Donations in cryptocurrency are much more than just peer-to-peer Bitcoin and Ether transactions.

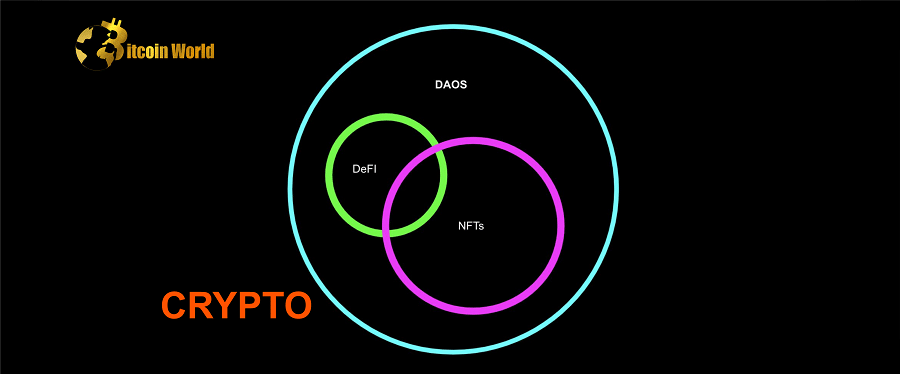

Non-fungible tokens (NFTs), decentralised autonomous organisations (DAOs), and decentralised finance (DeFi) are changing the way charities raise cash and distribute them to those in need.

Crypto philanthropists told Cointelegraph that they’ve experienced “new wealth distribution mechanisms” never seen before thanks to ever-evolving crypto and blockchain-related technology.

“With web3, collective decision-making organisations like DAOs can employ tools that streamline financial coordination and encourage more involvement,” noted Omar Antila, Product Lead at Crypto for Charity.

“Crypto allows for new and novel fundraising techniques, such as philanthropic NFT-drop campaigns or allowing users to pool their crypto cash via decentralised finance (DeFi) protocols that earn interest for a specific cause,” he noted.

A number of breast cancer-related groups began implementing NFTs in October to commemorate Breast Cancer Awareness Month.

Antila said that he has seen many other philanthropic groups formed around non-fungible tokens (NFTs), which have generated funds for a variety of worthy causes, including testicular cancer, human trafficking, and the Ukrainian war.

UkraineDAO, a decentralised autonomous organisation, raised $6.1 million last year for a 1/1 Ukrainian flag nonfungible token (NFT). The proceeds went to nonprofit groups in Ukraine that support those harmed by the Russian invasion.

Meanwhile, Anne Connelly, co-author of “Bitcoin and the Future of Fundraising,” believes the crypto charity industry will soon extend beyond Bitcoin (BTC) and Ether (ETH), which are currently the most popular cryptocurrencies for donations:

“Over time, however, we’ll see organizations accepting a much larger spread of tokens — similar to how they would accept gifts of securities. We’ll also see gifts of NFTs and other tokenized assets like real estate or collectibles.”

“I believe that if […] more organisations recognise the charitable potential of this donor segment, every institution will have a crypto donation platform, just as every organisation accepts credit cards,” she continues.

According to Antila, the vastness of crypto means that the total addressable market for crypto philanthropy is also vast.

Antila believes that the world’s “2 billion or so unbanked adults” will soon have the means “to engage in the global economy, transact, and build wealth without third parties getting in the way or demanding a piece.”

This may be especially true in countries where trust in the state’s monetary system is low, and when crypto adoption rates are high.

Connelly claims that impoverished countries have the highest adoption rates, citing Nigeria, Argentina, Vietnam, and South Africa as examples, since people simply cannot trust their country’s monetary system:

“More than half of the world’s population is subjected to double, treble, or quadruple inflation rates. Most individuals do not believe their governments can properly control the monetary system.

“Having the option to use cryptocurrency is an essential alternative for citizens, but it also demonstrates to governments that if they want people to use their fiat money, they must clean up their act,” she added.