Satoshi clearly seems to have an eventful year because of the price rally observed in the last few weeks. It surpassed all its previous highs in an attempt to draw imagination to reality. Where the crypto king strived towards reaching the moon, its transaction fees also rocketed in the same momentum. Nevertheless, the second largest currency Ethereum also is currently facing related concerns after the launch of Ethereum Beacon Chain.

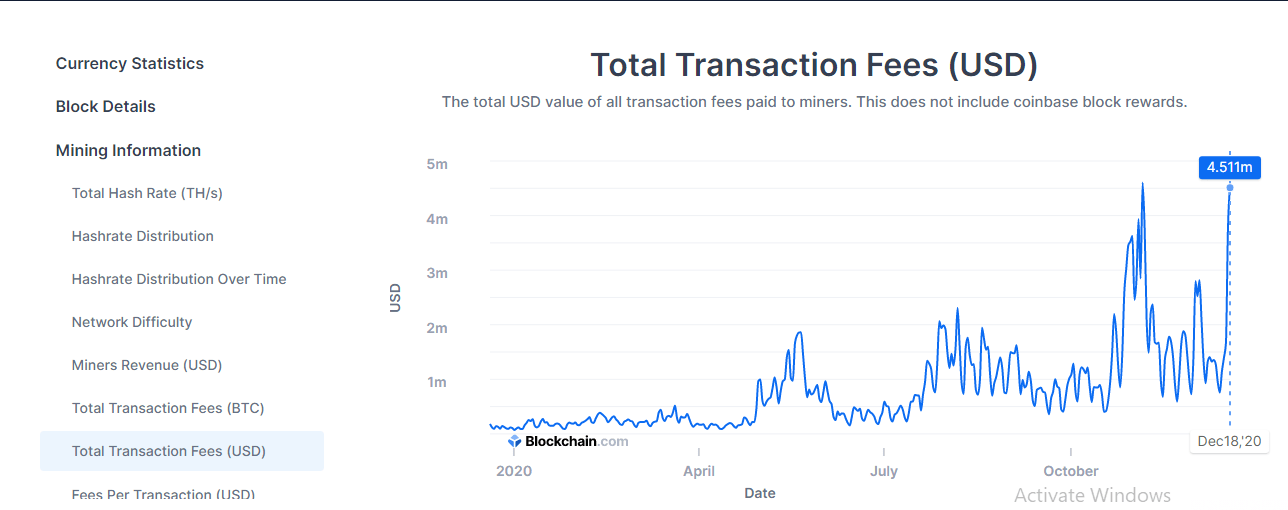

According to Blockchain charts, the total Bitcoin transaction fees stand at a whopping 4.511 million. This has substantially increased in the last two months, where the foremost currency enjoyed its peaks amidst the crypto price rally. However, the beginning of 2020 did not observe much in terms of increased transaction fees. Therefore, the total transaction fees fluctuated between $1 million to $2 million. Furthermore, the primary cause of Bitcoin’s price rally is due to the foray of institutional players in the crypto space. The rising demand for conventional financial players has thundered the crypto industry resulting in huge gains to the pioneers. The fees per transaction currently stand at USD 11.828. The highest transaction fees were 13.154 USD as of October 2020.

Bitcoin transaction fees follow the footsteps of the currency at large.

In a time span of two weeks, the Bitcoin transaction fees rallied from a mere $2.71 to 11.828 at the time of this publication. This is approximately 436% of an aggregate increase. Therefore, every other day, the transaction fees spike to almost 30% in a conducive crypto rally. However, the figures remain shallow in comparison with the transfer fees in 2017. On 22nd December 2017, the average transaction fee was $54.638. This remains the most expensive transaction fees in the history of Bitcoin. The current transaction fees are 461% below the lofted fees of 2017. However, the current Bitcoin price momentum appears to surpass the previous transfer fee highs.

Besides, the Bitcoin network difficulty also arose to 18.67t representing a substantial increase in difficulty to mine a block. Consequently, from the miner’s perspective, the overall miners’ reward has escalated remarkably over the past few weeks. The total miners’ rewards aggregate to 27.241 million at the press time.

Conclusively, the increase in transaction fees represents some significant phenomenon. It advocates that with the currency’s escalating price, the transaction fees automatically increases since the miner gets rewarded in the satoshis. It further represents that Bitcoin is continuously in action in tandem with its usage and trade. Hence, irrespective of the increased fees, users are inclined to pay more as instant transaction confirmation fees.

Follow BitcoinWorld for more updates.