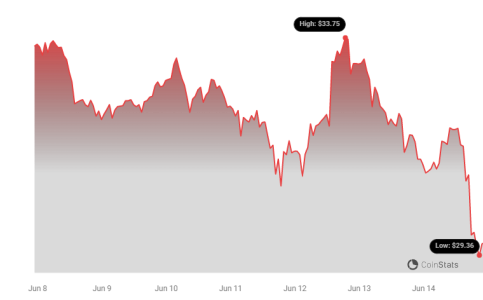

Navigating the volatile cryptocurrency market can feel like riding a rollercoaster. Recently, Avalanche (AVAX), a popular smart contracts platform, has experienced a notable dip. Over the past 24 hours, AVAX’s price has slid by 7.24%, landing at $29.53. This downward pressure isn’t isolated to a single day; it’s part of a broader trend. Let’s delve into the details and understand what’s influencing AVAX’s price movement.

Avalanche (AVAX) Price in Freefall: Key Highlights

The numbers tell a clear story of recent market activity for Avalanche:

- 24-Hour Price Drop: AVAX has decreased by 7.24% in the last 24 hours.

- Current Price: As of now, AVAX is trading at $29.53.

- Weekly Downtrend: Extending beyond a single day, AVAX has experienced a 10.0% loss over the past week.

- Previous Week’s Price: Just seven days ago, AVAX was valued at $32.98.

This consistent decline prompts us to look deeper into the factors at play.

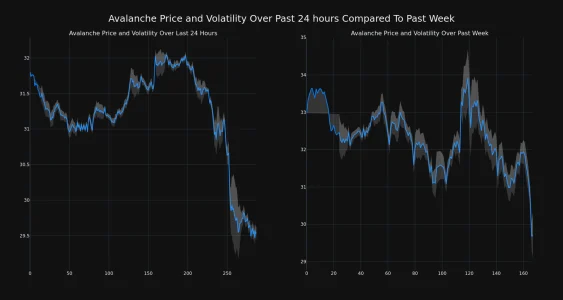

Visualizing the Volatility: 24 Hours vs. 7 Days

To better understand the price fluctuations, visuals are incredibly helpful. The charts below offer a comparative view of AVAX’s price movement and volatility over two distinct periods:

- Left Chart: Focuses on the past 24 hours.

- Right Chart: Illustrates price movement over the last week.

Notice the gray bands in these charts? These are Bollinger Bands, a technical analysis tool used to measure market volatility. Essentially:

- Wider Bands = Higher Volatility: The wider the gray bands appear, the greater the price swings and uncertainty in the market.

- Narrower Bands = Lower Volatility: Conversely, tighter bands suggest a period of relative price stability.

By examining the width of the Bollinger Bands, you can quickly gauge the level of volatility in AVAX’s price action over both the daily and weekly timeframes.

Trading Volume and Circulating Supply: What’s the Connection?

Price isn’t the only metric to consider. Trading volume and circulating supply offer crucial insights into the health and dynamics of a cryptocurrency. Here’s what’s happening with AVAX:

- Trading Volume Decline: A significant 42.0% drop in trading volume has been observed over the past week.

- Circulating Supply Reduction: Interestingly, the circulating supply of AVAX has also slightly decreased by 0.78% during the same period.

- Current Circulating Supply: This brings the current circulating supply to 393.30 million AVAX.

- Percentage of Max Supply: This circulating supply represents approximately 54.62% of AVAX’s total maximum supply of 720.00 million coins.

The directional alignment of decreasing trading volume and circulating supply might indicate a potential cooling off in market interest or broader tokenomics adjustments.

AVAX Market Ranking and Market Cap: Where Does it Stand?

Despite the recent price decline, Avalanche maintains a strong position in the overall cryptocurrency market:

- Market Cap Ranking: AVAX currently holds the #13 rank in terms of market capitalization.

- Market Cap Value: Its market capitalization stands at a substantial $11.59 billion.

This ranking and market cap demonstrate that AVAX remains a significant player in the crypto space, even amidst short-term price fluctuations. You can also explore previous positive news, such as AVAX’s partnership with Chainlink, which highlights its ongoing development and potential.

What Does This Mean for AVAX Investors?

The recent price drop in Avalanche (AVAX) is a reminder of the inherent volatility within the cryptocurrency market. While short-term fluctuations are common, understanding the underlying trends and market dynamics is crucial for informed decision-making.

Key Takeaways:

- Monitor Volatility: Keep an eye on volatility indicators like Bollinger Bands to understand the risk level.

- Track Trading Volume: Significant changes in trading volume can signal shifts in market sentiment.

- Consider Market Context: Analyze AVAX’s performance within the broader cryptocurrency market trends.

- Long-Term Perspective: Remember that short-term price drops don’t necessarily negate the long-term potential of a project.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial or trading advice. Cryptocurrency investments are inherently risky. Bitcoinworld.co.in is not liable for any investment decisions made based on this information. We strongly advise conducting thorough independent research and seeking advice from a qualified financial advisor before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.