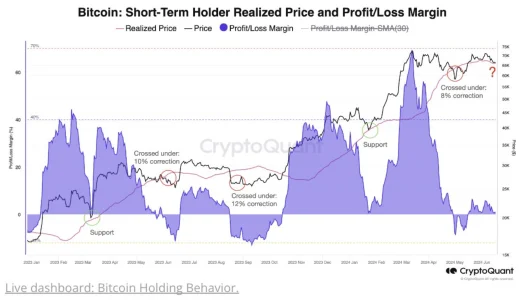

- Bitcoin (BTC) recently fell below $64,000, breaking its short-term holder realized price and signaling fear that a further correction toward $60,000 might be on the horizon.

Bitcoin’s price briefly dipped below a critical level for traders sparking fears that a possible further decline to levels unseen in 49 days, according to cryptocurrency analysis firm CryptoQuant.

“Bitcoin is trading below the critical support level of $65.8K, now below $64K,” CryptoQuant wrote in a June 21 X post.

#Bitcoin is trading below the critical support level of $65.8K, now below $64K.

Falling under this threshold suggests a potential 8%-12% correction toward $60K. pic.twitter.com/hXwUkC13up

— CryptoQuant.com (@cryptoquant_com) June 21, 2024

“Falling under this threshold suggests a potential 8%-12% correction toward $60K,” CryptoQuant added, a level not broken since May 3, when Bitcoin was trading at $59,122, according to CoinMarketCap data.

On June 22, Bitcoin’s recent decline saw it drop 2% to $63,442, falling below the short-term holder’s realized price at the time, which was $64,230, according to LookIntoBitcoin data.

Short-term holder realized price (STH-RP) is an important indicator for traders as it is the aggregate cost basis of more speculative Bitcoin hodlers — wallets storing Bitcoin for 155 days or less.

It can act as a solid support, as it did for much of the bull markets since early 2023. Bitcoin’s price has tested the STH-RP multiple times in recent weeks, however, breaching this level raises concerns among traders that a further decline in Bitcoin’s price is possible.

“Bitcoin’s short-term holder realised price generally acts as support in upward trending markets,” pseudonymous crypto trader Crypto Caesar wrote on June 19.

#BITCOIN ‘s short-term holder realised price generally acts as support in upward trending markets (see chart).

Currently sitting at $63,900. Historically this has been a good BTFD opportunity before more banana 🍌 mode. pic.twitter.com/OmLX4K9pwk

— 👑Crypto Caesar👑™️ (@crypto_caesar1) June 18, 2024

“Let’s see if it holds,” LookIntoBitcoin founder Phillip Swift added.

Short-term Holder Realized Price acting as support for #bitcoin AGAIN this cycle. Let's see if it holds. pic.twitter.com/PYWt1eTpcK

— Philip Swift (@PositiveCrypto) June 20, 2024

A move down to $60,000 would wipe $1.64 billion in long positions, as per CoinGlass data.

Bitcoin May See An Upside Swing Following Extended Consolidation

Bitcoin has been hovering around $65,000 for a while now, making traders speculate where to next, especially after two big events this year, the launch of spot Bitcoin ETFs in the United States in January and the Bitcoin halving in April.

On June 13, Cointelegraph reported that Bitcoin has been in its longest period of consolidation for 92 days, and analysts believe the extended steadiness could be setting the asset up for a “massive upside rally.”

Founder and CEO of on-chain and market analytics firm CryptoQuant Ki Young Ju believes “Bitcoin network fundamentals could support a market cap three times its current size compared to the last cyclical top.”

On May 8, Young Ju referred to a chart comparing BTC’s price and the associated hash rate to market capitalization ratio, highlighting the crypto’s ongoing volatility and the resilience of the Bitcoin network.

If this ratio continues to grow, Young Ju declared it could “potentially sustain” Bitcoin’s price to $265,000.