Gensler stated that he observed a number of crypto assets exhibiting characteristics of a security.

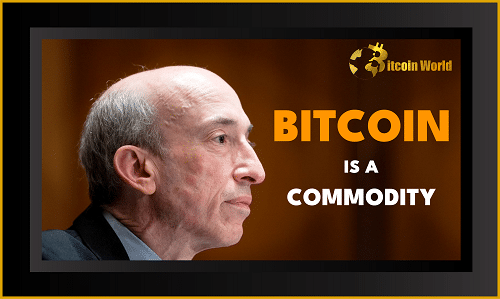

Gary Gensler, chairman of the Securities and Exchange Commission, enraged Crypto Twitter on Monday by confirming that Bitcoin (BTC) is a commodity. Concerns were raised regarding the impact on Grayscales’ proposed Bitcoin ETF and the omission of Ethereum.

In an interview with Jim Cramer on CNBC’s Squawk Box on Monday, June 27, the head of the SEC stated that while numerous crypto-financial assets possess the defining characteristic of a security, Bitcoin is the “only one” that he felt comfortable publicly classifying as a commodity.

Some, such as Bitcoin — and that’s the only one I’ll mention because I won’t discuss any of these tokens — those have been described as commodities by my predecessors and others.

Grayscale Bitcoin exchange-traded fund

Grayscale’s application to convert its Bitcoin Trust into a spot-based exchange-traded fund (ETF) is scheduled to be approved or denied by the Securities and Exchange Commission on July 6.

James Seyffart, an ETF analyst at Bloomberg Intelligence, informed his 19,300 Twitter followers that while Gensler’s comments are favourable for Bitcoin, they may not be enough for Grayscale’s Bitcoin-spot ETF to be authorized the next week.

Eric Balchunas, a senior ETF analyst at Bloomberg, stated that Grayscale’s GBTC had only a 0.5 percent probability of being permitted to convert to an ETF.

Crypto Twitter also caught up on the fact that Gensler failed to mention whether he placed Ethereum (ETH) in the same commodities boat, despite the regulator and the Commodity Futures Trading Commission (CTFC) having previously agreed that the asset was a commodity similar to Bitcoin.

Favorable for Bitcoin

However, Gensler’s opinions on Bitcoin have been viewed as beneficial for the crypto king.

Michael Saylor, a Bitcoin bull, posted the video with his 2.5 million Twitter followers, noting that Bitcoin is vital as a treasury reserve asset, allowing governments and institutions to promote it as a digital asset for economic growth.

Eric Weiss, the founder of Blockchain Investment Group, pointed out on Twitter that Gensler is the second SEC chair to classify Bitcoin as a commodity, making it nearly impossible to change this classification in the future.