Bitcoin is back in the spotlight, surging to new year-to-date highs and reigniting excitement in the crypto market. Recently, Bitcoin touched $48,234 on the Bitstamp exchange, a significant milestone demonstrating its resilience and growing adoption. But here’s the twist: while Bitcoin is enjoying a robust comeback, the stocks of companies directly involved in the cryptocurrency ecosystem, particularly crypto mining firms, are telling a different story. It’s a curious divergence – Bitcoin is booming, yet crypto stocks are… well, not so much. Let’s dive into why this is happening and what it means for investors.

The Crypto Stock Paradox: Bitcoin Rises, Stocks Stumble

You’d expect that a surging Bitcoin price would lift all boats in the crypto sea, right? Logically, if Bitcoin is doing well, companies that revolve around Bitcoin – like miners and Bitcoin-heavy investment firms – should also be thriving. However, the reality is proving to be quite different. Crypto-related stocks are struggling to mirror Bitcoin’s positive momentum. Mining stocks, in particular, have been hit hard. Imagine this:

- Mining Stock Plunge: Since November, the stock prices of cryptocurrency mining companies have plummeted by more than 50%! That’s a significant downturn, especially considering Bitcoin’s recent gains.

- Stronghold Digital’s Shock: Bitcoin mining company Stronghold Digital experienced a dramatic stock drop of over 30% after a disappointing revenue report. Shareholders were caught off guard, and the company has had to revise its 2022 outlook, admitting it won’t meet its ambitious hashrate targets due to operational hurdles.

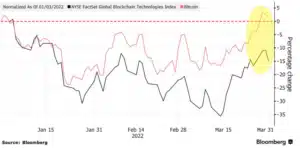

Image Source: bloomberg.com

Which Crypto Stocks Are Feeling the Heat?

It’s not just one or two isolated cases. Several prominent crypto mining companies are facing similar headwinds. Let’s take a look at some examples:

- Bit Digital & Hut 8 Mining Corp: Despite Bitcoin’s brief foray into positive territory this year, shares of these well-known mining firms have decreased by over 20% since the start of 2023.

- MicroStrategy’s Mixed Bag: MicroStrategy, a business intelligence firm famously bullish on Bitcoin and holding a massive BTC portfolio, has also seen its stock value decline by more than 10% year-to-date. It’s down a significant 41% from its peak in November 2021. Interestingly, even with this stock dip, MicroStrategy remains committed to Bitcoin, recently securing a $205 million loan to buy even more BTC. They currently hold the title of the world’s largest corporate Bitcoin holder, with a market cap of $5.9 billion. Their unwavering faith in Bitcoin hasn’t translated to stock market success, at least not recently.

Why the Disconnect? Unpacking the Reasons Behind Crypto Stock Underperformance

So, what’s causing this divergence between Bitcoin’s price and the performance of crypto stocks? Several factors are likely at play:

-

Broader Stock Market Sentiment:

According to expert Christopher Brendler, the overall negative sentiment in the stock market is a significant drag on crypto stock valuations. It’s not just crypto stocks that are underperforming. Many tech stocks, particularly those considered high-growth or speculative, are also struggling.

-

Comparison with Tech Stock Downturn:

Brendler points out that several leading tech companies, including Robinhood, Wish, Roku, and Opendoor, have seen their stocks plummet by over 75% from their 2021 highs. This highlights that the underperformance isn’t isolated to crypto equities. A broader market correction, particularly in the tech sector, is affecting these stocks.

-

Mining Specific Challenges:

Mining companies face unique operational challenges that can impact their profitability and stock performance, even when Bitcoin prices are favorable. These can include:

- Energy Costs: Mining is energy-intensive. Fluctuations in energy prices can significantly affect mining profitability.

- Hashrate Competition: The Bitcoin mining hashrate (total computing power on the network) is constantly increasing. Miners need to continually invest in more efficient equipment to remain competitive.

- Operational Issues: As Stronghold Digital’s case illustrates, operational problems, such as equipment malfunctions or delays in expansion, can severely impact mining output and revenue.

-

Investor Risk Perception:

Crypto stocks, especially mining stocks, are often perceived as riskier investments compared to holding Bitcoin directly. They are subject to both Bitcoin price volatility and the operational risks of the underlying business. In times of market uncertainty, investors may prefer to hold Bitcoin itself rather than the more complex and potentially riskier crypto stocks.

The Bottom Line: Navigating the Crypto Investment Landscape

The current situation presents a complex picture for crypto investors. While Bitcoin’s price recovery is undoubtedly positive for the overall crypto market, the underperformance of crypto stocks highlights that investing in this space requires careful consideration and nuanced understanding. It’s crucial to remember that:

- Crypto stocks are not a direct proxy for Bitcoin: Their performance is influenced by a broader range of factors beyond just Bitcoin’s price.

- Due diligence is key: Thoroughly research individual crypto companies, understanding their business models, operational risks, and financial health, before investing.

- Market sentiment matters: Broader market trends and investor risk appetite can significantly impact crypto stock valuations.

While Bitcoin’s resurgence is encouraging, the crypto stock market is sending a reminder that the crypto investment journey can be full of surprises and requires a strategic, informed approach. Keep a close eye on both Bitcoin’s price action and the underlying fundamentals of crypto companies to make well-rounded investment decisions.

Related Posts – XRP Price Goes Up After Unexpected Reappearance On Coinbase

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.