Ever wondered about the darker side of the booming cryptocurrency world? While crypto promises decentralization and financial freedom, it also, unfortunately, attracts illicit activities. A recent report by blockchain analytics firm Chainalysis sheds light on a concerning trend: the rise of ‘criminal whales’ in the crypto space. These aren’t your friendly neighborhood crypto enthusiasts; they’re individuals amassing fortunes through illegal means and stashing them in cryptocurrency wallets. Prepare to dive deep into the data and uncover the scale of crypto crime lurking beneath the surface.

What Exactly are ‘Criminal Whales’?

Chainalysis, a leading name in blockchain analysis, doesn’t just throw around terms lightly. They define ‘criminal whales’ with precision. According to their Crypto Crime Report, a ‘criminal whale’ is a private crypto wallet that meets two key criteria:

- Holds over $1 million worth of cryptocurrency.

- Receives more than 10% of its funds from illicit addresses.

These illicit addresses are linked to a range of cybercrimes, including:

- Scams

- Fraud

- Malware

- Darknet Markets

- Stolen Funds

- And more

Essentially, these are the big players in the crypto underworld, using digital currencies to store and potentially launder their ill-gotten gains.

The Shocking Numbers: $25 Billion Held by Crypto Criminals

The Chainalysis report paints a stark picture. Here are some key takeaways that highlight the magnitude of the problem:

- 4,068 Criminal Whales Identified: Chainalysis has pinpointed a staggering 4,068 individual criminal whales operating within the cryptocurrency ecosystem.

- $25 Billion in Cryptocurrency Held: Collectively, these criminal whales are hoarding over $25 billion worth of cryptocurrencies. That’s a massive amount of money derived from illegal activities!

- 3.7% of All Crypto Whales are Criminals: While seemingly a small percentage, it signifies that a notable portion of the big crypto holders are involved in or benefiting from criminal enterprises. Imagine nearly 4 out of every 100 crypto millionaires potentially linked to illegal activities.

To put it in perspective, $25 billion could fund a lot of positive initiatives globally. Instead, it’s locked up in wallets associated with cybercrime. This underscores the urgent need for stronger regulations and better tracking mechanisms within the crypto space.

Breakdown of Illicit Funds: How Deep Does the Rabbit Hole Go?

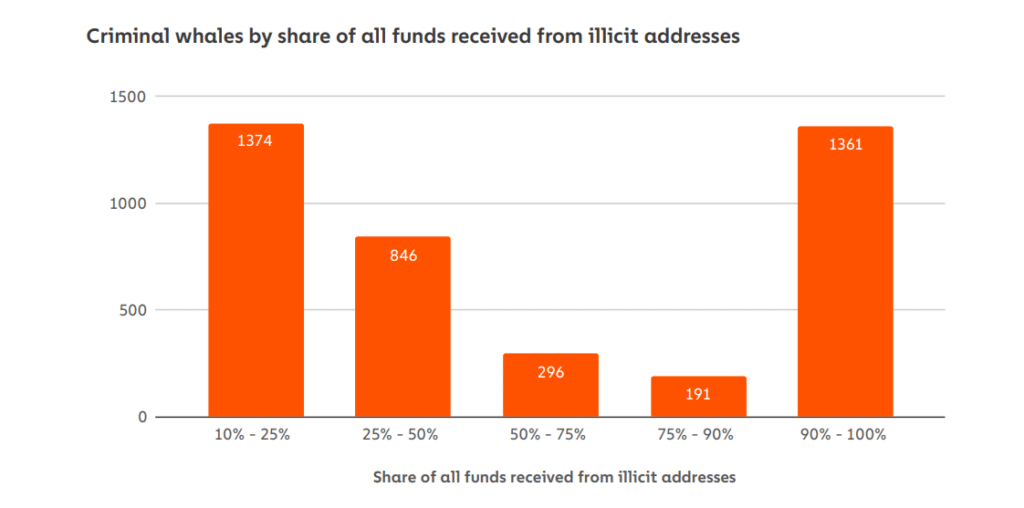

Chainalysis further breaks down the criminal whales based on the percentage of illicit funds in their wallets, revealing different levels of involvement with criminal activities:

| Percentage of Illicit Funds | Number of Criminal Whales |

| 10% – 25% | 1,374 |

| 25% – 90% | 1,333 |

| 90% – 100% | 1,361 |

As you can see, the numbers are fairly distributed across different levels of illicit fund percentages. Notably, a significant number of criminal whales (1,361) have a portfolio almost entirely composed of illicit funds (90% to 100%). This indicates a high degree of criminal involvement for a substantial portion of these whales.

Percentage of whale balance via illicit addresses: Chainalysis

Where are These Illicit Funds Coming From?

