As the market matures, regulatory frameworks are likely to evolve to address the complexities and challenges posed by a diverse range of cryptocurrencies. Governments and regulatory bodies may develop more nuanced and comprehensive regulations that balance innovation with investor protection and market integrity.

Global Adoption and Integration

Altcoin Seasons contribute to the global adoption and integration of cryptocurrencies into mainstream financial systems. Increased adoption by businesses, financial institutions, and consumers drives the utility and acceptance of digital assets, enhancing their role in the global economy.

Impact on Traditional Finance

The rise of altcoins challenges traditional financial systems, prompting banks and financial institutions to explore blockchain technology and digital assets. This integration can lead to the development of new financial products, services, and infrastructure, reshaping the financial landscape.

Lessons Learned and Best Practices

The current Altcoin Season offers valuable lessons for investors, developers, and policymakers aiming to navigate and shape the future of the cryptocurrency market.

Importance of Diversification

Diversification remains a fundamental investment strategy. By holding a mix of Bitcoin and altcoins, investors can capitalize on the growth potential of multiple projects while mitigating the risks associated with volatility in any single asset.

Thorough Due Diligence

Conducting thorough due diligence is crucial for identifying projects with strong fundamentals, active development, and supportive communities. Investors should assess the use case, technological innovation, team expertise, and market positioning of altcoins before investing.

Emphasis on Innovation

Continuous innovation is essential for the sustained growth and success of altcoins. Projects that prioritize technological advancements, address market needs, and adapt to changing conditions are more likely to outperform and contribute positively to the overall market.

Community and Ecosystem Support

A strong and engaged community is vital for the success of any cryptocurrency project. Projects should foster community involvement, encourage developer participation, and build partnerships that enhance their ecosystem and market presence.

Risk Management

Effective risk management strategies are crucial for navigating the high volatility of cryptocurrency markets. Investors should implement measures such as stop-loss orders, position sizing, and portfolio diversification to protect against significant losses.

Regulatory Compliance

Adhering to regulatory requirements is essential for the long-term sustainability of cryptocurrency projects. Projects should prioritize compliance with anti-money laundering (AML), know your customer (KYC), and other relevant regulations to ensure legal and operational integrity.

Adaptability and Flexibility

The dynamic nature of the cryptocurrency market requires projects and investors to remain adaptable and flexible. Being able to quickly respond to market changes, technological advancements, and regulatory developments is crucial for sustained success.

Conclusion

The Altcoin Season Index falling by one point to 81 still firmly establishes the market within an Altcoin Season, highlighting the robust performance of altcoins over Bitcoin in recent months. This trend underscores a shift in market sentiment towards diversification and the potential of altcoins to deliver substantial returns. While opportunities abound, investors must also be mindful of the inherent risks and volatility associated with the altcoin market.

As the cryptocurrency ecosystem continues to evolve, the interplay between Bitcoin and altcoins will remain a critical factor in shaping investment strategies and market dynamics. By leveraging the insights provided by the Altcoin Season Index, investors can better navigate the complexities of the cryptocurrency market and make informed decisions to optimize their portfolios.

The current Altcoin Season signifies a period of growth and opportunity for altcoins, driven by factors such as increased institutional adoption, macro-economic trends, technological advancements, and growing community support. However, maintaining this momentum requires continued innovation, effective risk management, and favorable market conditions.

Investors should adopt a strategic approach, emphasizing diversification, thorough due diligence, and a long-term perspective to capitalize on the potential benefits of the Altcoin Season. By staying informed about market trends, regulatory developments, and technological innovations, investors can navigate the dynamic landscape of cryptocurrency markets and achieve sustained growth and stability in their investment portfolios.

Furthermore, the ongoing Altcoin Season has broader implications for the cryptocurrency ecosystem, influencing technological innovation, regulatory evolution, and the integration of digital assets into mainstream financial systems. As the market matures, the role of altcoins in driving economic growth, fostering innovation, and enhancing financial inclusion will continue to expand, shaping the future of the global financial landscape.

In summary, the Altcoin Season represents a transformative phase in the cryptocurrency market, offering significant opportunities for investors, developers, and the broader ecosystem. By understanding the factors driving this trend and implementing strategic measures to navigate its challenges, stakeholders can harness the full potential of altcoins and contribute to the continued growth and maturation of the cryptocurrency market.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on the latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.