Bitcoin (BTC) has been in a bit of a sideways shuffle lately, hasn’t it? While the price action might seem uneventful, behind the scenes, something quite significant is brewing. Guess who’s been busy during this period of consolidation? You guessed it – Bitcoin whales!

Are Bitcoin Whales Loading Up? On-Chain Data Says Yes!

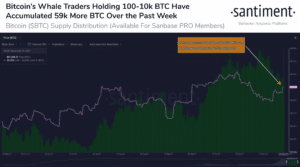

According to Santiment, a leading on-chain data provider, millionaire-tier Bitcoin whale addresses have been on an accumulation spree, scooping up a whopping 60,000 Bitcoins in just the past week. That’s a significant chunk of the supply!

Santiment highlighted this surge in accumulation, stating:

“If you’ve been waiting for #Bitcoin whales to show signs of accumulation,…”

“our data indicates it’s happening once again. In the past week, a total 59k $BTC has been…”

“added to addresses that hold between 100 to 10k $BTC. This is 0.29% of the total supply.”

This level of accumulation by major players often signals strong conviction in Bitcoin’s future prospects. Think about it – these whales aren’t known for making rash decisions. Their moves are typically calculated and based on in-depth market analysis.

Bullish Divergence: Are Strong Hands Getting Stronger?

Adding further fuel to the bullish narrative, popular crypto analyst Will Clemente pointed out a clear bullish divergence. What does that mean exactly? In simple terms, it suggests a disconnect between price action and underlying strength. Clemente observed that while Bitcoin’s price has been moving sideways, the supply is increasingly shifting into the hands of “strong hands” – long-term holders who are less likely to sell during short-term price fluctuations.

Clemente tweeted his observation, noting:

“Over the last two weeks, clear bullish divergence between…”

“BTC supply moving to strong hands and price.” pic.twitter.com/6jeairtXX8

— Will Clemente (@WClementeIII) November 24, 2021

This divergence can be interpreted as a build-up of potential energy. Imagine a spring being compressed – the price might not be reflecting it yet, but the potential for a significant upward move is increasing as more BTC gets locked away by strong holders.

Bitcoin in Oversold Territory? The Advanced NVT Signal

Adding another layer to this intriguing picture, crypto analyst Philip Swift highlights that Bitcoin might currently be in oversold territory. He points to the Advanced NVT (Network Value to Transactions) Signal, a metric used to gauge whether Bitcoin is overbought or oversold based on its network activity relative to its market cap.

Bitcoin Now In Oversold Territory

So, Bitcoin (BTC) price continues trading sideways around $56,000 levels. Then, crypto analyst Philip Swift notes a bull flag on Bitcoin’s Advanced NVT Signal.

The Advanced NVT Signal essentially compares Bitcoin’s market capitalization to the volume of transactions happening on its network. A low NVT signal can suggest that Bitcoin is undervalued relative to its network activity, indicating it might be oversold.

To be more precise, the Advanced Bitcoin NVT is calculated by dividing the total BTC market cap by the 90-day moving average of the network transaction volume. Swift explains in his tweet:

“Advanced NVT (blue line) has now dropped deep into oversold territory (green bands)…”

“#Bitcoin is looking seriously cheap relative to network activity here on high time frames…”

“Expecting a strong reaction in the not too distant future.”

According to Swift, the Advanced NVT signal has dipped into oversold territory, suggesting that Bitcoin is currently undervalued based on network activity. This could be another strong indicator that a price correction to the upside might be on the horizon.

What Does This Mean for Bitcoin?

Putting it all together, we have a compelling narrative forming:

- Whale Accumulation: Large Bitcoin holders are actively increasing their positions.

- Bullish Divergence: Supply is moving to strong hands, even as price consolidates.

- Oversold Signal: The Advanced NVT signal suggests Bitcoin is undervalued.

These factors combined paint a potentially bullish picture for Bitcoin in the near future. While the crypto market is known for its volatility and surprises, these on-chain metrics and analyst observations offer intriguing insights into the current market dynamics.

Of course, it’s crucial to remember that this is just analysis, and the crypto market can be unpredictable. However, the confluence of whale accumulation, bullish divergence, and oversold signals certainly warrants attention and suggests that the current sideways movement in Bitcoin might be setting the stage for a significant move upwards.

Galaxy Interactive Rises Additional $325M Fund For Metaverse and Next Gen…>>

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.