Decentralized finance (DeFi) investors have locked in over $67 million worth of stablecoins in a new yield farming project called APY.Finance within one hour of its launch.

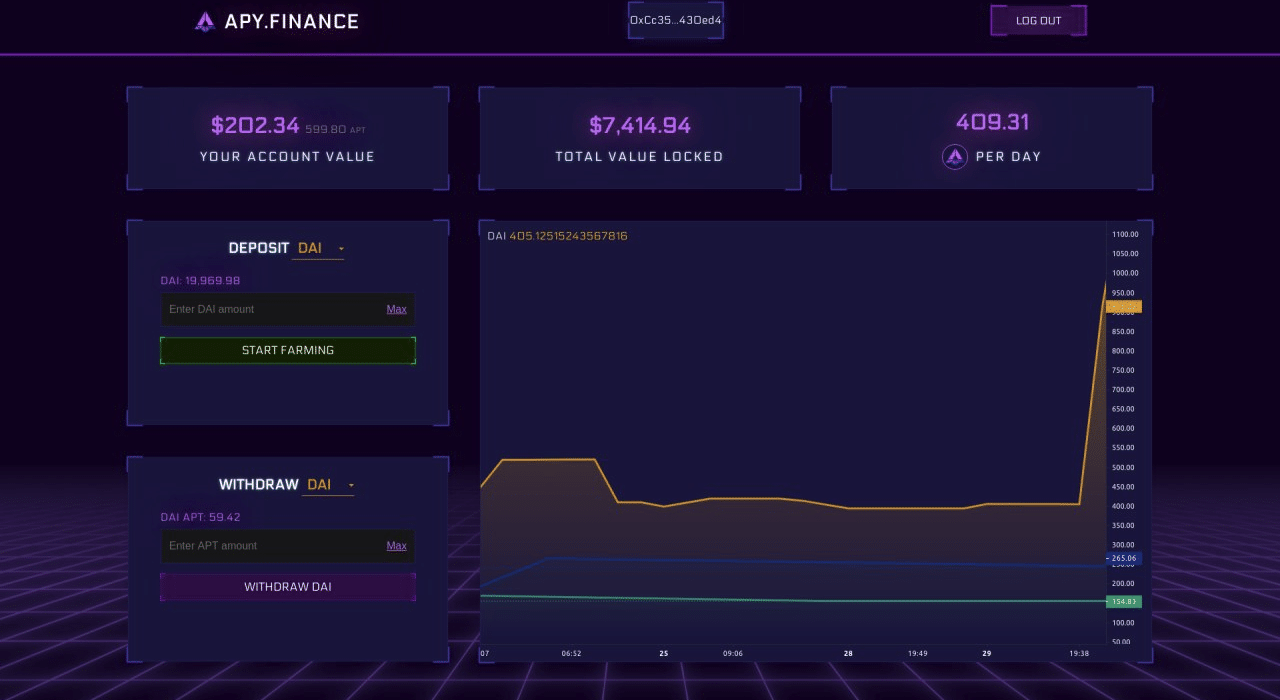

APY.Finance uses smart contracts to help uses generate as much interest as possible from liquidity provided to various other DeFi platforms using DAI, USDC, and USDT. Users are also rewarded with the platform’s APY governance token for adding liquidity.

In a blog post, the project reveals the first month will see liquidity miners earn 900,000 APY tokens, with “incentivization details” varying month-to-month. In total, 31.2 million APY tokens will be mined, and these represent 31.2% of its total supply.

As Cointelegraph reports, the APY token distribution model has raised concerns in the cryptocurrency community, with some arguing regular users will not be able to compete with whales and venture capitalists on the project, which raised $3.6 million in a private sale with investments from Arrington XRP Capital, Alameda research, and others.

While it isn’t clear how many tokens were sold at what prices on this private sale, the project’s token distribution model sees 20% of the tokens going to seed round investors at $0.09, and 16,5% going to strategic investors at $0.135 per token. A further