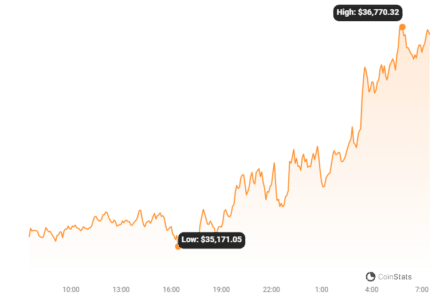

Hold onto your hats, crypto enthusiasts! Bitcoin is back in the spotlight, and it’s making waves! If you blinked, you might have missed it – Bitcoin (BTC) just smashed through the $36,700 mark, a level we haven’t seen since May 2022. That’s right, the king of crypto is flexing its muscles again, sending ripples of excitement (and maybe a little FOMO) across the digital asset landscape. But what’s fueling this impressive surge? Is this just a flash in the pan, or are we witnessing the dawn of a new crypto bull run? Let’s dive into the details and unpack what’s happening in the Bitcoin world and beyond.

Bitcoin’s Bullish Breakout: What’s Driving the Price Surge?

Bitcoin’s recent price action is nothing short of spectacular. Reaching an 18-month peak of nearly $36,700, as reported by CoinMarketCap, is a significant milestone. But this isn’t happening in isolation. The entire cryptocurrency market seems to be catching a ‘green wave,’ with other major digital assets also showing strong performance. Think of Ethereum (ETH), Binance Coin (BNB), Cardano (ADA), Polygon (MATIC), Polkadot (DOT), and many others – they’re all riding this bullish momentum.

- Bitcoin (BTC) Surpasses $36,700: Hitting its highest price point since May 2022, signaling strong market recovery.

- Broad Crypto Market Rally: Other major cryptocurrencies like ETH, BNB, ADA, MATIC, DOT are also experiencing significant gains.

- Market-Wide Optimism: The surge reflects growing investor confidence and renewed interest in digital assets.

Millions in Liquidations: The Ripple Effect of Bitcoin’s Rise

With Bitcoin’s dramatic ascent, there’s been a significant shake-up in the market. This ‘green wave’ has triggered substantial liquidations, totaling around $150 million in the last 24 hours alone, according to CoinGlass. Interestingly, short positions were hit the hardest, accounting for over 80% of these liquidations. This suggests that many traders were caught off guard by the speed and strength of Bitcoin’s upward movement, betting against BTC and facing the consequences as the price soared.

Let’s break down the liquidation figures:

| Cryptocurrency | Liquidation Amount (Last 24 Hours) |

|---|---|

| Bitcoin (BTC) | Over $65 Million |

| Ether (ETH) | Roughly $16 Million |

| Total Liquidations | Approximately $150 Million |

As you can see, Bitcoin trades alone accounted for the lion’s share of liquidations, exceeding $65 million. Ether followed, with around $16 million in liquidations. This highlights the immense leverage and volatility inherent in the cryptocurrency market, especially when Bitcoin makes such decisive moves.

Read Also: Bitcoin Inscriptions Reach Mania Levels Again, Miners Benefit

Is Bitcoin’s Upswing Just Getting Started? What Experts Are Saying

The million-dollar question on everyone’s mind is: Is this just the beginning? Are we on the cusp of a major Bitcoin bull run? Interestingly, many analysts, including the ever-insightful AI language model ChatGPT, seem to think so. There’s a growing consensus that Bitcoin’s current upswing has plenty of room to run, with some even suggesting that a new all-time high could be within reach in the coming months.

What are the factors fueling this optimistic outlook? Several key catalysts are being cited as potential drivers for continued Bitcoin price appreciation:

- Spot Bitcoin ETF Approval in the US: The potential approval of a spot Bitcoin Exchange-Traded Fund (ETF) in the United States is arguably the most significant factor. A spot ETF would open the floodgates for institutional investment, making it easier and more accessible for traditional investors to gain exposure to Bitcoin. This could inject billions of dollars into the market and significantly boost demand.

- Mainstream Adoption: We’re witnessing increasing adoption of Bitcoin and cryptocurrencies across various sectors. From major corporations adding Bitcoin to their balance sheets to countries exploring digital currencies, the narrative around crypto is shifting from niche technology to mainstream asset. Wider adoption naturally translates to increased demand and potentially higher prices.

- The Imminent Bitcoin Halving: The Bitcoin halving, a pre-programmed event that occurs roughly every four years, is another highly anticipated catalyst. The halving reduces the reward for mining new Bitcoin blocks by 50%, effectively cutting the supply of new Bitcoin entering the market. Historically, halvings have been followed by significant price increases due to reduced supply and increased scarcity. The next halving is expected in 2024, adding to the bullish sentiment.

- Broader Economic Factors: While crypto markets operate somewhat independently, they are not entirely immune to macroeconomic trends. Concerns about inflation, global economic uncertainty, and the potential for further monetary easing by central banks can drive investors towards alternative assets like Bitcoin, often seen as a hedge against traditional financial system risks.

Navigating the Bitcoin Boom: Key Takeaways and Considerations

Bitcoin’s resurgence is undoubtedly exciting, but it’s crucial to approach the crypto market with a balanced perspective. Here are some key takeaways and points to consider as you navigate this dynamic landscape:

- Volatility is Inherent: Cryptocurrencies, including Bitcoin, are known for their volatility. While the recent surge is encouraging, price corrections and downturns are always possible. Be prepared for price swings and avoid investing more than you can afford to lose.

- Do Your Own Research (DYOR): Never make investment decisions based solely on hype or headlines. Conduct thorough research, understand the technology, market dynamics, and risks involved before investing in Bitcoin or any other cryptocurrency.

- Consider Long-Term Potential: Many investors view Bitcoin as a long-term store of value and a disruptive technology. Focus on the long-term potential rather than getting caught up in short-term price fluctuations.

- Risk Management is Key: Implement proper risk management strategies, such as diversification and position sizing, to protect your capital. Don’t put all your eggs in one basket, and only invest what you are comfortable losing.

- Stay Informed: The crypto market is constantly evolving. Stay updated on market news, regulatory developments, and technological advancements to make informed decisions.

Conclusion: Bitcoin’s Bullish Momentum – A Sign of Things to Come?

Bitcoin’s leap above $36,700 marks a significant moment in the cryptocurrency narrative. Fueled by anticipation of a spot ETF, growing adoption, the upcoming halving, and broader market optimism, the current rally has captured the attention of investors worldwide. While the future remains uncertain, the confluence of these factors suggests that Bitcoin’s bullish momentum may indeed be more than just a fleeting surge. Whether this is the start of a sustained bull run or a temporary peak remains to be seen. However, one thing is clear: Bitcoin is back in the game, and the crypto world is watching with bated breath. As always, remember to approach the market with caution, do your research, and invest responsibly. The crypto journey is often a rollercoaster, but for those prepared, it can also be incredibly rewarding.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.