- FTX has dropped its plans to relaunch the exchange, failing to meet sufficient capital, but the exchange, instead, focuses on repaying its customer funds fully.

- FTT tokens fell by 35%, with whales selling the tokens following the platform’s revelation.

The bankrupt crypto exchange FTX has abandoned its plans to restart the company, dismissing anticipations of FTX re-launching as FTX.com.

According to recent reports, FTX declared that the firm is looking forward to liquidation in a bid to completely reimburse the customer funds.

Previously, FTX announced its plans to reboot the company as FTX.com, focusing on international customer services.

Along with the plan, the company proposed a draft creditor-repayment plan intending to settle its customer claims in cash.

In addition, a recent report claimed that FTX, struggling to settle its customer claims, initiated unloading its crypto holdings as a means to fetch funds.

Adding more clarity to the matter, in a court hearing, FTX attorney Andy Dietderich shared insights on the company’s efforts in repaying its customer funds, which were locked when the company fell in 2022.

See Also: Annoyed FTX Customers Ask Judge To Block The Exchange’s Valuation Plan

Reportedly, the company has recovered more than $7 billion in assets and expects to repay its customers fully. Government regulators, who hold about $9 billion in claims, have agreed with the company to wait until the customers are fully paid.

However, FTX has dropped its plans to re-establish the exchange, failing to meet enough capital to invest in the launch.

The attorney stated that though FTX negotiated with potential bidders and investors, they hesitated to invest enough money for the establishment of the platform.

He added that the matter underscored Sam Bankman-Fried’s failure to build the prerequisite technology and administration needed for a company to establish success. The attorney cited,

“FTX was an irresponsible sham created by a convicted felon. The costs and risks of creating a viable exchange from what Mr. Bankman-Fried left in a dumpster were simply too high.”

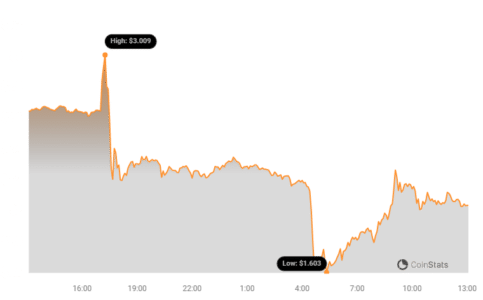

Meanwhile, FTX’s FTT token, currently trading at $2.04, fell by about 35% to $1.6, as highlighted by Coinstats, a prominent analytics platform, before soaring slightly to its current price.

$FTT's price has dropped 🔻 by 35% in the past few hours. Who is selling?

➡️ FTX and Alameda still hold 76% of the total supply, with no selling in the past 2 months, even though the $FTT price reached $5.5 at some points.

➡️ There haven't been many significant on-chain token… https://t.co/xbZniFs9Yx pic.twitter.com/KynXGLyggb

— Spot On Chain (@spotonchain) February 1, 2024

With internal exchange transactions identified in the past hours, Spot on Chain added that the “whales are playing the game here, based on the news that ‘the defunct crypto exchange won’t be restarted.’”

#Binance #WRITE2EARN