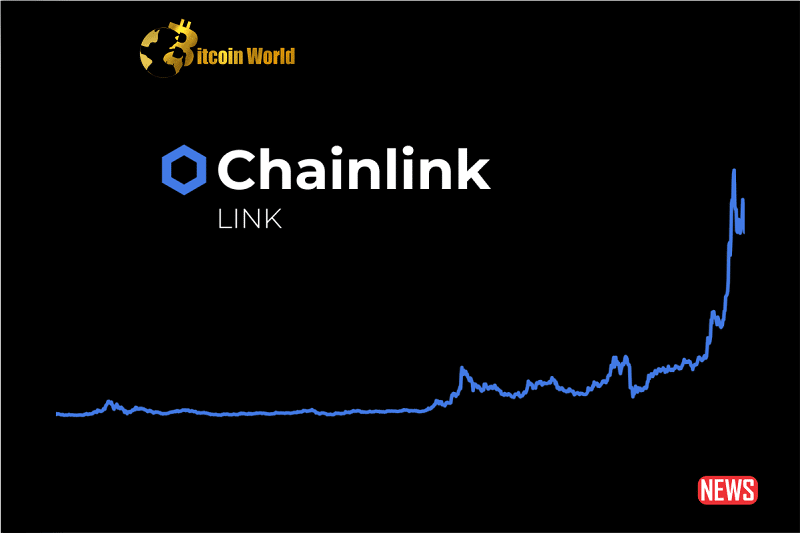

Are you keeping a close eye on the crypto markets, searching for the next big opportunity? The world of cryptocurrency is always buzzing with activity, and recent analysis on Chainlink (LINK) has caught the attention of many. A prominent crypto strategist, Kevin Svenson, is suggesting that Chainlink might be gearing up for a significant upward move. Let’s dive into what’s fueling this optimistic outlook and what it could mean for LINK enthusiasts.

Who is Kevin Svenson and Why Should You Care?

In the crypto sphere, information is king, and insights from experienced analysts can be invaluable. Kevin Svenson is a well-regarded crypto strategist who has built a strong following of over 70,700 subscribers on YouTube. His analyses are known for blending technical expertise with clear, understandable explanations, making complex market dynamics accessible to a wider audience. When Svenson talks, people in the crypto community listen. His recent focus? Chainlink (LINK).

The 500-Day SMA: A Key Indicator for Chainlink’s Potential

Svenson’s bullish perspective on Chainlink isn’t based on a whim. It’s rooted in technical analysis, specifically the observation that LINK has ascended above the 500-day Simple Moving Average (SMA). But what exactly does this mean, and why is it significant?

Moving Averages (MAs) are essential tools in technical analysis. They smooth out price fluctuations to help identify trends. The 500-day SMA is a long-term moving average, representing the average closing price of an asset over the past 500 days. Crossing above such a long-term average is often seen as a strong signal that a potential shift in market sentiment is underway.

As Svenson himself explains, “We’ve ascended above the 500-day SMA, which is the longest moving average we’ve observed. This crossover by Chainlink is telling. Typically, transcending these extensive SMAs indicates an overarching shift in dynamics.”

In simpler terms, breaking above the 500-day SMA suggests that Chainlink might be transitioning from a prolonged period of downward pressure to a phase of potential upward momentum. It’s like a ship finally turning after a long voyage in one direction.

Is This the End of Chainlink’s Downtrend?

For Chainlink holders who have weathered the storms of market volatility, Svenson’s analysis offers a glimmer of hope. The strategist interprets Chainlink’s current price action as a preliminary reversal signal. This means that the prolonged downtrend LINK has experienced might be losing steam, and the tides could be turning.

However, it’s crucial to manage expectations. Svenson isn’t suggesting an immediate moonshot. He speculates a situation where this Ethereum (ETH)-anchored altcoin retains its optimistic vigor in the imminent future, soaring towards its overarching resistance. However, Svenson remarks that LINK probably requires an extended period before genuinely adopting a bullish demeanor.

This suggests a more measured, gradual climb rather than a sudden parabolic surge. Patience, as always in the crypto market, might be key.

Targeting Resistance: Where Could Chainlink Go Next?

If Chainlink is indeed poised for upward movement, where could it realistically be headed? Svenson points to a key resistance level that LINK needs to overcome. He states, “Currently, the macro slipping resistance level is approximately $10.90. Therefore, the zone sparking curiosity ranges from roughly $10.13 to a rounded $11. Expectations would align with an evaluation around the $11 mark in a potential surge. If Chainlink surpasses this resistance, it’s plausible it might retrace to assess lower levels, eventually breaking out at a subsequent time.”

