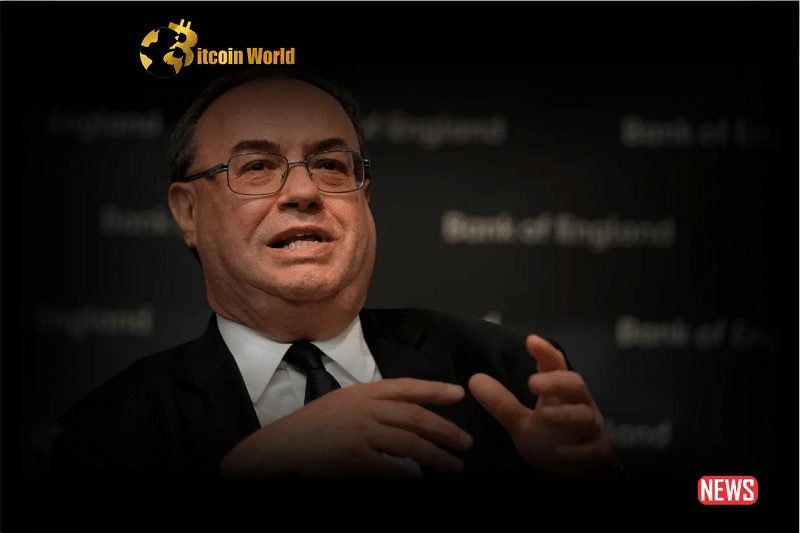

Bank of England Governor Andrew Bailey recently expressed his skepticism towards cryptocurrencies, including Bitcoin, stating that they do not meet the standards to be recognized as money. Instead, Bailey emphasized the concept of “enhanced digital money” as a potential future form of finance. In his speech at the Financial and Professional Services Dinner in London, he highlighted the importance of singleness and finality of settlement, which he believes cryptocurrencies lack. Let’s delve into Bailey’s remarks and his perspective on the future of money.

Cryptocurrencies as Speculative Investments:

According to Bailey, cryptocurrencies are best classified as “extremely speculative investments” rather than legitimate forms of money. He questioned their ability to provide the singleness and finality of settlement that are fundamental to safe and reliable financial transactions. Bailey stressed that money should hold a consistent value across different accounts, ensuring exchangeability at par value, which he believes cryptocurrencies fail to achieve.

Enhanced Digital Money as the Future:

Bailey proposed the concept of “enhanced” digital money as a potential alternative to cryptocurrencies. He described enhanced digital money as being based on internet systems capable of executing actions, such as smart contracts, expanding beyond the scope of central bank digital currencies (CBDCs). Bailey suggested that this form of money would promote singleness by providing the public with the option to access fully functional central bank money for their everyday transactions.

Promoting Singleness of Money:

The main motivation behind Bailey’s support for retail CBDCs is to ensure the singleness of money. By offering the public the opportunity to use central bank money in their daily lives, Bailey aims to uphold the exchangeability and consistent value of money. While CBDCs are one potential avenue for achieving this, Bailey also emphasized the importance of internet-based systems capable of executing smart contracts, indicating a broader vision for enhanced digital money.

Cautionary Warnings:

It is worth noting that Bailey’s comments align with his previous warnings to the public regarding cryptocurrencies. In June, he cautioned investors, advising them to be prepared to lose all their money when investing in cryptocurrencies. These remarks highlight his concerns regarding the volatility and risks associated with these digital assets.

Bank of England Governor Andrew Bailey’s recent statements reinforce his skepticism towards cryptocurrencies and their viability as money. Instead, he advocates for the development of enhanced digital money, which encompasses internet-based systems capable of executing actions such as smart contracts. Bailey believes that enhanced digital money, combined with the availability of retail central bank digital currencies, can provide the singleness and finality of settlement necessary for safe and reliable financial transactions. As the debate over the future of money continues, Bailey’s perspective adds to the ongoing discussion surrounding the role of cryptocurrencies and the potential evolution of digital currencies.