What’s the buzz in the crypto world this week? Let’s dive into the latest technical analysis for Bitcoin (BTC) and Ethereum (ETH), and explore what on-chain data is telling us about the current market sentiment. Ready to get started?

BTC Analysis: Decoding the Bitcoin Price Action

Weekly, Daily, and 4-Hour Breakdown

Weekly Perspective

If we zoom out to the weekly view, it’s clear Bitcoin has been in a bearish trend since that significant drop in June. For the past couple of months, the price has been navigating between the $18,000 and $24,000 range. Sound familiar?

Daily Insights: Last Week’s Expectations vs. Reality

Remember last week’s forecast? We were eyeing the $19,000 mark, anticipating a potential dip towards the $18,000 ‘Red Box’ before a bounce back upwards. Let’s see how that played out.

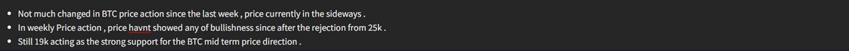

Chart 1 (Previous week )

So, what actually happened? The price action did follow the anticipated direction, but instead of hitting the $18,000 lows, it found support around $18,500 at the 4-hour demand zone. From there, Bitcoin surged to around $22,800 – a solid 22% gain from the lows! Not bad, right?

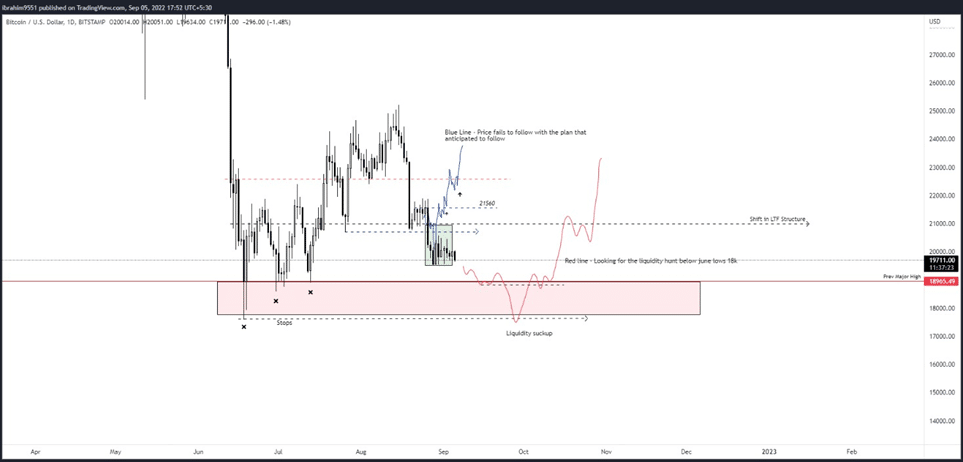

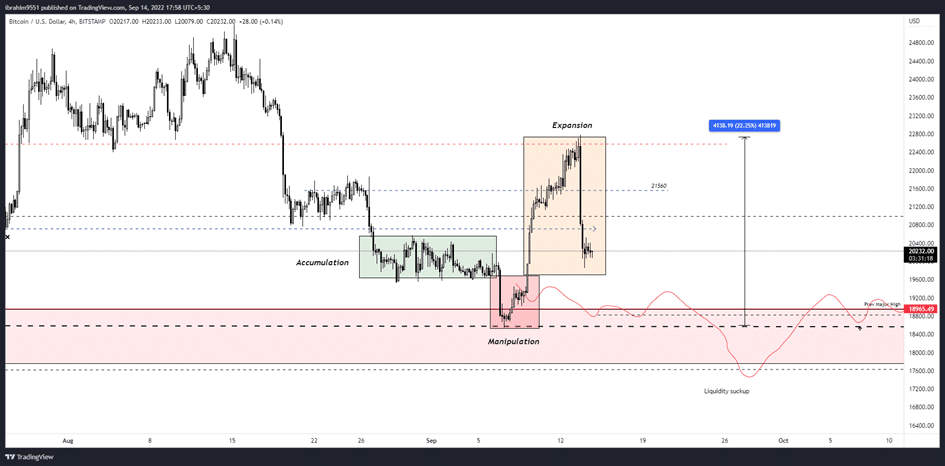

Chart 2 ( Current week)

Diving into the 4-Hour Chart

Let’s zoom in closer. On the 4-hour timeframe, the price action seems to have followed a classic three-phase pattern: Accumulation, Manipulation, and Expansion. Sound familiar to any trading strategies you use?

- Accumulation: The price consolidated between $19,600 and $20,400.

- Manipulation: A move down to the demand zone around $18,600.

- Expansion: A significant push upwards from $18,600 to $22,700.

What’s Driving the Market Now?

The crypto market’s current phase feels heavily influenced by regulatory news and macroeconomic factors. Keep an eye on traditional news outlets and the Federal Reserve’s decisions on interest rates and monetary policy – these are key drivers right now.

Yesterday’s CPI reports triggered a significant 10% drop in prices, fueled by fears of a potential 100 basis point interest rate hike. Fear can be a powerful market mover, can’t it?

