Optimistic Outlook for Bitcoin in 2025, Says Ark Invest Analyst

Bitcoin’s prospects for 2025 remain optimistic, according to David Puell, an on-chain analyst at Ark Invest. In a recent monthly report, Puell highlighted several indicators, including Bitcoin’s historical performance following halvings, increasing holder confidence, and low realized volatility, suggesting significant room for market growth. Despite a recent correction attributed to derivatives market activity, the overall outlook for Bitcoin remains strong.

Key Drivers of Bitcoin’s Optimistic Outlook

1. Post-Halving Trends

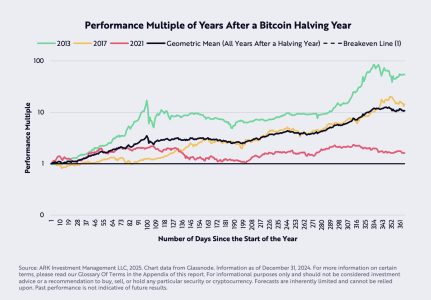

Bitcoin has historically seen significant price appreciation in the year following its halving events:

- Reduced Supply: Halvings cut block rewards in half, tightening Bitcoin’s supply.

- Past Performance: Previous halvings in 2016 and 2020 preceded bull runs, and 2024’s halving is expected to follow a similar trajectory.

2. Long-Term Holder Confidence

- 62% of Bitcoin Unmoved for Over a Year: A significant portion of Bitcoin’s total supply has remained dormant, signaling strong conviction among long-term holders.

- Implications: Reduced selling pressure from long-term holders supports price stability and growth potential.

3. Low Realized Volatility

- Market Expansion Potential: Despite recent price movements, Bitcoin’s realized volatility remains relatively low, indicating room for further growth and investor participation.

Short-Term Challenges: Derivatives Market Activity

Overheated Market Indicators

The Ark Invest report pointed to an imbalance in the derivatives market:

- Short Position Liquidations: Larger-than-expected short liquidations suggest excessive leverage among bearish traders.

- Recent Corrections: This activity likely contributed to Bitcoin’s recent price dips, as the market adjusted to over-leveraged positions.

Market Stabilization Needed

- Cooling Off Period: Adjustments in the derivatives market may pave the way for more sustainable growth.

- Focus on Fundamentals: Long-term investors are advised to prioritize on-chain data and market fundamentals over short-term fluctuations.

What This Means for Bitcoin Investors

Long-Term Perspective

- Accumulation Phase: The current market conditions, coupled with post-halving trends, suggest a favorable period for accumulation.

- Store of Value: Bitcoin’s increasing role as a hedge against inflation continues to attract institutional and retail interest.

Short-Term Strategy

- Cautious Trading: Investors should monitor derivatives market activity and avoid excessive leverage.

- Key Support Levels: Maintaining Bitcoin’s price above critical support zones, such as $90,000, will be crucial for sustaining upward momentum.

Historical Context: Bitcoin Halving and Growth

| Year | Halving Event | Price Before Halving | Peak Post-Halving | Growth |

|---|---|---|---|---|

| 2016 | July 9 | $650 | $19,000 (Dec 2017) | ~2,800% |

| 2020 | May 11 | $8,700 | $69,000 (Nov 2021) | ~690% |

| 2024 | April 22 | $28,000 | TBD | TBD |

The data reinforces Bitcoin’s pattern of significant growth following halving events, supporting an optimistic outlook for 2025.

Conclusion

David Puell’s analysis for Ark Invest paints a bright picture for Bitcoin in 2025. With historical post-halving performance, strong long-term holder confidence, and low realized volatility, Bitcoin is well-positioned for growth. While short-term corrections due to derivatives market activity present challenges, the long-term fundamentals remain robust. Investors should balance short-term caution with long-term optimism to capitalize on Bitcoin’s potential in the coming year.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.