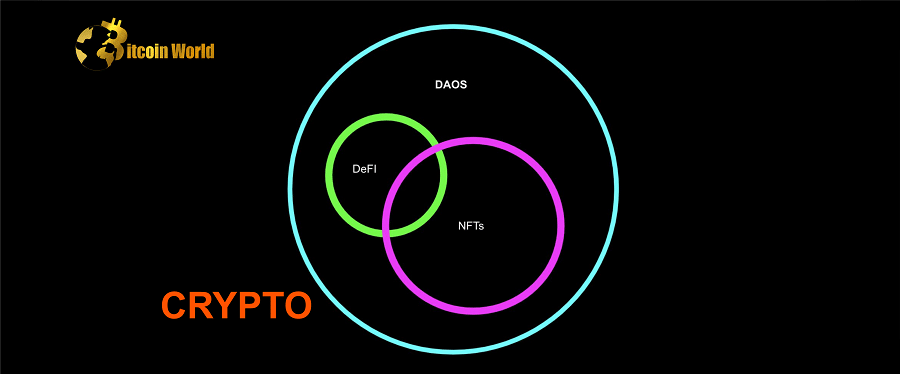

Imagine a world where donating to your favorite charity is as easy as trading digital art, where communities pool resources transparently to support global causes, and where financial aid reaches those in need directly, bypassing traditional intermediaries. This isn’t a futuristic fantasy; it’s the reality being shaped by the burgeoning world of crypto philanthropy. Non-fungible tokens (NFTs), decentralised autonomous organisations (DAOs), and decentralised finance (DeFi) are not just buzzwords in the tech world; they are fundamentally changing how charities raise funds and distribute aid in the 21st century.

Unlocking New Avenues for Charitable Giving

For years, traditional charities have relied on conventional methods of fundraising – galas, donation drives, and online platforms accepting fiat currencies. While these methods are still relevant, crypto philanthropy offers a fresh, dynamic, and potentially more impactful approach. Crypto philanthropists are witnessing firsthand the emergence of “new wealth distribution mechanisms,” enabled by the ever-evolving landscape of crypto and blockchain technology. Let’s delve into how these technologies are making a difference:

- NFTs for Fundraising: Imagine owning a unique digital artwork that not only represents a cause but also directly contributes to it. Philanthropic NFT-drop campaigns are becoming increasingly popular. Charities create and auction or sell NFTs, with proceeds directly benefiting their missions. Think of it as a digital-age charity auction where the items are unique digital assets with inherent value and collectibility.

- DAOs for Collective Impact: Decentralised Autonomous Organisations (DAOs) are revolutionizing group efforts. As Omar Antila, Product Lead at Crypto for Charity, explains, “With web3, collective decision-making organisations like DAOs can employ tools that streamline financial coordination and encourage more involvement.” DAOs offer transparency and community-driven governance, ensuring funds are managed and distributed according to the collective will of the DAO members.

- DeFi for Good: Decentralised Finance (DeFi) protocols offer innovative ways to grow charitable funds. Users can pool their crypto assets through DeFi platforms, earning interest that is then directed towards a specific cause. This allows donations to work harder, generating passive income to amplify their impact over time.

Breast Cancer Awareness and Beyond: Real-World Examples

The potential of crypto philanthropy isn’t just theoretical; it’s being demonstrated in real-world applications. During Breast Cancer Awareness Month in October, numerous breast cancer-related organizations began incorporating NFTs into their fundraising efforts. This is just the tip of the iceberg. Antila highlights the broader trend: “many other philanthropic groups formed around non-fungible tokens (NFTs), which have generated funds for a variety of worthy causes, including testicular cancer, human trafficking, and the Ukrainian war.”

UkraineDAO: A Case Study in Crypto-Powered Aid

Perhaps one of the most compelling examples of crypto philanthropy in action is UkraineDAO. This decentralised autonomous organisation made headlines by raising a staggering $6.1 million in 2022 through the sale of a 1/1 Ukrainian flag NFT. These funds were directly channeled to nonprofit organisations in Ukraine, providing crucial support to those affected by the Russian invasion. UkraineDAO showcases the speed and scale at which crypto can mobilize resources for urgent humanitarian crises.

Expanding Beyond Bitcoin and Ethereum

While Bitcoin (BTC) and Ether (ETH) currently dominate as the cryptocurrencies of choice for donations, the future of crypto charity is poised for diversification. Anne Connelly, co-author of “Bitcoin and the Future of Fundraising,” predicts a broader acceptance of various tokens. She notes:

“Over time, however, we’ll see organizations accepting a much larger spread of tokens — similar to how they would accept gifts of securities. We’ll also see gifts of NFTs and other tokenized assets like real estate or collectibles.”

This evolution will open up new possibilities for donors to contribute using their preferred cryptocurrencies and even donate tokenized real-world assets, further bridging the gap between the traditional and digital worlds of philanthropy.

The Untapped Potential: Reaching the Unbanked

One of the most transformative aspects of crypto philanthropy lies in its potential to reach underserved populations. Antila emphasizes the vastness of the crypto space, suggesting a correspondingly vast total addressable market for crypto philanthropy. He believes that the world’s “2 billion or so unbanked adults” will soon have the means “to engage in the global economy, transact, and build wealth without third parties getting in the way or demanding a piece.”

This is particularly significant in regions where trust in traditional financial institutions is low, and crypto adoption is high. Connelly points to countries like Nigeria, Argentina, Vietnam, and South Africa as examples where high crypto adoption rates are driven by a lack of faith in national monetary systems. In these contexts, cryptocurrency offers not just an alternative financial tool but a lifeline.

She further elaborates on the impact of inflation:

“More than half of the world’s population is subjected to double, treble, or quadruple inflation rates. Most individuals do not believe their governments can properly control the monetary system. Having the option to use cryptocurrency is an essential alternative for citizens, but it also demonstrates to governments that if they want people to use their fiat money, they must clean up their act,”

The Future is Decentralised and Distributed

Crypto philanthropy is more than just a trend; it’s a paradigm shift in how we approach charitable giving. It leverages the power of blockchain technology to create more transparent, efficient, and accessible systems for fundraising and aid distribution. As more organizations recognize the potential of this donor segment, we can anticipate a future where crypto donation platforms become as commonplace as credit card processing for charities. This decentralized approach empowers individuals, fosters global communities, and ultimately promises to reshape the landscape of philanthropy for the better.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.