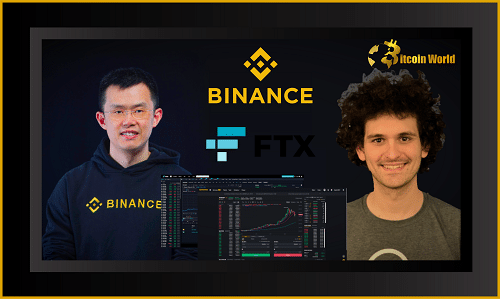

Changpeng “CZ” Zhao, CEO of cryptocurrency exchange Binance, expressed worry for traders after becoming aware of the infamous phenomena known as trade jitters on other cryptocurrency exchanges.

Jitters in cryptocurrency trading refer to a trade occurrence where a buyer’s or seller’s purchase or sell order becomes stalled and slides down the list, allowing for the execution of subsequent trade orders.

Despite the fact that CZ’s worries about jitters did not specifically mention any one exchange, the cryptocurrency community on Twitter felt it was a jab at FTX, a cryptocurrency exchange run by Sam Bankman-Fried. In response to the community’s comment that “jitters” is a common and accepted condition, CZ added:

CZ followed up with the VIP traders on Binance, who are said to have admitted being aware of the illegal trade activity. The indirect accusation against FTX perfectly matches the period of time when the exchange and four other cryptocurrency companies received cease-and-desist letters from the Federal Deposit Insurance Corporation (FDIC).

The FDIC claims that FTX US, SmartAssets, FDICCrypto, Cryptonews, and Cryptosec misled investors by asserting that their products were FDIC-insured. Brett Harrison, the president of FTX US, deleted a tweet that made the statements the FDIC refuted in response to the directive. Crypto Twitter, however, was quick to point out a number of additional occasions when Harrison misrepresented the existence of FDIC insurance.

SBF stated his intention to collaborate with the FDIC in the future while stressing the fact that “FTX US isn’t FDIC insured” in an effort to stem the freefall.

FTX has reportedly started barring accounts that have sent cryptocurrencies through zk.money, a private layer-2 chain made available by the Aztec Network on Ethereum, in conjunction to the aforementioned events.

In response, SBF supported FTX’s choice to keep an eye on the accounts, citing AML compliance. He added, “but that does not mean that any accounts were frozen,” in response to the allegations.