Cryptocurrency markets are known for their volatility, but recent news has sent ripples through the Monero (XMR) community. The privacy-focused coin has experienced a significant price drop, and the culprit? A major exchange, OKX, decided to delist XMR and several other cryptocurrencies. Let’s dive into what happened, why it matters, and what it could mean for Monero moving forward.

Why is Monero’s Price Taking a Hit? The OKX Delisting Effect

In a move that caught many by surprise, OKX, a leading cryptocurrency exchange, announced on December 29th the delisting of 20 trading pairs. Unfortunately for Monero enthusiasts, XMR was among the affected assets. OKX cited that these cryptocurrencies “do not fulfill our listing criteria” as the reason behind the delisting. While the exact criteria weren’t specified, this decision has clearly impacted market sentiment.

Here’s a quick rundown of what you need to know:

- Price Drop: Monero’s price has decreased by 6% in the last 24 hours.

- OKX Delisting: OKX removed 20 trading pairs, including XMR, DASH, ZEC, and ZEN, among others like KSM, FLOW, JST, KNC, ANT, FSN, ZKS, CAPO, and CVP.

- Negative Funding Rates: For the first time in two months, Monero’s funding rates have turned negative, signaling a bearish market sentiment.

This delisting isn’t just about numbers on a chart; it represents a significant shift in market accessibility for Monero. Major exchanges play a crucial role in providing liquidity and access to cryptocurrencies, and delisting from one can impact trading volume and investor confidence.

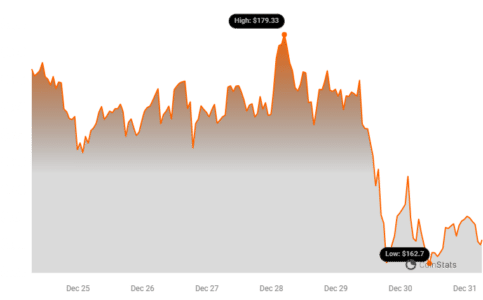

How Deep is the Dip? Analyzing Monero’s Price Performance

Currently, Monero (XMR) is trading at approximately $164.46. The 6% drop in the last 24 hours places it among the top three assets experiencing the most significant losses during this period, according to Coinstats data.

Looking at the 12-hour chart, the price decline appears to be driven by reduced buying pressure. Let’s examine some key momentum indicators to understand the market sentiment:

- Relative Strength Index (RSI): At 36.77, the RSI is below the neutral 50 mark, indicating bearish momentum and suggesting that the asset is approaching oversold territory, but not quite there yet.

- Money Flow Index (MFI): With a value of 38.05, the MFI also points to selling pressure outweighing buying activity.

These indicators, coupled with the OKX news, suggest that traders are reacting to the delisting by selling off their XMR holdings, contributing to the price decline.

See Also: OKX Crypto Exchange To Delist Privacy Tokens Like Monero And Zcash In Early 2024

Bearish Signals Confirmed: DMI and MACD

Further confirming the bearish outlook, let’s look at the Directional Movement Index (DMI) and the Moving Average Convergence Divergence (MACD):

- Directional Movement Index (DMI): The negative directional index (red line) is above the positive directional index (green line) with a value of 23.42. This clearly indicates that sellers are currently in control of the market in the 12-hour timeframe.

- Moving Average Convergence Divergence (MACD): The MACD line is below both the signal line (trend line) and the zero line. This is a classic bearish signal in technical analysis. When the MACD line crosses below the signal line and falls into negative territory, it often suggests further downward price movement.

These technical indicators paint a picture of prevailing bearish sentiment in the short term for Monero.

Short Sellers Jump In: Are They Fueling the Fire?

As Monero’s price continues to slide, short-traders are capitalizing on the downward momentum. Data from Coinglass reveals some interesting trends in the XMR futures market:

- Trading Volume Surge: A significant 109% increase in trading volume in the derivatives market over the last 24 hours indicates heightened activity and speculation.

- Open Interest Uptick: A 23% rise in Open Interest suggests that more positions are being opened, further amplifying market activity.

- Negative Funding Rates: Most notably, Monero’s funding rates across exchanges have turned negative for the first time since October 30th.

What do Negative Funding Rates Mean?

Negative funding rates in the futures market are a key indicator of market sentiment. When funding rates are negative, it means that traders who are shorting XMR (betting on a price decrease) are paying a fee to those who are longing XMR (betting on a price increase). This implies that a larger portion of traders currently believe that Monero’s price is likely to decline further. It’s a strong signal of prevailing bearish expectations.

Looking Ahead: Will Monero Recover?

The delisting from OKX is undoubtedly a setback for Monero, contributing to the recent price drop and negative market sentiment. However, it’s important to remember that the cryptocurrency market is dynamic and often cyclical. While the short-term outlook appears bearish based on technical indicators and funding rates, the long-term prospects for Monero remain to be seen.

Monero’s core value proposition as a privacy coin remains unchanged. In a world increasingly concerned with data privacy, assets like Monero could still hold significant appeal. Whether this delisting is a temporary hurdle or a sign of deeper challenges will depend on various factors, including broader market trends, future exchange listings, and the ongoing development and adoption of privacy-focused technologies.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.