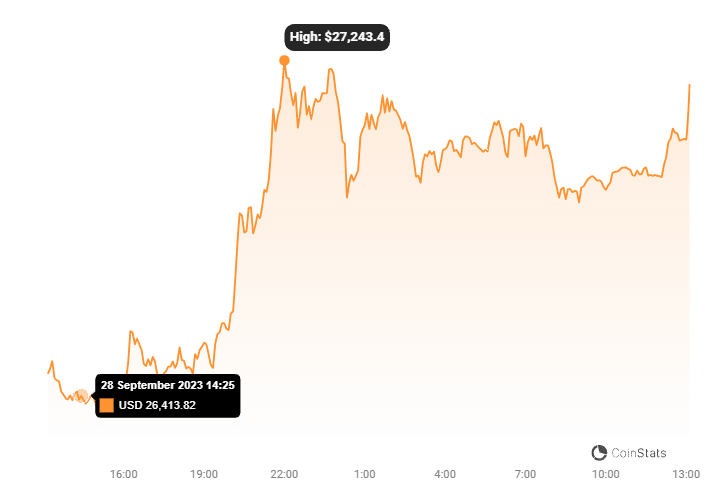

Bitcoin has been keeping crypto enthusiasts on their toes! Recently, the digital gold has shown promising signs, skillfully maneuvering around potential hurdles near the $27,500 mark. If you’re watching the charts, you’ll notice Bitcoin has consistently traded above $26,850 and the 100-hourly Simple Moving Average (SMA) – key indicators of its current strength. Adding to the bullish sentiment, Kraken data reveals a distinct upward trendline forming, providing solid support around $26,800 on the hourly BTC/USD chart. Let’s dive deeper into what this means for Bitcoin’s next move.

Is Bitcoin Building Momentum for a Breakout?

The crypto air is thick with anticipation! The big question on everyone’s mind: Can Bitcoin conquer the formidable $27,500 resistance? If it does, we could witness another exciting rally. Bitcoin has already demonstrated its resilience by pushing past the $26,800 resistance and comfortably settling above the $27,000 pivot point. However, the bears aren’t backing down easily. They’ve put up a strong defense near the $27,500 level, with a recent peak forming around $27,494. Currently, Bitcoin seems to be in a phase of consolidating its gains, taking a breather before its next attempt to break higher.

Key Resistance Levels: What Hurdles Does Bitcoin Face?

Bitcoin’s journey upwards isn’t without its obstacles. Here’s a breakdown of the key resistance levels that stand in its path:

- Immediate Resistance: $27,450. This is the closest hurdle Bitcoin needs to overcome.

- Major Resistance Zone: $27,500. This is the critical level to watch. A decisive break above this could signal a significant bullish move.

- Next Target Resistance: $28,200. Clearing $27,500 could pave the way to test this level.

- Potential Long-Term Target: $29,500 – $30,000. A strong push beyond $28,200 could generate momentum towards these higher targets.

Think of these resistance levels as ceilings Bitcoin needs to break through to reach new heights. Each level conquered strengthens the bullish case and opens the door for further gains.

Support Levels: Where Will Bitcoin Find its Footing?

While the upside potential is exciting, it’s crucial to consider potential pullbacks. Where are the key support levels that could cushion Bitcoin’s fall?

- Immediate Support: $27,050. This level should provide initial support if Bitcoin retraces.

- Crucial Support Zone: $26,800. This is a significant level, reinforced by the bullish trendline and the 76.4% Fibonacci retracement level.

- Fibonacci Retracement Level: $26,800 (76.4% Fib). This level is derived from the Fibonacci retracement of the recent upward move from $26,657 to $27,494, adding confluence to the $26,800 support zone.

- Next Major Support: $26,200. A break below $26,800 could lead to a test of this lower support level.

These support levels act as floors, potentially halting downward movements and offering buying opportunities. Monitoring these levels is essential for understanding Bitcoin’s downside risk.

Technical Indicators: What are the Signals Saying?

Technical indicators provide valuable insights into market momentum and potential trend changes. Let’s look at what key indicators are suggesting:

- Hourly MACD (Moving Average Convergence Divergence): The MACD suggests a decelerating bullish momentum. This implies that while Bitcoin is still in bullish territory, the upward momentum might be weakening slightly. Traders often look for MACD crossovers to signal potential trend reversals.

- Hourly RSI (Relative Strength Index) for BTC/USD: The RSI remains above 50. An RSI above 50 generally indicates bullish momentum, suggesting buying pressure is still present. However, traders also watch for overbought conditions (RSI above 70) which could signal a potential pullback.

These indicators provide a snapshot of the current technical picture. It’s important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management strategies.

Key Bitcoin Price Levels at a Glance

To summarize, here are the critical price levels to watch for Bitcoin in the short term:

| Level Type | Price | Significance |

|---|---|---|

| Immediate Resistance | $27,450 | First hurdle to overcome |

| Major Resistance | $27,500 | Critical breakout level |

| Next Resistance | $28,200 | Potential target after $27,500 |

| Immediate Support | $27,050 | Initial defense against pullbacks |

| Crucial Support | $26,800 | Strong support zone, trendline & Fib level |

| Major Support | $26,200 | Lower support level to watch |

Actionable Insights for Traders

Based on this technical analysis, here are some potential actionable insights for traders:

- Monitor the $27,500 Resistance: A decisive break and sustained trading above this level could present a buying opportunity, targeting the $28,200 and potentially $29,500 levels.

- Watch Support Levels for Pullbacks: If Bitcoin fails to break $27,500, watch for pullbacks to the $27,050 and $26,800 support levels. These could offer potential re-entry points for long positions or areas to tighten stop-loss orders.

- Be Cautious Below $26,800: A sustained break below $26,800, especially with a daily close, could signal a shift in momentum and potentially lead to further downside towards $26,200.

- Use Technical Indicators in Conjunction: Combine MACD and RSI readings with price action analysis for a more comprehensive view. Divergence between price and indicators can offer early warnings of potential trend changes.

- Manage Risk: Always use appropriate risk management strategies, including stop-loss orders, and never invest more than you can afford to lose. Cryptocurrency trading involves significant risk.

In Conclusion: Bitcoin at a Crossroads

Bitcoin is currently at an interesting juncture. It’s showing resilience and bullish tendencies by holding above key moving averages and support levels. The bulls are eyeing a breakout above the critical $27,500 resistance, which could unlock further upside potential. However, the bears are still active, and a failure to overcome this resistance could lead to a downward correction. Traders and investors should closely monitor price action around these key levels and consider the technical indicators to make informed decisions. The coming days will be crucial in determining whether Bitcoin can sustain its bullish momentum and embark on its next leg up, or if it will face a period of consolidation or correction. Stay tuned and trade wisely!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.