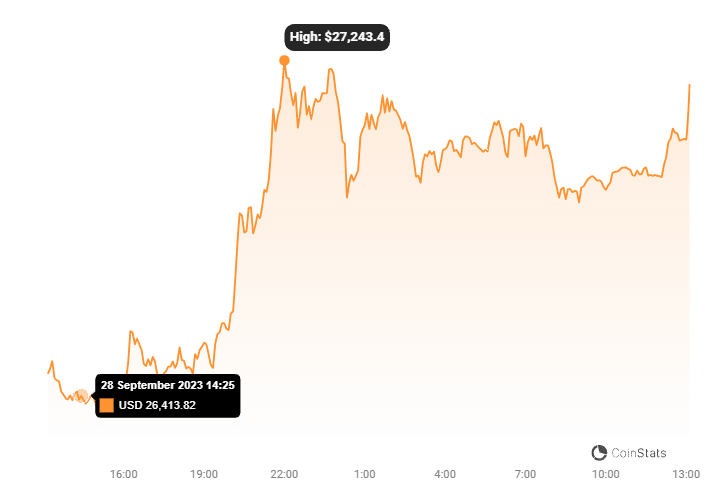

Bitcoin’s performance recently has exhibited positive signals, navigating potential obstacles near the $27,500 mark. Significantly, the cryptocurrency has maintained its trading stance above $26,850 and the 100-hourly Simple Moving Average. Moreover, data from Kraken illustrates a prominent bullish trend line shaping up with steadfast support pegged at approximately $26,800 on the hourly chart of the BTC/USD pair.

Consequently, there’s an atmosphere of anticipation. If Bitcoin surpasses the looming resistance at $27,500, there’s potential for further rally. However, the digital currency has its adversaries. While Bitcoin did manage to edge past the $26,800 resistance threshold and even hover comfortably over the $27,000 pivot, the bears have posed significant challenges near the $27,500 point. A discernible peak formed close to $27,494. Hence, the cryptocurrency’s current strategy consolidates its gains.

Bitcoin, besides its impressive performance, is still consolidating gains. An immediate hurdle to conquer rests at the $27,450 point. Yet, the $27,500 zone is the major resistance to watch. A decisive breach above this zone could propel Bitcoin into another upward trajectory, potentially challenging resistance at $28,200. Even more enticing is the possibility that a firm push past the $28,200 mark will usher in momentum toward an enticing $29,500 resistance. In such a scenario, the coveted $30,000 level may be attainable.

However, it’s essential to ponder whether the dips in Bitcoin’s value are limited. We might witness a downward correction if the coin can’t muster enough strength for a fresh ascent past $27,500. Immediate fortifications against such a decline are positioned at $27,050. The next crucial buffer is also stationed close to the $26,800 mark and its corresponding trend line. This is close to the 76.4% Fib retracement level, stemming from the climb that started at $26,657 and peaked at $27,494. A downward plunge and a closing below the $26,800 benchmark could distressingly direct the coin toward the next support, hovering around $26,200.

The hourly MACD suggests a decelerating pace in the bullish territory regarding technical indicators. Additionally, the Hourly RSI for BTC/USD remains above 50. Noteworthy support levels to observe include $27,050 and $26,800. Meanwhile, Bitcoin faces resistance at $27,450, $27,500, and a significant $28,200.