Dogecoin (DOGE), the meme-turned-crypto sensation, has seen a notable price dip recently. If you’re keeping an eye on your DOGE holdings or considering jumping in, you’re probably asking: what’s behind this downward trend and what could be on the horizon? Let’s dive into the latest Dogecoin price movements and market indicators to understand what’s happening.

Dogecoin Price Overview: Recent Performance

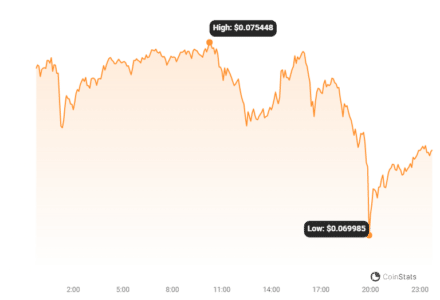

Over the past 24 hours, Dogecoin’s price has decreased by 7.43%, landing at approximately $0.07. This continues a week-long downward trend where DOGE has slipped by 1.0% from a previous price point of $0.07. While a daily dip might be common in the crypto world, understanding the context is crucial. Let’s break down the key factors contributing to this price action.

Volatility Check: How Bumpy is the DOGE Ride Right Now?

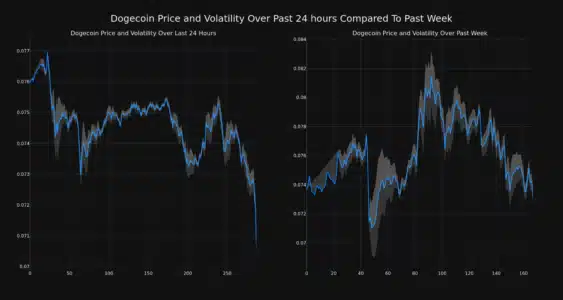

Cryptocurrencies are known for their volatility, and Dogecoin is no exception. To visualize this, Bollinger Bands are a helpful tool. These bands measure price fluctuations over a set period, giving us an idea of market volatility. Take a look at the chart below:

The gray bands illustrate Dogecoin’s volatility over the last 24 hours (left) and the past week (right). Wider bands indicate higher volatility, meaning larger price swings. Currently, the bands suggest moderate volatility in both the daily and weekly timeframes. This implies that while there are price movements, they aren’t exceptionally erratic compared to typical crypto market behavior.

Diving Deeper: Trading Volume and Circulating Supply

Beyond price and volatility, other factors influence a cryptocurrency’s market dynamics. Let’s examine Dogecoin’s trading volume and circulating supply:

- Trading Volume: Over the past week, Dogecoin’s trading volume has decreased by a significant 17.0%. A drop in trading volume can sometimes indicate waning interest or reduced market activity, potentially contributing to price stagnation or decline.

- Circulating Supply: Interestingly, while trading volume decreased, the circulating supply of DOGE has slightly increased by 0.35% over the past week. This brings the total circulating supply to 141.83 billion coins. An increase in circulating supply, without a corresponding increase in demand, can sometimes exert downward pressure on price.

Market Cap and Ranking: Where Does DOGE Stand?

Despite the recent price dip, Dogecoin remains a significant player in the crypto market. Currently, DOGE holds the #10 market cap ranking, with a market capitalization of $10.20 billion. This ranking reflects the overall value of all circulating Dogecoin and highlights its continued popularity and market presence.

What Does This Mean for Dogecoin Investors?

The recent data paints a picture of a slight downward trend for Dogecoin, accompanied by reduced trading volume and a minor increase in circulating supply. Here’s a quick recap of key takeaways:

- Price Decrease: Dogecoin’s price has decreased in both the short-term (24 hours) and the slightly longer term (past week).

- Moderate Volatility: Volatility remains within typical crypto ranges.

- Decreased Trading Volume: Lower trading volume could signal reduced market enthusiasm or activity.

- Increased Circulating Supply: A slight increase in supply might contribute to price pressure.

Important Note: This analysis is based on recent market data and should not be taken as financial advice. The cryptocurrency market is inherently volatile and unpredictable. Always conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

In Conclusion: Navigating the DOGE Waters

Dogecoin’s recent price action reflects the dynamic nature of the cryptocurrency market. While the current trend is downward, understanding the underlying factors like volatility, trading volume, and circulating supply provides valuable context. Whether this dip presents a buying opportunity or signals a longer-term trend requires further monitoring and your own informed investment decisions. Stay informed, do your research, and navigate the crypto waters wisely!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.