Hold onto your hats, crypto enthusiasts! Bitcoin SV (BSV) is making headlines with a price surge that’s turning heads. If you thought the crypto market was taking a breather, think again. BSV, a fork of Bitcoin, has just smashed through the $100 mark for the first time since February 2022. What’s fueling this impressive rally? Let’s dive into the details and uncover the factors propelling BSV into the spotlight.

What’s Behind the BSV Price Rocket?

In a market known for its volatility, BSV’s recent performance is nothing short of spectacular. We’re talking about a price jump of nearly 110% in a single week! This isn’t just a minor blip; it’s a significant movement that’s piqued the interest of traders and investors alike. But what’s the secret sauce behind this sudden surge?

The answer, in large part, points towards increased trading activity and a surge of interest emanating from the South Korean crypto market. Let’s break down these key drivers:

- South Korean Market Influence: South Korea has long been a vibrant hub for cryptocurrency trading, and its influence on global crypto markets is undeniable. Recently, South Korean exchanges have become major players in the BSV story.

- Trading Volume Spike: Accompanying the price increase is a massive spike in BSV trading volume. This indicates strong market participation and buying pressure, pushing the price upwards.

Upbit: The Epicenter of the BSV Trading Frenzy

When we talk about South Korean exchanges and BSV, one name stands out prominently: Upbit. As South Korea’s largest crypto exchange, Upbit’s activity has been instrumental in BSV’s recent price rally. Just on New Year’s Day, Upbit witnessed a staggering $275 million in BSV trading volume. To put that into perspective, that single day’s trading activity on one exchange contributed massively to the token’s upward trajectory!

The impact of Upbit can be visualized in the sheer volume of trades. The overall trading volume for BSV has skyrocketed, reaching a whopping $753.5 million. This surge in activity has not only boosted the price but also significantly increased Bitcoin SV’s market capitalization, pushing it to an impressive $1.7 billion.

See Also: SOL Surges Over 10% As Solana Breaks Key Resistance Levels, Aiming New High

Beyond Upbit: OKX and Bithumb Join the BSV Party

While Upbit has been a major catalyst, it’s not the only exchange experiencing a surge in BSV trading. OKX, another prominent exchange, has also seen a significant increase in BSV volume, surpassing $47.5 million in the last 24 hours alone. This represents a remarkable 300% increase, demonstrating a broader wave of interest in BSV trading.

Furthermore, Bithumb, another leading South Korean exchange, is also playing a crucial role. Together, Upbit and Bithumb have become the dominant forces in the recent BSV trading frenzy. In the last 24 hours, these two exchanges alone accounted for approximately 70% of BSV’s total trading volume. This concentration of trading activity in South Korean exchanges highlights their significant influence on BSV’s current market dynamics.

BSV Price: A Closer Look at the Numbers

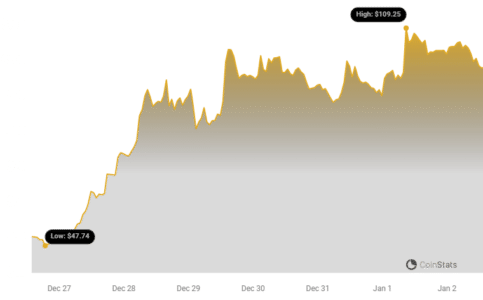

Let’s take a closer look at the current price and recent performance of Bitcoin SV. According to the latest data from Coinstats, Bitcoin SV is currently trading around $98. While this is a slight dip from the $100 mark, it still represents a substantial 7.3% increase in the last 24 hours and an astounding 109.1% increase over the past week. These figures underscore the rapid and significant price appreciation BSV has experienced recently.

The price chart visually confirms this dramatic upward trend, illustrating the volatility and rapid changes that are characteristic of the cryptocurrency market. The influence of regional trading trends, particularly from South Korea in this case, is clearly evident in the token’s valuation.

Navigating the Crypto Volatility: Key Takeaways

BSV’s recent price surge serves as a powerful reminder of the dynamic and often unpredictable nature of the cryptocurrency market. Here are a few key takeaways:

- Regional Market Influence: Geographical factors and regional trading trends can significantly impact token prices. The South Korean market’s activity is a prime example of this.

- Volatility is Inherent: The crypto market is known for its volatility. Dramatic price swings, both upwards and downwards, are a common occurrence.

- Trading Volume Matters: Increased trading volume often accompanies and can drive price movements. Monitoring trading volume can provide insights into market sentiment and potential price trends.

In Conclusion: Riding the BSV Wave?

Bitcoin SV’s impressive price surge, fueled by South Korean market enthusiasm and heightened trading activity, is a compelling story in the crypto world. While the gains are significant, it’s crucial to remember the inherent volatility of cryptocurrencies. Understanding the factors driving these price movements, such as regional market dynamics and trading volumes, is essential for anyone navigating the crypto landscape. Whether this surge marks the beginning of a sustained uptrend for BSV or a temporary spike remains to be seen. As always, staying informed and conducting thorough research are paramount in the ever-evolving world of crypto investments.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.