Bitcoin’s price is steady above the $26,200 support level, serving as a psychological baseline for investors. Moreover, the cryptocurrency trades above $26,500 and a critical 100-hour Simple Moving Average (SMA). These signs point to a bullish uptrend in the short term.

Additionally, the hourly chart for the BTC/USD pair shows a connecting bullish trend line, providing support at the $26,500 level. This trend line is an immediate cushion, suggesting the currency might maintain its upward trajectory. If Bitcoin stabilizes above $26,850 and reaches $27,000, a steady increase could be on the horizon.

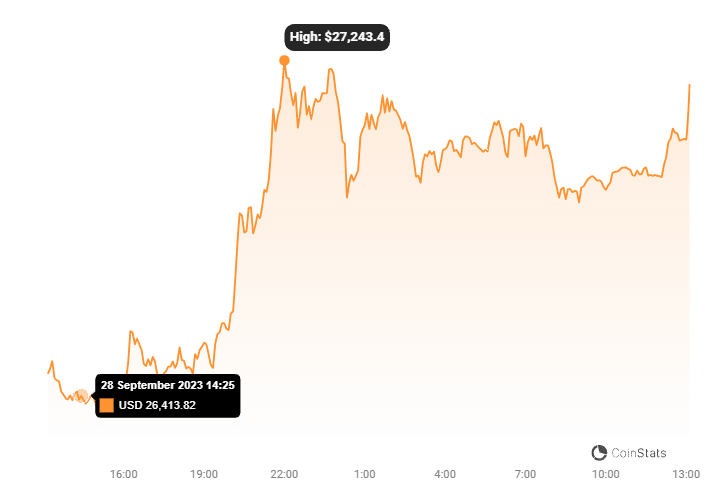

However, the journey has been somewhat smooth for Bitcoin. The currency did experience a brief setback, falling below $26,550 at one point. Specifically, the price dipped to as low as $26,412 before rebounding. Importantly, the currency has crossed the 50% Fibonacci retracement level, moving from a low of $26,412 to a swing high of $26,887.

Regarding resistance, the immediate hurdle lies near $26,700, the 61.8% Fibonacci level. The next substantial barriers are at $26,850 and then $27,000. A successful close above these resistance points could open the gates to $27,200, sparking another bullish wave. Hence, the ultimate prize for the bulls may be a rally toward the $28,500 mark.

Conversely, if Bitcoin fails to break past $26,850, it might face a downturn. The immediate support comes at $26,500, aligning with the bullish trend line. Failure to hold this could lead the price toward the next significant support level at $26,200. A close below this threshold might direct Bitcoin toward the $25,650 level, bringing a bearish sentiment into play.

Significantly, technical indicators like the Hourly MACD and RSI favor the bulls. The MACD is accelerating in the bullish zone, and the RSI has risen above 50. Consequently, these indicators align with the optimistic sentiment around Bitcoin’s short-term price actions.

To summarize, Bitcoin is currently in a delicate balance between bullish and bearish outcomes. The upcoming days will be critical in determining which path it chooses, making the $26,850 and $27,000 resistance levels and the $26,500 and $26,200 support levels the ones to watch.