In 2022, cryptocurrency investors poured up to $4.6 billion into crypto tokens that were allegedly involved in “pump and dump” operations.

In a report released on February 16 by the blockchain analytics company Chainalysis, it was discovered that over 9,900 tokens issued in 2022 on the Ethereum and BNB Smart Chain blockchains exhibited traits of a “pump and dump” plan.

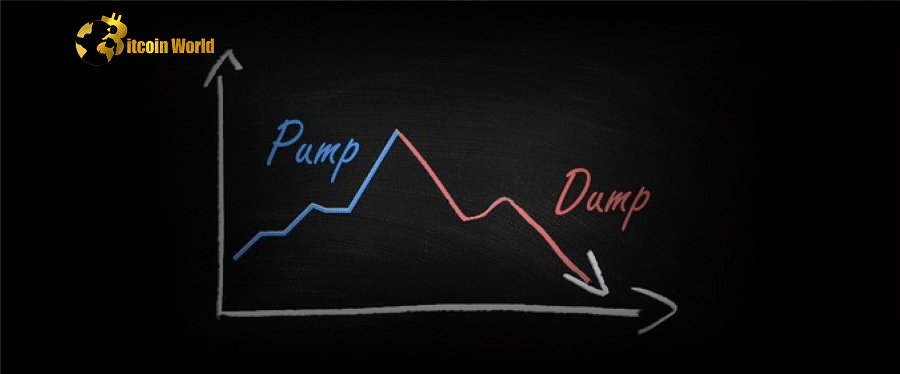

A pump-and-dump scam often entails the creators executing a campaign of false advertising, hype, and Fear Of Missing Out (FOMO) in order to convince investors to buy tokens while covertly selling their interest in the scheme at inflated prices.

Chainalysis calculated that investors purchased the almost 9,900 different suspected fake tokens it detected using crypto worth $4.6 billion.

Chainalysis stated: “Teams launching new projects and tokens can remain anonymous, which makes it possible for serial offenders to carry out several pump and dump schemes.” The most frequent alleged pump and dump inventor, who was unnamed, is accused of alone generating 264 such tokens last year.

A coin was deemed “worth examining” by Chainalysis as potentially a “pump and dump” if it had at least 10 swaps and four consecutive days of trade on decentralized exchanges (DEXs) in the week after its launch. Little about 40,500 of the 1.1 million new tokens introduced last year met the requirements.

A price fall of 90% or more in the first week for a token from this category was considered likely to be a “pump and dump” by Chainalysis. Of the 40,500 tokens examined, the company discovered that 24% met the secondary condition.

Considering that developers sometimes start several projects, Chainalysis calculated that only 445 people or groups are responsible for the alleged pump-and-dump tokens. They claim to have generated $30 million in total profits from selling their shares.

The company continued, “Of course, it’s likely that in some situations, teams engaged with token launches did their best to develop a solid product, and the ensuing dip in price was just the result of market forces.

Notwithstanding the alarming data, the company reported in a separate analysis that income from cryptocurrency scams were reduced by almost half in 2022, partly as a result of falling cryptocurrency values.