Bitcoin’s recent price action has traders on edge! After briefly dipping below $64,000, breaking a crucial support level, fears of a further correction towards $60,000 are spreading. What’s behind this dip, and what does it mean for your crypto portfolio? Let’s dive in.

Bitcoin Breaches Key Support: What Happened?

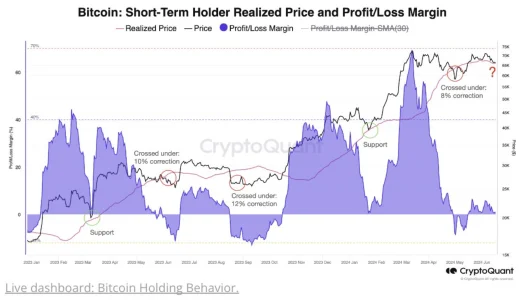

Bitcoin’s price recently dipped below a critical level, sparking concerns of a more significant downturn. CryptoQuant, a leading cryptocurrency analysis firm, highlighted this breach, noting the potential for an 8%-12% correction.

- Critical Level Broken: Bitcoin fell below $65,800, then $64,000.

- Analyst Warning: CryptoQuant suggests a possible drop to $60,000.

- Last Seen: This level hasn’t been tested since early May.

This decline is significant because it breaks the short-term holder realized price (STH-RP), a key indicator for market sentiment. The STH-RP represents the average cost basis of Bitcoin held for less than 155 days – typically more speculative investors.

Understanding the Short-Term Holder Realized Price (STH-RP)

Think of the STH-RP as a gauge of speculative investor confidence. When Bitcoin’s price stays above this level, it signals bullish sentiment. However, when it falls below, it can trigger fear and further selling pressure.

Historically, the STH-RP has acted as a reliable support level during bull markets. The recent breach raises concerns that the current consolidation phase might lead to a deeper correction.

Expert Opinions: Holding the Line or Further Decline?

The crypto community is closely watching to see if Bitcoin can reclaim the STH-RP. Here’s what some experts are saying:

- Crypto Caesar: “Bitcoin’s short-term holder realised price generally acts as support in upward trending markets.”

- Phillip Swift: “Let’s see if it holds.”

A drop to $60,000 could trigger significant liquidations, potentially wiping out billions in long positions. This highlights the importance of risk management during volatile periods.

Could Bitcoin See an Upside Swing?

Despite the current concerns, some analysts remain optimistic about Bitcoin’s long-term prospects. The extended consolidation period, coupled with strong network fundamentals, could set the stage for a significant rally.

Long Consolidation: Preparing for a “Massive Upside Rally?”

Bitcoin has been consolidating around $65,000 for over 90 days, leading some to believe that a major breakout is on the horizon. This consolidation follows two major events: the launch of spot Bitcoin ETFs and the Bitcoin halving.

Ki Young Ju, founder of CryptoQuant, believes that Bitcoin’s network fundamentals could support a market cap three times its current size. He points to the growing ratio of Bitcoin’s hash rate to market capitalization as a sign of strength.

According to Young Ju’s analysis, if this ratio continues to grow, Bitcoin’s price could potentially reach $265,000.

Key Takeaways and Actionable Insights

- Monitor the STH-RP: Watch for Bitcoin to reclaim and hold above this level.

- Manage Risk: Be prepared for potential volatility and adjust your positions accordingly.

- Stay Informed: Keep an eye on expert analysis and market trends.

- Consider the Long Term: Remember that Bitcoin’s long-term fundamentals remain strong.

In Conclusion: Navigating Bitcoin’s Current Crossroads

Bitcoin’s recent dip below $64,000 has sparked legitimate concerns, but it’s crucial to maintain a balanced perspective. While a further correction is possible, the long-term outlook for Bitcoin remains positive. By understanding key indicators like the STH-RP, managing risk effectively, and staying informed, you can navigate the current market conditions with confidence. Is this a buying opportunity, or a sign of further decline? Only time will tell, but being prepared is half the battle.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.