With the FOMC meeting on the horizon next week, we’re in a bit of a waiting game to see how their decisions will impact the market’s direction. Patience might be key here.

Technical Outlook: Key Levels to Watch

From a technical standpoint, it’s crucial for Bitcoin to hold the $18,000 – $19,000 support zone. For the immediate future, expect more ranging and observation of how the price reacts to these key levels. Don’t expect any dramatic moves just yet.

ETH Analysis: The Merge Effect and Beyond

Daily and 4-Hour Insights for Ethereum

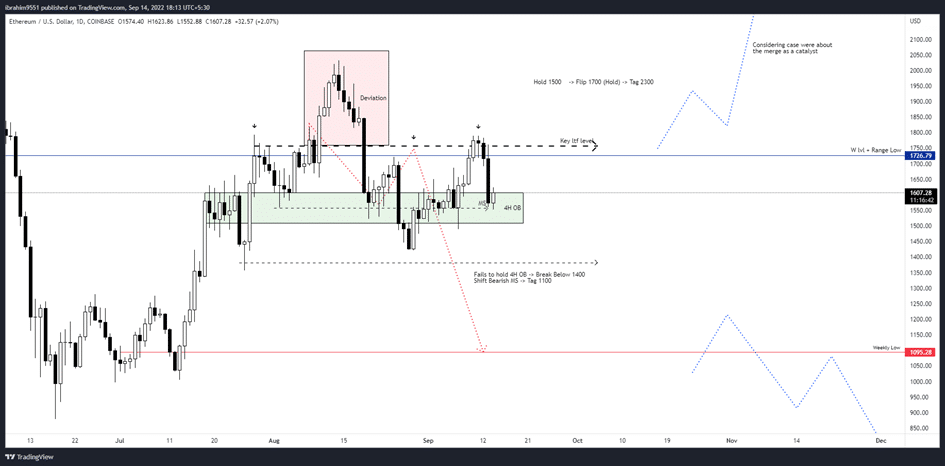

Daily Chart Analysis

Despite the highly anticipated Merge event, Ethereum’s price action hasn’t shown any overwhelming bullish momentum. It’s been trading within the $1450 – $1750 range, with a brief push above $2000. Did the hype live up to the reality?

The recent CPI news acted as a bearish catalyst at the $1726 weekly key level, leading to a price drop. Keep an eye on the red path highlighted in the chart – it’s crucial for understanding potential future movements.

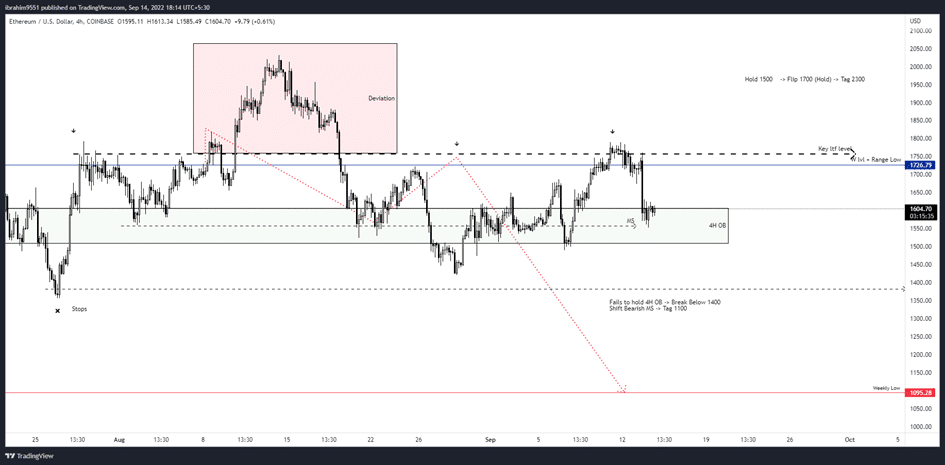

Ethereum on the 4-Hour Timeframe

Looking at the lower timeframe, the 4-hour order block continues to be a significant factor in holding the price. A break below $1400 could potentially send the price down towards the $1000 area. Something to keep a close watch on.

On-chain Analysis: Peering into the Blockchain

Want to dig deeper? On-chain metrics transform raw blockchain transaction data into valuable insights about the crypto market’s underlying health. Let’s explore one key metric.

Percent Supply in Profit: What Does It Tell Us?

