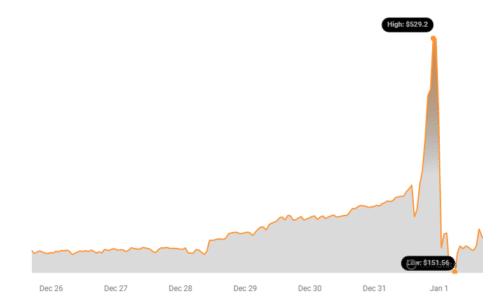

In an unexpected and dramatic turn of events, the price of Tellor (TRB) suddenly crashed to $151 within a span of 24 hours after soaring to an all-time high of $529, according to Coinstats data.

This sudden volatility has triggered a massive $68 million in liquidations, making TRB the most liquidated token in recent trading history.

Crypto analytics platform Lookonchain sounded the alarm on X (formerly Twitter), stating that this TRB crash led to the liquidation of $68 million worth of assets, marking it as the most liquidated token.

In the past 24 hours, $TRB soared to $600 and then plummeted to $137, causing $68M of assets to be liquidated, making it the most liquidated token.

We noticed that the #Tellor team deposited 4,211 $TRB($2.4M) after the price of $TRB skyrocketed.

Address:https://t.co/efHPXCiMiG pic.twitter.com/IBty2Wf2gI

— Lookonchain (@lookonchain) January 1, 2024

Lookonchain also observed that the Tellor team had deposited 4,211 TRB, equivalent to $2.4 million, following the sharp increase in the price of TRB.

The community and investors were taken by surprise as Tellor, a decentralized oracle network, witnessed an unprecedented surge in its token value.

As a result, numerous leveraged positions were forced to liquidate, leading to significant losses for traders and investors alike.

See Also: Ripple XRP Plunged After Whales Send 47M Tokens to Exchanges

At the time of reporting, Tellor’s price has experienced a partial recovery, currently standing at $185.

However, this represents a staggering 34.05% decline in the last 24 hours, leaving the market in a state of uncertainty.

Is This A Market Manipulation?

Meanwhile, the Tellor team’s response to the situation has garnered attention, especially their decision to deposit 4,211 TRB after the price spike.

This move has sparked discussions within the crypto community, with some questioning the motives behind such a deposit during a period of extreme price volatility.

Crypto tracking service Spot On Chain weighed in on the situation, stating in a tweet that both long and short positions had been cleared out by whales.

🕵️🕵️ Both long and short positions are cleared out by the whales. pic.twitter.com/u3t1a9ZLOq

— Spot On Chain (@spotonchain) December 31, 2023

This observation suggests that large market participants, commonly referred to as whales, may have played a significant role in the drastic price movements and subsequent liquidations.

As the crypto market remains inherently volatile, incidents like these serve as a stark reminder of the risks associated with trading and investing in digital assets.

The Tellor community and market participants will undoubtedly be closely monitoring the situation, seeking clarity on the factors contributing to the extreme price fluctuations and the subsequent impact on the project’s long-term viability.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.