Let’s break down these levels:

- Immediate Resistance Zone: $10.13 – $11.00: This is the initial hurdle Chainlink needs to clear. Svenson highlights this zone as the primary area of interest for potential upward movement.

- Target Price: Around $11: Svenson anticipates a potential surge towards the $11 mark if the momentum continues.

- Potential Retracement: Even if LINK breaks through the $11 resistance, Svenson suggests a possibility of a retracement or pullback to lower levels before a more sustained breakout. This is a common pattern in crypto markets – prices rarely move in a straight line.

It’s important to remember that these are potential targets based on technical analysis. The crypto market is volatile, and prices can be influenced by a multitude of factors beyond technical indicators.

Chainlink’s Current Market Position

As of now, Chainlink’s value is $7.32, and recent market data shows a 2% dip over the past day. This minor dip underscores the inherent volatility of the crypto market and reminds us that even with positive analyst predictions, short-term price fluctuations are normal.

Here’s a quick snapshot of Chainlink’s current market standing:

| Metric | Value |

|---|---|

| Current Price | $7.32 |

| 24-Hour Price Change | -2% |

| Market Sentiment (based on Svenson’s analysis) | Potentially Bullish (Long-term) |

Despite the slight daily decline, Svenson’s analysis provides a beacon of optimism for those invested in or considering Chainlink. It suggests that the current price might represent an opportune entry point for those with a longer-term perspective.

Beyond Price Action: Why Chainlink Matters

While price predictions and technical analysis are fascinating, it’s crucial to remember the fundamental value proposition of Chainlink. Chainlink is not just another cryptocurrency; it’s a decentralized oracle network. But what does that actually mean?

In simple terms, Chainlink bridges the gap between blockchains and the real world. Blockchains, by design, are isolated systems. They need a secure and reliable way to access data from external sources like APIs, data feeds, and payment systems to execute complex smart contracts. This is where Chainlink comes in.

Key Benefits of Chainlink:

- Decentralized Oracles: Chainlink uses a network of decentralized oracles, making it highly secure and resistant to manipulation compared to centralized oracle solutions.

- Data Integrity: Chainlink ensures data integrity by aggregating data from multiple sources, enhancing the reliability of information fed to smart contracts.

- Wide Range of Use Cases: Chainlink powers various applications across DeFi (Decentralized Finance), insurance, supply chain management, gaming, and more.

- Established Partnerships: Chainlink has established partnerships with numerous reputable projects and enterprises, showcasing its credibility and real-world adoption.

- Active Development: The Chainlink team is continuously developing and expanding the network’s capabilities, fostering innovation and growth.

Essentially, Chainlink is a critical infrastructure component for the growing Web3 ecosystem. Its technology enables smart contracts to become truly “smart” by connecting them to the vast amount of data and systems that exist outside of blockchains.

Navigating the Crypto Waters: Proceed with Caution

While Kevin Svenson’s analysis is encouraging, and Chainlink’s fundamentals are strong, it’s essential to approach crypto investments with a balanced perspective. As with any market speculation, it’s essential to approach cautiously and research.

Here are some key considerations for anyone looking at Chainlink or any cryptocurrency:

- Market Volatility: The crypto market is notoriously volatile. Prices can swing dramatically in short periods. Never invest more than you can afford to lose.

- Do Your Own Research (DYOR): Don’t rely solely on any single analyst’s opinion. Conduct thorough research, understand the technology, and assess the risks involved.

- Risk Management: Implement proper risk management strategies. Diversify your portfolio and use stop-loss orders if appropriate for your trading style.

- Long-Term Perspective: Consider your investment horizon. Crypto investments, especially in promising projects like Chainlink, often require a long-term outlook to realize their full potential.

- Stay Informed: Keep up-to-date with market news, technological advancements, and regulatory developments in the crypto space.

In Conclusion: Is Chainlink Gearing Up for a Rebound?

Kevin Svenson’s analysis suggests that Chainlink (LINK) might be at a pivotal point. Breaking above the 500-day SMA is a significant technical signal, hinting at a potential shift from a downtrend to upward momentum. The identified resistance zone around $10-$11 provides a near-term target to watch.

Coupled with Chainlink’s strong fundamentals and crucial role in the blockchain ecosystem, the technical indicators paint an interesting picture. However, the crypto market remains unpredictable. While Svenson’s insights offer valuable guidance, they should be considered as part of a broader research and risk assessment strategy.

For Chainlink enthusiasts and potential investors, this analysis provides a reason for cautious optimism. Keep an eye on LINK’s price action, stay informed, and remember that in the world of crypto, informed decisions and patience are your best allies. Will Chainlink indeed break through the resistance and embark on a new upward trajectory? Only time will tell, but the signals are certainly worth watching.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.