Ether supply deflation reached a year-high lately. The Annualized EIP-1559 Burn Rate exceeded the ETH Issuance Rate by 1.425% on Wednesday, the biggest since a one-day deflation rate of 17% last May. When deflation rises, ETH tokens become scarcer faster. Most analysts expect this to enhance bitcoin prices over time.

ETH/near-5.0% USD’s decrease on Friday, as crypto markets fall on fears over crypto bank Silvergate and claims that Tether committed fraud to keep access to the global financial system, indicating traders aren’t paying much heed to recent developments in the ETH deflation rate.

ETH/USD is down 10% from its mid-$1,700 highs, trading at $1,570. ETH’s deflation rate isn’t dropped since February. It’s rising. ETH might rise later this year if deflation becomes a discussion concern. Ethereum network enhancements, such as the debut of staked ETH withdrawals next month, a DeFi revival, and a macro background improvement if a US recession can be averted and decreasing inflation allows the US Federal Reserve to decrease rates may also help.

Before answering the issue of what is causing the growth in ETH deflation, we need to understand why ETH deflation occurs, which needs a knowledge of the Ethereum network fee structure. Network costs are two-part. All users must pay a basic charge to process their transactions on the blockchain.

Users can tip to expedite their transaction. The Ethereum network automatically calculates the basic fee, which grows during peak traffic. In the August 2021 London hardfork, Ethereum Improvement Proposal (EIP) 1559 mandated that all base fees paid by users be destroyed, permanently removing the tokens from circulation.

Ether burns faster when the basic gas charge rises. The ETH supply will decrease when this burn rate reaches the 0.55% ETH Issuance Rate. Nodes and stakers safeguard Ethereum with ETH. Recent Ethereum network (base) gas fees are shown below. Early 2022 saw a 6.0% daily annualized ETH (EIP 1559) burn rate due to network congestion. At the time, Ethereum’s issuance rate was 4.4-4.6% each year because to the miners’ increased energy expenses and miner rig costs due to the proof-of-work consensus process.

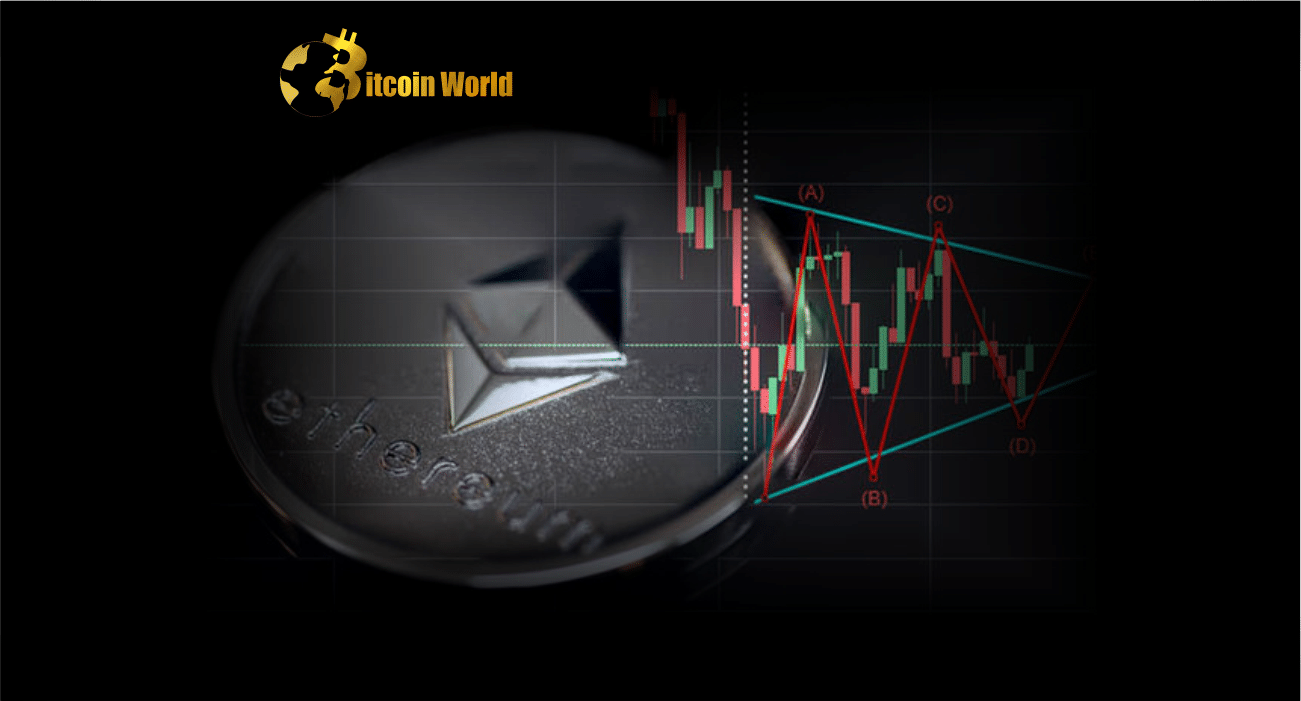

Ether deflation peaked at 1.5%. If a bitcoin and DeFi market recovery boosts the EIP 1559 burn rate to its early 2022 highs, the new considerably lower burn rate will Ether might deflate 5.5% due to ETH Issuance Rate. While ETH deflation sounds thrilling, investors may need to be patient as the near-term forecast for the world’s second-largest cryptocurrency by market value is rocky. ETH’s recent dip broke a 2023-long uptrend.

Ether may reach February lows in the mid-$1,400s. The robust comeback in US stock markets on Friday might avoid crypto market declines next week. ETH may stay in its February mid-$1,400s to mid-$1,700s range.