Delving deeper, the report identifies the primary sources of these illicit funds flowing into criminal whale wallets. Understanding these sources is crucial for developing strategies to combat crypto crime effectively.

According to Chainalysis, the top sources are:

- Darknet Markets: Leading the pack, darknet markets are a significant source of illicit funds for criminal whales. These online black markets facilitate the trade of illegal goods and services, often using cryptocurrencies for transactions.

- Scams: Coming in second, scams are another major contributor. The crypto space, unfortunately, is rife with scams, from phishing schemes to Ponzi schemes, preying on unsuspecting investors.

- Stolen Funds: Rounding out the top three, stolen funds also constitute a significant portion of illicit balances. This includes cryptocurrency stolen from exchanges, individuals, or through hacks and exploits.

While stolen funds represent a large chunk of the overall criminal balances, darknet markets and scams are the primary channels through which these illicit funds are supplied to criminal whales.

The Alarming Rise in Crypto Crime Transactions

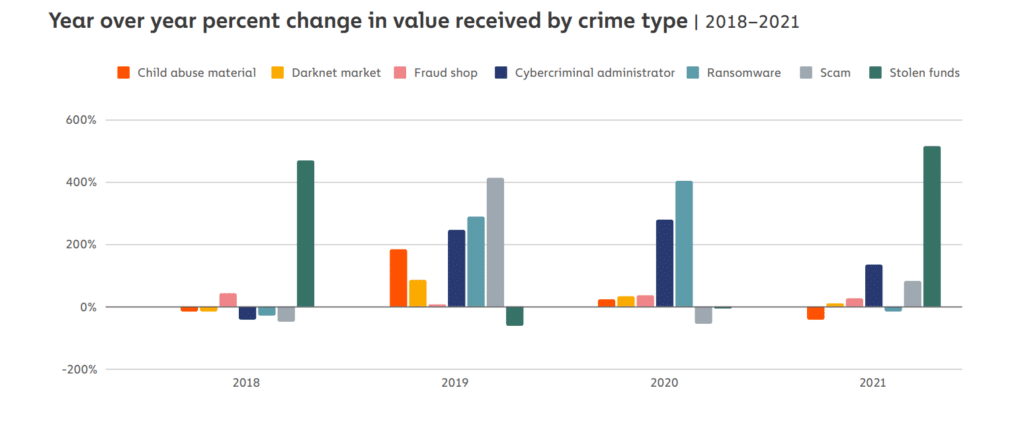

The Chainalysis report also highlights a disturbing trend: a significant surge in the value of illicit transactions within the crypto ecosystem.

In 2021, criminal addresses received over $14 billion. To truly grasp the scale of this increase, consider this:

- In 2020, the value received by criminal addresses was only $7.8 million.

That’s a monumental leap, indicating a dramatic escalation in crypto-related criminal activity within just one year. This exponential growth is a serious cause for concern and demands immediate attention from regulators and law enforcement agencies.

Value received via type of crypto crime: Chainalysis

Scams Dominate Crypto Crime, DeFi Rug Pulls on the Rise

Breaking down the $14 billion in illicit transaction value further, the report reveals that scams were the dominant force, accounting for a staggering $7.8 billion in 2021. This represents an 82% increase year-over-year, highlighting the growing sophistication and prevalence of crypto scams.

Within the realm of scams, DeFi (Decentralized Finance) rug pulls emerged as a particularly concerning trend. Rug pulls are malicious schemes where developers of DeFi projects abruptly abandon the project, making off with investors’ funds. These rug pulls accounted for a total value of $2.8 billion in 2021, demonstrating the significant financial damage they inflict on crypto investors.

The rise of DeFi rug pulls underscores the risks associated with the rapidly evolving and often unregulated DeFi space. Investors need to exercise extreme caution and conduct thorough due diligence before investing in DeFi projects.

Conclusion: The Crypto Underworld Demands Attention

The Chainalysis Crypto Crime Report’s findings are a wake-up call for the cryptocurrency industry and its stakeholders. The existence of thousands of ‘criminal whales’ holding billions in illicit funds is a serious problem that cannot be ignored. While cryptocurrency offers numerous benefits, its anonymity and decentralized nature also make it attractive to criminals.

Key takeaways to remember:

- Crypto crime is a significant and growing problem.

- ‘Criminal whales’ are a real phenomenon, holding vast amounts of illicit crypto.

- Scams, especially DeFi rug pulls, are a major driver of crypto crime.

- Increased vigilance, regulation, and robust tracking tools are crucial to combat crypto crime effectively.

As the crypto space matures, addressing these criminal elements is paramount to ensure its long-term sustainability and legitimacy. Staying informed, practicing caution, and supporting efforts to combat crypto crime are essential steps for everyone involved in the cryptocurrency ecosystem.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.