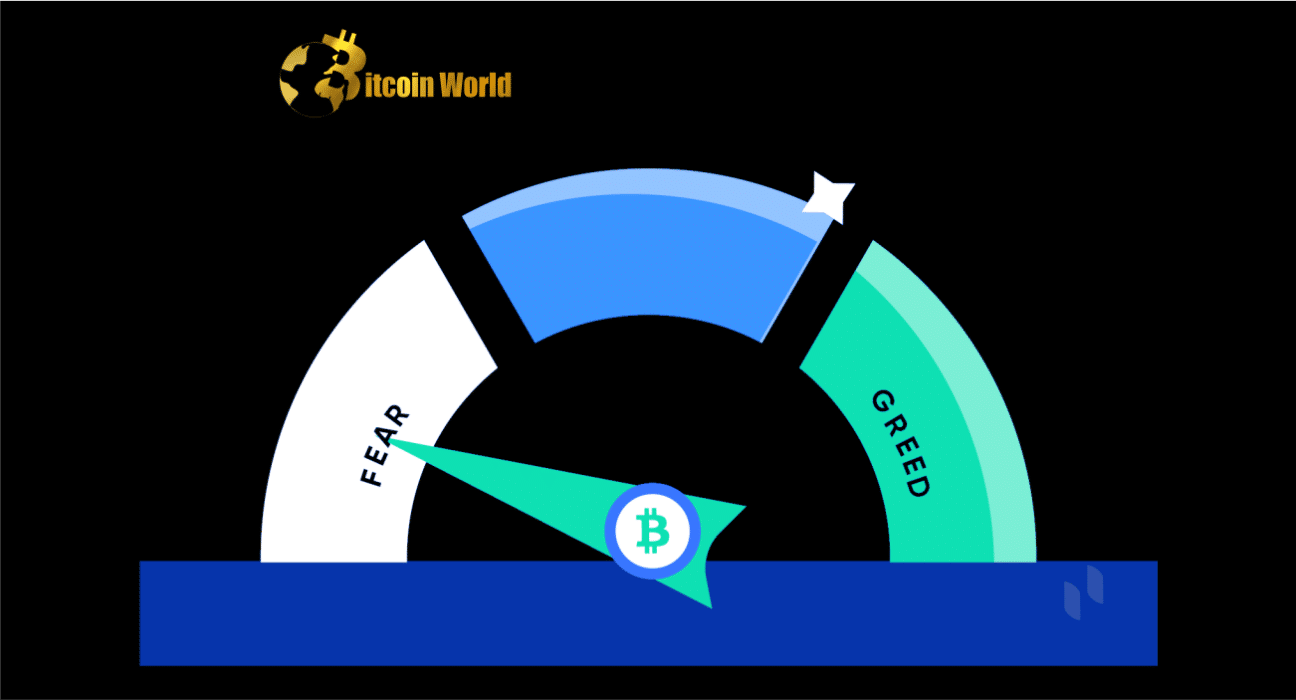

The Crypto Fear and Greed Index has reached its highest level this year, surpassing Bitcoin 27,981’s all-time high in November 2021. The Index had a score of 68 as of March 20, placing it squarely in the “Greed” category.

The Crypto Fear and Greed Index attempts to numerically represent current “emotions and attitudes” about Bitcoin and the cryptocurrency market, with a maximum score of 100.

According to Coingecko, the last time the index recorded a score above 66 was on Nov. 16, 2021, just days after Bitcoin’s all-time high of nearly $69,000 was achieved on Nov. 10, 2021. After the failure of Silicon Valley Bank and the ensuing fallout in the traditional financial system, sentiment toward Bitcoin and cryptocurrency has been optimistic.

According to Coingecko data, Bitcoin has gained roughly 27.8% in the last seven days, reaching $28,000 for the first time since June 2022. Markus Thielen, the head of research at crypto financial services Matrixport, said in a March 20 analysis that there is additional upside for BTC as the “liquidity story continues to be in Bitcoin’s favor.”

The analyst has lowered his short-term price goal to $36,000 by June 2023, with a year-end forecast of $45,000. Meanwhile, Charles Edwards, founder and CEO of investing firm Capriole, forecasted a $100,000 price goal for Bitcoin. In a March 14 tweet, Edwards described BTC price activity in 2023 as a “Textbook flawless Bitcoin ‘Bump & Run Reversal,” and he believes “the target is over $100,000” based on his reading of the data.

He did, however, mention that “Chart patterns fail; do not use this as a trading or investment strategy. Take precautions!” In a March 16 post, Ryan Selkis, founder and CEO of crypto analytics business Messari, gave a similar “rough” prediction, outlining why he thought Bitcoin may reach $100,000 in the next twelve months.

According to Selkis, a combination of bank failures and changes in government monetary policies would result in increased outside investment in cryptocurrency. “But, the trick is threading the needle so that institutions can buy it and defend it with us. “Right now, the best case scenario,” Selkis added.

“This is an optimistic future bet, as Bitcoin is viewed as a life raft and tranquil exit alternative,” he added.

The asset management stated in a March 17 note that Bitcoin’s overall returns YTD had surpassed those of information technology, gold, the NASDAQ 100, and the S&P 500, among others.