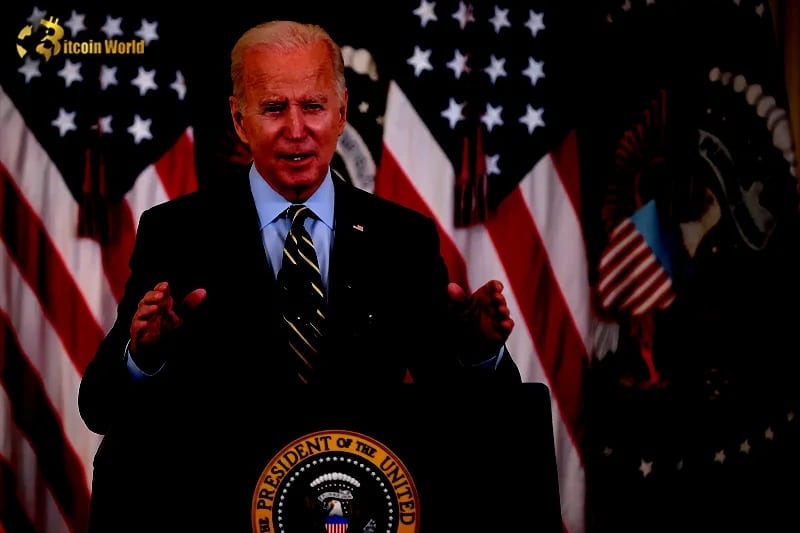

United States President Joe Biden has recently made an astonishing announcement, one that has sent ripples of amazement across the nation. He unveiled a groundbreaking decision to unshackle a staggering $127 billion student debt burden, liberating approximately 3.6 million citizens from this financial quagmire.

This proclamation has ignited a tapestry of reactions, ranging from fervent speculation regarding the impact on the cryptosphere to profound inquiries about the intricacies underpinning this debt relief initiative.

The United States Government’s Momentous Student Debt Amnesty Within the digital cacophony of X (formerly known as Twitter), President Biden’s thunderous declaration of a nationwide student debt clearance has birthed a cornucopia of responses. He reaffirmed the magnitude of this move, emphasizing that it was nothing short of “a monumental milestone.”

A prominent voice in the financial landscape, Mike Alfred, generously shared his insights with a captivated audience of 134,500 followers. He tantalizingly hinted at the possibility that this event could serve as a harbinger of positive fortunes for the enigmatic realm of Bitcoin:

“Yes, indeed, for it virtually guarantees an ascent in Bitcoin’s value.”

Nevertheless, not everyone joined the chorus of jubilation; a cloud of uncertainty loomed over some, casting shadows on the path ahead. One denizen of X expressed apprehension, dubbing it “an added burden on the shoulders of taxpayers,” while another cast doubt on the authenticity of President Biden’s declaration:

“Is it genuinely ‘canceled’ when the rest of us are left to foot the bill?”

Debt Pardon: A Potential Catalyst for Cryptocurrency Investments This debt absolution may serve as a gateway for individuals who once bore the oppressive yoke of financial indebtedness to embark on thrilling adventures in the realm of cryptocurrency.

Akin to a cosmic alignment, in January 2021, as the United States Government disbursed COVID-19 stimulus checks, the cryptocurrency market bore witness to a historic surge. The entire market’s capitalization breached the celestial threshold of $1 trillion, while Bitcoinascended to its zenith, flirting with the hallowed mark of $65,000 during that epoch.

The colossal $1.9 trillion stimulus package, adorned with $1,400 direct disbursements to the populace, not only extended a lifeline to local authorities and businesses but also set the stage for an augmentation of collective net worth.

As the words etch onto this page, Bitcoin’s value stands resolutely at $27,961, an emblem of the volatile tides coursing through the cryptoverse.

This narrative unfolds against the backdrop of a daunting milestone—the United States’ national debt has scaled unprecedented heights. On September 19, BeInCrypto solemnly chronicled the momentous occasion when the total federal debt of the United States eclipsed the colossal summit of $33 trillion. Maya MacGuineas, President of the Committee for a Responsible Federal Budget, articulated this somber milestone:

“The United States has achieved a lamentable milestone, one that offers little reason for celebration: our gross national debt has soared beyond the ominous threshold of $33 trillion.”