Are you feeling a mix of excitement and maybe a little bit of apprehension in the crypto market lately? You’re not alone! The Crypto Fear and Greed Index, a key indicator of market sentiment, has just hit its highest point this year, surging into ‘Greed’ territory. But what does this mean for you and your crypto investments? Let’s dive into what’s driving this surge and what experts are predicting.

What Exactly is the Crypto Fear and Greed Index?

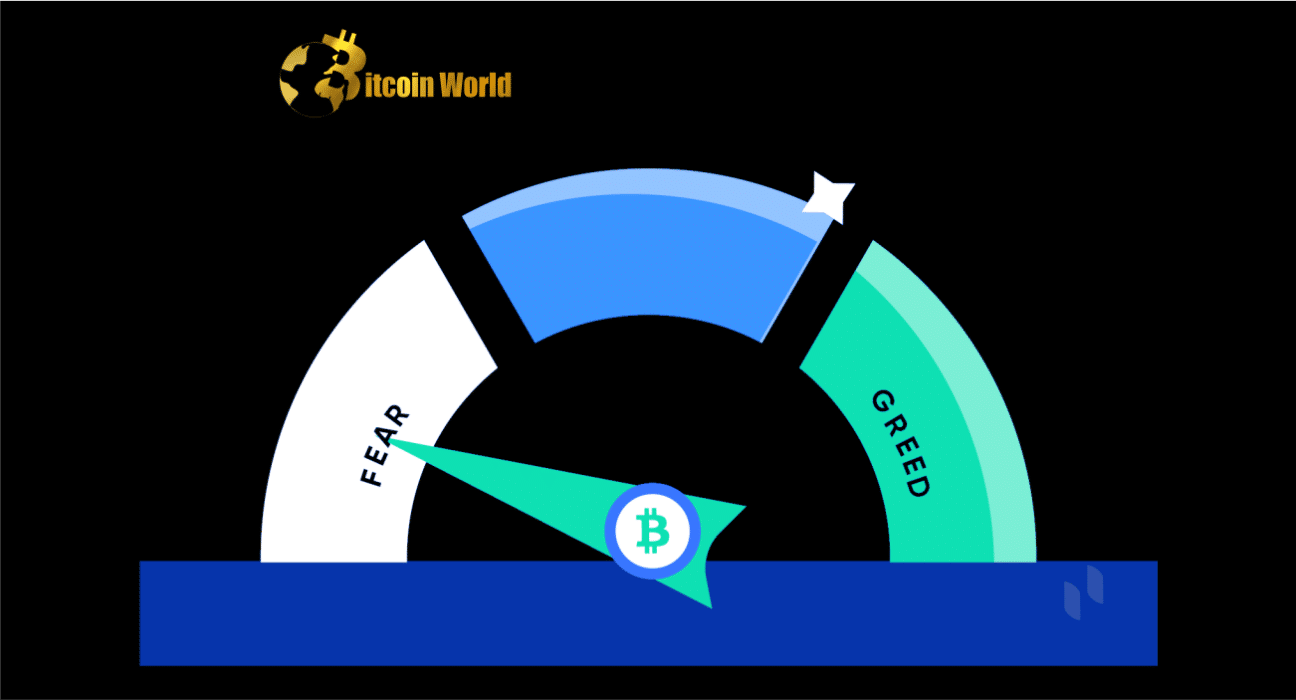

Think of the Crypto Fear and Greed Index as a snapshot of the overall emotions and attitudes swirling around Bitcoin and the wider cryptocurrency market. It’s a numerical scale from 0 to 100, where:

- 0: Extreme Fear – Signaling investors are very worried, potentially indicating a buying opportunity.

- 100: Extreme Greed – Suggesting the market is overly optimistic, which might be a sign of an impending correction or bubble.

This index aggregates data from various sources to gauge market sentiment, helping us understand whether investors are currently feeling fearful, neutral, or greedy. And right now? Well, the needle is pointing firmly towards ‘Greed’.

Greed is Back: Index Hits Levels Not Seen Since Bitcoin’s All-Time High

As of March 20th, the Crypto Fear and Greed Index registered a score of 68, firmly placing it in the ‘Greed’ zone. This is a significant jump, marking the highest level since November 2021, according to reports. To put this in perspective, the last time the index was this high (above 66) was on November 16, 2021 – just days after Bitcoin reached its historic peak of nearly $69,000 on November 10, 2021, as per Coingecko data.

