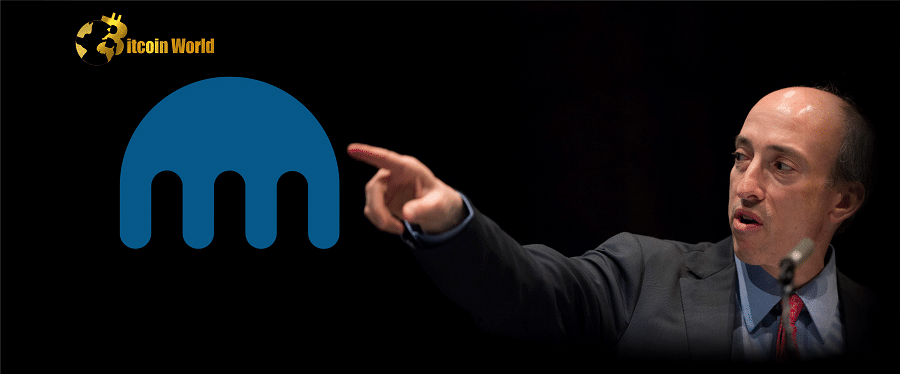

The SEC’s new allegations against crypto exchange Kraken for its staking program have shook the cryptocurrency sector.

Members in the cryptocurrency community appear outraged by the latest accusations brought against crypto exchange Kraken in connection with its staking-as-a-service program in the United States.

The US Securities and Exchange Commission (SEC) stated on Feb. 9 that it had settled charges with Kraken for “failing to register the offer and sale of their crypto asset staking-as-a-service business,” which it says qualifies as securities under its jurisdiction.

Kraken agreed to settle the accusations by paying $30 million in fines and to stop offering staking services to retail investors in the United States, but they will continue to be offered overseas.

The action appears to have enraged not only the crypto community as a whole, but also investors, legislators, and industry executives.

Adam Cochran, a Cinneamhain Ventures partner and Ethereum bull, chastised SEC Chairman Gary Gensler, calling him as “an agent of an anti-crypto agenda” rather than a regulator, and wondering why the same criteria were not applied to Sam Bankman-Fried and FTX:

Kristin Smith, CEO of the Blockchain Association, stated on Twitter on Feb. 9 that the current situation is a perfect example of why Congress, not the SEC, should be working with industry leaders to draft suitable legislation:

US Congressman Tom Emmer, a longtime adversary of Gary Gensler, has emphasized the importance of staking in the crypto economy.

In a Feb. 9 Twitter post, the lawmaker explained that staking services will play an important role in “building the next generation of the internet,” and he argued that the “purgatory strategy” will harm “everyday Americans the most,” as they may soon be forced to obtain such services from outside the country.

Meanwhile, Ryan Sean Adams, the creator of the Ethereum show Bankless, said on Feb. 9 to his 220,800 Twitter followers that the SEC might have taken different actions instead of charging Kraken out of the blue:

Other members of the community questioned Kraken’s registration with the securities regulator, claiming that there was “no obvious path” to authorize crypto staking.

Others speculated that it might have an impact on Ethereum’s consensus layer, considering that Kraken is the fourth-largest validator on the Ethereum blockchain, according to on-chain monitoring platform Nansen.

However, not everyone was against the SEC’s ruling. Prominent Bitcoin bull Michael Saylor, who has long viewed ETH and other proof-of-stake cryptocurrencies to be securities, concurred with Gensler’s analysis that when tokens are delegated to external staking service providers, retail investors “lose control” of them:

Meanwhile, Jake Chervinsky, attorney and chief policy officer of the Blockchain Association, stated that such “settlements are not law” and that Kraken’s choice to pay was most likely an economic one rather than a legal one:

The controversy comes as the SEC’s push to take action against staking service providers prompted Coinbase CEO Brian Armstrong to declare that “regulation by enforcement” would be a “bad road” for U.S. innovators, compelling them to shift more of their services offshore.