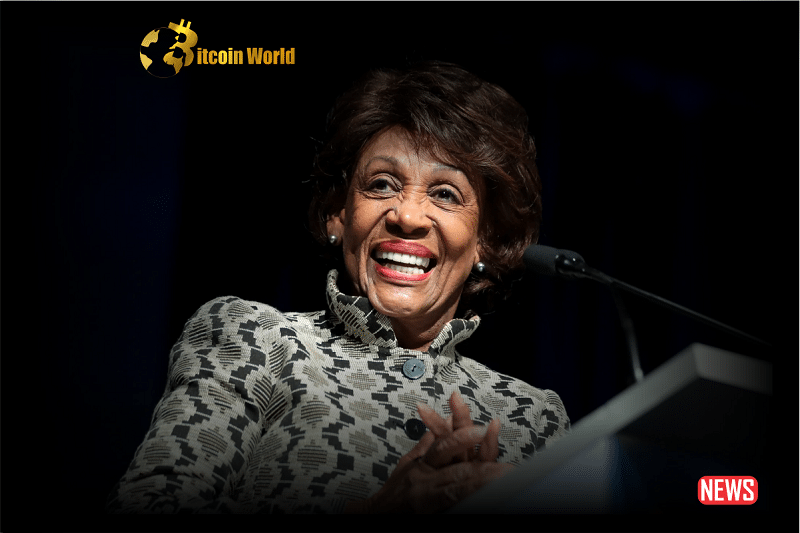

Democratic Congresswoman Maxine Waters (D-CA) has criticised PayPal’s recent launch of its dollar-backed stablecoin, PYUSD. In her statement, Waters expressed concerns that PayPal proceeded with the stablecoin launch without waiting for federal regulatory approval, emphasizing the absence of a federal framework for regulation.

Waters, a prominent House Financial Services Committee figure, highlighted her worry about the lack of oversight and regulation for PayPal’s stablecoin operations. She emphasized that given PayPal’s extensive global customer base of 435 million users, federal oversight is imperative to ensure stability and security in the financial system.

PayPal’s stablecoin, PYUSD, is managed by Paxos Trust and is backed by deposits in U.S. dollars, short-term Treasuries, and similar cash assets. The stablecoin offers holders the ability to convert it into U.S. dollars and use it within PayPal’s network, including for transactions involving cryptocurrencies like Bitcoin, Bitcoin Cash, Ether, and Litecoin.

Waters asserted the need for federal regulation of stablecoins, as they introduced a new currency form requiring oversight and guidance from federal agencies. She highlighted the role of the Federal Reserve in maintaining monetary policy and money supply, suggesting that the central bank needs to be equipped to manage this new aspect of the financial landscape.

The Congresswoman’s concerns are echoed by other lawmakers who have been advocating for regulations for stablecoins following the collapse of Terra’s algorithmic stablecoin, UST, last year. The House Financial Services Committee recently approved legislation to establish regulations for U.S. stablecoins.

However, Waters criticized the Republican-backed bill for not adequately involving the Federal Reserve in overseeing stablecoins. She asserted that the bill essentially allows state-regulated stablecoins like PYUSD to operate without federal oversight, which could hinder the central bank’s ability to manage economic factors like inflation and employment.

In contrast to Waters’ stance, Rep. Patrick McHenry (R-North Carolina), the Chair of the House Financial Services Committee, expressed approval of PayPal’s stablecoin launch, seeing it as a sign that stablecoins could become an integral part of the modern payment system under a well-defined regulatory framework.

The debate surrounding stablecoin regulation continues, highlighting the need for lawmakers to find common ground to ensure these emerging financial instruments’ stability, security, and effective regulation.