Following the worst start to a year since the crypto winter of 2018, Bitcoin’s (BTC) price is showing signs of recovery.

Notably, the price of the leading digital assets has risen from $33,000 at the end of January to over $41,000 as of February 5. So, as some analysts projected that certain market indicators were exhibiting symptoms of an upside turnaround. That’s, with historical data also indicating a return of over $40,000.

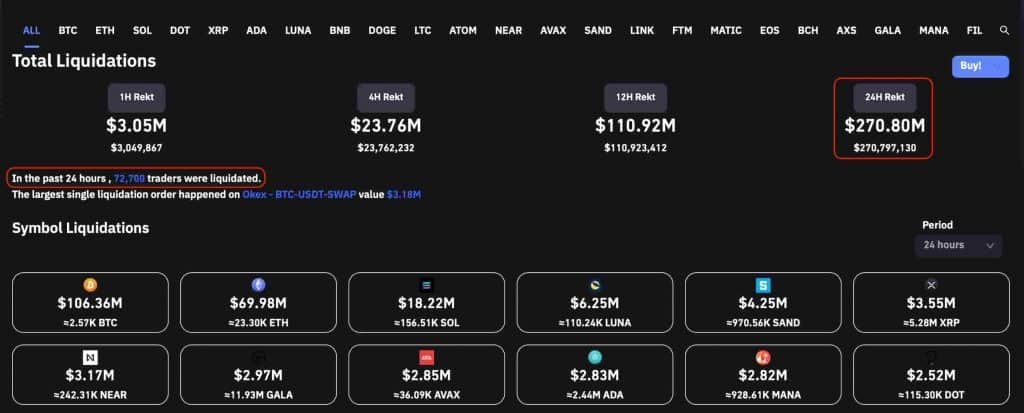

According to real-time liquidations of all exchanges and currencies on Coinglass. Of course, 72,700 traders have left the market in the last 24 hours. Thereby, resulting in a total liquidation of $270.8 million across all cryptocurrencies.

BTC had the most liquidations, totaling $106.36 million, followed by Ethereum, which had $69.98 million in total liquidations.

Bitcoin is currently trading at $41,432, up 9.17 percent in the last 24 hours and 9.53 percent over the last week.

Bitcoin’s price has broken above the $40,000 price barrier, indicating that it has moved beyond the condition of stagnation in which it had been trading for the previous few weeks. Furthermore, BTC has gained more than 25% since its more than six-month low in late January.

Bitcoin was the most frequently referenced cryptocurrency on Twitter this week, with 3,134,852 million mentions, thanks to rising market sentiment.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…