Why the Sudden Shift to Greed? The Banking Crisis and Bitcoin’s Resilience

So, what’s fueling this surge in market greed? Interestingly, it seems to be linked to the recent turmoil in the traditional financial system. The collapse of Silicon Valley Bank and the subsequent instability in traditional banking have, surprisingly, boosted confidence in Bitcoin and cryptocurrencies. Investors appear to be viewing crypto as a safe haven amidst the traditional finance uncertainty.

This sentiment is reflected in Bitcoin’s price action. Coingecko data reveals that Bitcoin has experienced a remarkable rally, gaining approximately 27.8% in just seven days. This surge pushed Bitcoin to $28,000, a price point not seen since June 2022. It’s clear that the market is reacting strongly and positively to Bitcoin’s perceived resilience.

Expert Predictions: How High Could Bitcoin Go?

The rising Fear and Greed Index and Bitcoin’s price surge have naturally led to renewed optimism and bold price predictions from crypto analysts. Let’s take a look at what some experts are saying:

- Markus Thielen (Matrixport): The head of research at Matrixport, a crypto financial services firm, believes there’s still room for Bitcoin to grow. He initially set a short-term price target of $36,000 by June 2023, with a year-end forecast of $45,000. Thielen points to the ongoing “liquidity story” favoring Bitcoin as a key factor in his bullish outlook.

- Charles Edwards (Capriole): The founder and CEO of Capriole, an investment firm, is even more bullish, forecasting a $100,000 price target for Bitcoin! Edwards highlighted Bitcoin’s price action in 2023, describing it as a “Textbook flawless Bitcoin ‘Bump & Run Reversal.” He believes this pattern indicates a target price exceeding $100,000.

- Ryan Selkis (Messari): Ryan Selkis, the founder and CEO of crypto analytics firm Messari, echoes the $100,000 prediction. He attributes this potential surge to a combination of bank failures and shifts in government monetary policies, which he believes will drive increased institutional investment into cryptocurrency. Selkis sees Bitcoin as a “life raft” and a desirable alternative exit strategy in the current economic climate.

It’s important to note that while these predictions are exciting, they come with caveats. Charles Edwards himself cautioned, “Chart patterns fail; do not use this as a trading or investment strategy. Take precautions!” The crypto market is known for its volatility, and predictions are not guarantees.

Bitcoin Outperforming Traditional Assets

Adding to the bullish narrative, a March 17th note from an asset management firm highlighted Bitcoin’s impressive year-to-date performance. According to the report, Bitcoin’s returns have surpassed those of several major asset classes, including:

- Information Technology

- Gold

- NASDAQ 100

- S&P 500

This outperformance further strengthens the argument for Bitcoin as a potentially valuable asset in a diversified portfolio, especially during times of economic uncertainty.

Navigating the Greed: What Should You Do?

The Crypto Fear and Greed Index reaching ‘Greed’ levels can be interpreted in different ways. On one hand, it signals strong market momentum and positive sentiment. On the other hand, it can also be a warning sign of potential overheating and a possible market correction.

Here are a few things to consider as you navigate this market sentiment:

- Stay Informed: Keep an eye on the Fear and Greed Index and other market indicators, but don’t rely on them solely for investment decisions.

- Do Your Own Research (DYOR): Understand the projects you’re investing in and the broader market dynamics.

- Manage Risk: Never invest more than you can afford to lose. Crypto is volatile, and market sentiment can shift quickly.

- Consider Diversification: Don’t put all your eggs in one basket. Diversify your investments across different asset classes.

- Long-Term Perspective: Focus on the long-term potential of crypto rather than getting caught up in short-term market swings driven by greed or fear.

Conclusion: Greed and Opportunity in the Crypto Market

The Crypto Fear and Greed Index is flashing ‘Greed’, reflecting the current bullish sentiment in the cryptocurrency market, particularly around Bitcoin. Fueled by the banking crisis and Bitcoin’s impressive price surge, investors are feeling optimistic. While expert predictions of $100,000 Bitcoin are exciting, it’s crucial to remember the inherent volatility of the crypto market. Approach this period of ‘greed’ with cautious optimism, informed decision-making, and a robust risk management strategy. The crypto market is dynamic, and understanding market sentiment is just one piece of the puzzle in your investment journey.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.