- Chinese Bitcoin miners are shifting to Ethiopia as their destination for its low energy costs and favorable policies amid global industry challenges.

- Ethiopia’s appeal is boosted by cheap, dam-sourced electricity and Chinese-built infrastructure, attracting crypto-mining operations.

- The move carries risks, given past backlashes against mining for energy use, but Ethiopia’s potential rewards draw significant interest.

Chinese Bitcoin miners have set their sights on Ethiopia, marking a significant shift towards the Horn of Africa as a new hub for their operations.

This pivot comes in the wake of stringent regulations and rising electricity costs in other parts of the world, with Ethiopia emerging as a particularly attractive destination due to its low energy prices and increasingly accommodating government policies.

Ethiopia’s Appeal To Chinese Bitcoin Miners

The Grand Ethiopian Renaissance Dam, Africa’s largest, has become a focal point for crypto miners, especially those from China, seeking refuge from the political and economic challenges that have marred their operations elsewhere.

See Also: Abu Dhabi Partners With Solana Foundation To Develop Distributed Ledger Technology (DLT)

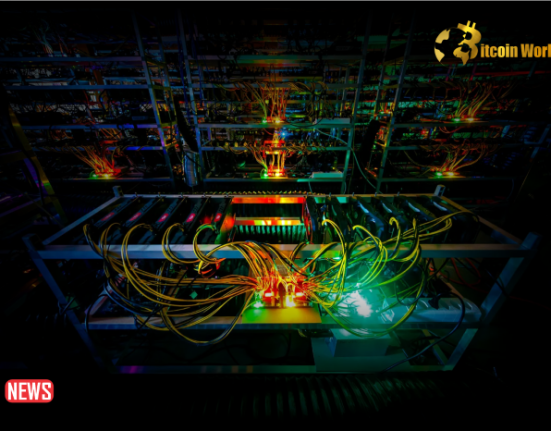

The presence of cargo containers filled with high-performance computing equipment near electricity substations linked to the dam clearly indicates the country’s rising prominence in the cryptocurrency mining sector.

Ethiopia’s allure is not limited to its cheap power; despite its prohibition on cryptocurrency trading, the government’s openness to Bitcoin mining signals a warming relationship with the industry.

The dam, a $4.8 billion project with significant Chinese involvement, epitomizes the country’s potential as a low-cost energy hub for crypto-mining endeavors.

Mining companies are drawn to Ethiopia for its competitive electricity rates, with the state power monopoly striking deals with 21 Bitcoin miners, most Chinese.

This trend is set against a backdrop of global challenges facing the industry, including environmental concerns and power shortages, making Ethiopia stand out as a rare opportunity for firms looking to maintain their competitive edge in Bitcoin mining.

Navigating Risks And Rewards

The shift towards Ethiopia is not without its risks, however.

Previous examples from Kazakhstan and Iran have shown that countries initially welcoming Bitcoin mining can quickly change their stance when energy consumption by miners begins to compete with domestic needs, leading to public discontent and regulatory clampdowns.

Ethiopia faces its challenges, with nearly half its population lacking access to electricity, making the expansion of Bitcoin mining a delicate issue.

Yet, the potential for foreign exchange earnings through locally produced electricity is an enticing prospect for the Ethiopian government.

Companies like Luxor Technology and BWP have already initiated significant regional investments, with plans to open large-scale data centers for mining equipment.

The fixed electricity rate offered to miners and Ethiopia’s ideal climate conditions for mining operations underscore the country’s attractiveness as a mining location.

Moreover, the geopolitical ties between China and Ethiopia, reinforced by extensive Chinese investment in the country’s infrastructure, provide a stable foundation for the growth of cryptocurrency mining activities.

See Also: South Korean Web3 Game Developer Wemade Under Investigations for Allegedly Evading Registration

Ethiopia’s emergence as a new crypto haven reflects the ongoing search for regions that offer a blend of economic incentives, political stability, and access to cheap, renewable energy sources.

With careful management and collaboration between miners and government authorities, Ethiopia could become a significant player in the global Bitcoin mining ecosystem, rivaling established hubs like Texas.

#Binance #WRITE2EARN