Binance, one of the leading cryptocurrency exchanges, has recently unveiled its 10th proof of reserves report, providing a comprehensive look at the assets held within the exchange’s custody. This report sheds light on Binance’s holdings and demonstrates its commitment to transparency, although questions regarding the reliability of such reports persist.

The report reveals several key findings, including a 4.3% decrease in users’ ETH deposits compared to the previous report. In contrast, USDT holdings experienced a minor 1% increase, reaching 15.44 billion USDT.

According to the report, Binance’s users currently hold over 580,000 BTC and more than 3.89 million ETH tokens on the platform. These figures showcase the substantial amount of digital assets entrusted to the exchange.

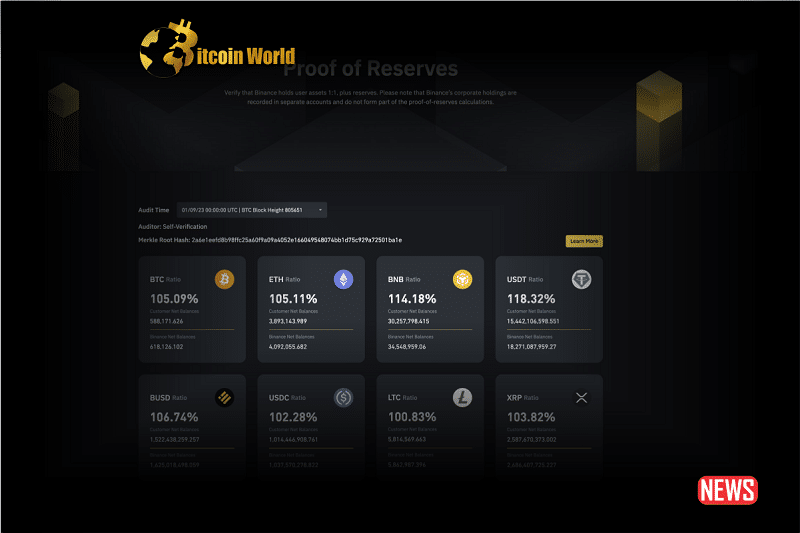

One notable highlight is Binance’s strong capitalization, with ratios of 105.09% for Bitcoin and 105.11% for Ethereum. Additionally, Binance’s native BNB token exhibits a healthy ratio of 114%. These ratios indicate that Binance has sufficient reserves to cover the assets held by its users.

The report delves into various digital assets, with ratios ranging from slightly above 100% to 119% for Polygon (MATIC). This suggests that Binance has the financial capacity to safeguard the deposits of all its users, as detailed in the report.

It’s essential to note that the report employed a “Self-Verification” method utilizing a cryptographic tool called a Merkle Tree. This tool consolidates extensive data into a single hash, a Merkle Root. Binance explains that the Merkle Root is a cryptographic seal summarizing all the inputted data. This innovative approach allows users to verify specific contents within the sealed data, ensuring their holdings are backed on the exchange.

This release of the proof-of-reserves report comes amid an ongoing executive exodus at Binance. Notable departures include Mayur Kamat, the Global Product Lead, Chief Strategy Officer Patrick Hillman, Senior Director of Investigations Matthew Price, and others. These departures are reportedly linked to the exchange’s response to a U.S. Department of Justice investigation into Binance following a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) earlier this year.

Despite the internal challenges and regulatory scrutiny, Binance’s commitment to transparency through its proof of reserves reports aims to instil confidence in its user base and the broader cryptocurrency community. However, as with any financial report, stakeholders will closely monitor Binance’s actions and adherence to industry standards.