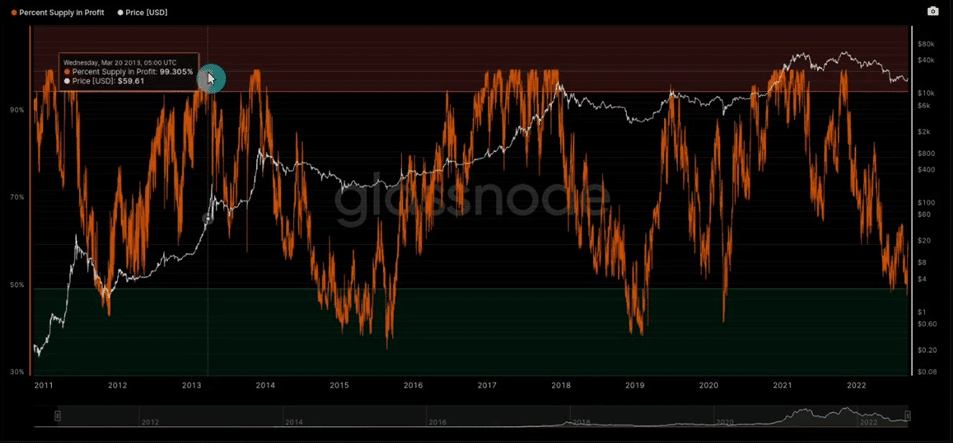

The ‘Percent Supply in Profit’ metric helps us understand two key aspects of the market:

- It gauges the major shifts between profit and loss for the total Bitcoin supply.

- It provides insights into the sentiment during consolidation periods – is it accumulation or absorption?

Let’s break down the charts:

Chart 1:

The white line represents the BTC price, while the orange line shows the percentage of the total BTC supply currently in profit or loss.

Back in the last quarter of 2013, a whopping 99% of participants holding Bitcoin were in profit. Those were the days!

Chart 2:

Fast forward to the last quarter of 2015, and the picture was quite different. Only 42% of Bitcoin holders were in profit. Market cycles can be dramatic, can’t they?

The price changes over the past two years suggest that active supply has been closely tied to Bitcoin’s price movements.

Now, let’s look at the current market data:

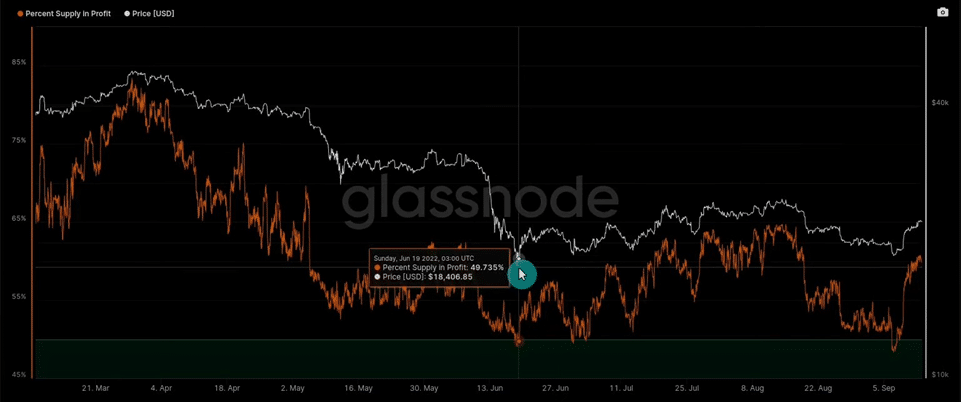

Chart 3:

Looking at the period between mid-June and now, we see that around 49.7% of participants holding Bitcoin are in profit. Interesting, right?

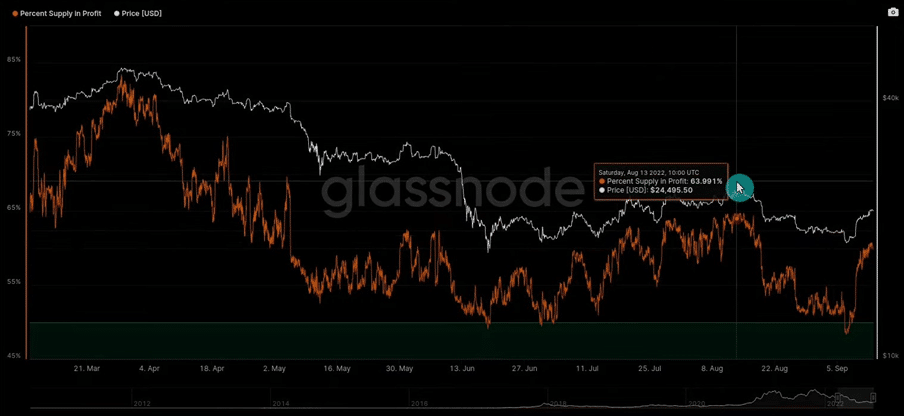

Chart 4:

At the recent high of the current range, profitability increased to 63% – a 13% jump. This suggests that roughly 13% of Bitcoin’s total supply is being actively traded, fluctuating between unrealized profit and loss.

This data hints that a significant amount of Bitcoin is being actively traded within this relatively tight price range.

Wrapping Up: Staying Informed in a Dynamic Market

The crypto market remains a fascinating and ever-changing landscape. By combining technical analysis with insights from on-chain data, we can gain a more comprehensive understanding of the forces at play. Keep an eye on those key levels for Bitcoin and Ethereum, and stay informed about macroeconomic developments. Navigating this market requires diligence and a bit of patience. Stay tuned for more updates!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.