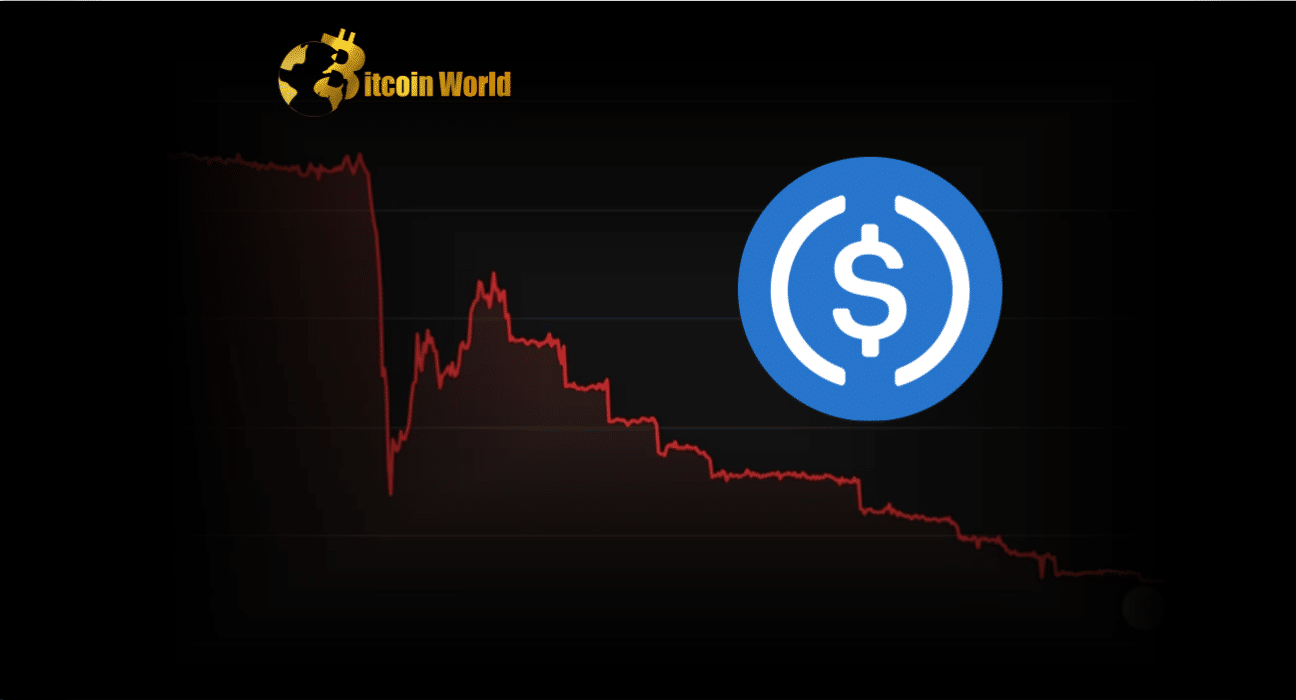

The market capitalization of the stablecoin fell to approximately $32.5 billion, representing a decline of approximately $10 billion over the past two weeks. Circle’s USDC continues to see redemptions on a mass scale.

“Despite Circle offering full redemptions without delays for USDC, it appears that the events of early March have damaged the trust that crypto investors and traders have in the reliability of the stablecoin,” said Steven Zheng, director of research at The Block. “It appears that the events of early March have damaged the trust that crypto investors and traders have in the reliability of the stablecoin.”

During the previous twenty-four hours, net redemptions came close to $463 billion, while a total of $487 billion was burned and only $24.1 million was minted. According to data provided by The Block, during the same time period, USDC’s market cap decreased from approximately $33.3 billion to $32.8 billion.

At the beginning of March, problems began to arise with the stablecoin when it became public knowledge that Circle had $3.3 billion of reserve funds held in Silicon Valley Bank. As a result of this news, USDC began to de-peg from the US dollar. The CEO of Circle, Jeremy Allaire, made the announcement that business would resume shortly after federal bank regulators in the United States guaranteed the complete return of customer deposits from Silicon Valley Bank and Signature Bank. Despite this, there have been ongoing redemptions.

The week before last, Allaire addressed concerns in a post on Twitter. In it, he connected the sell-off to a larger de-risking process among investors from projects that were exposed to regulatory risk in the United States and to banks in the United States. The stablecoin has “never failed to mint or redeem USDC for $1,” including during the stress test that took place over the past week, according to Allaire, who spoke on behalf of Circle and stated that “we are going to keep doing what we have always done.”

According to Allaire, “USDC as a protocol and digital currency continues to function on public chains, protocols, and wallets without interruption.”