The total number of transactions on the Ethereum network more than quadrupled that of Bitcoin, but Bitcoin remained the most searched cryptocurrency in 2022.

Last year, the Ethereum network surpassed Bitcoin in terms of total transaction volume, though the king of crypto has retained its lead in terms of online search interest.

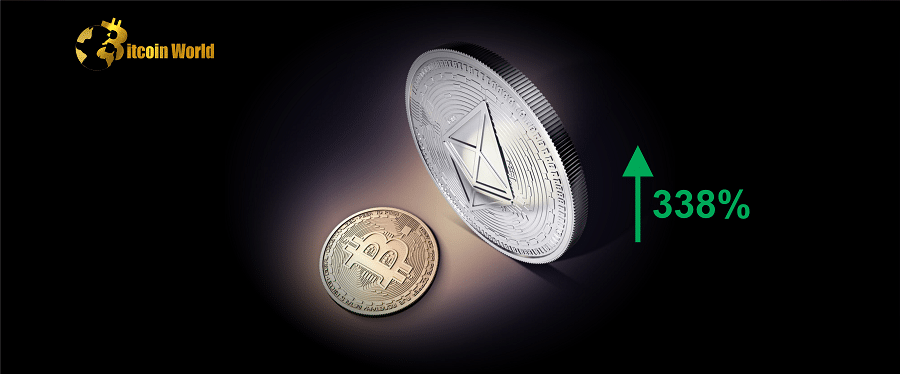

According to Nasdaq and Ycharts data shared on Reddit on January 2, Ethereum had 338% more total transaction volume (408.5 million) in 2022 than the Bitcoin network (93.1 million).

The values in the chart are in millions of transactions, with the average daily transaction volume for ETH being around 1.1 million and 255,000 for BTC.

However, transaction volumes on the Bitcoin network were more consistent and periodic than those on the Ethereum network, which experienced much greater volatility in transaction volumes. This was due to demand spikes at specific times, such as NFT launches and other gas-guzzling events, such as XEN minting.

According to Bitinfocharts, Ethereum’s larger transaction volumes have continued into the new year, with the Ethereum transaction count on Jan. 2 reaching 924,614, a 300% increase over Bitcoin’s 229,191 on the same day.

The analyst who posted the metrics expressed his “scepticism about people saying that a flippening could happen someday,” but added that those advocating for it now have reason to do so.

A flippening happens when one chain outperforms another for the same metric, in this case, transactions and activity.

The charts also exclude layer 2 transactions, which would put Ethereum ahead of Bitcoin in this metric. According to L2beat, the number of L2 transactions per second (TPS) surpassed layer 1 Ethereum in mid-October and has remained higher ever since.