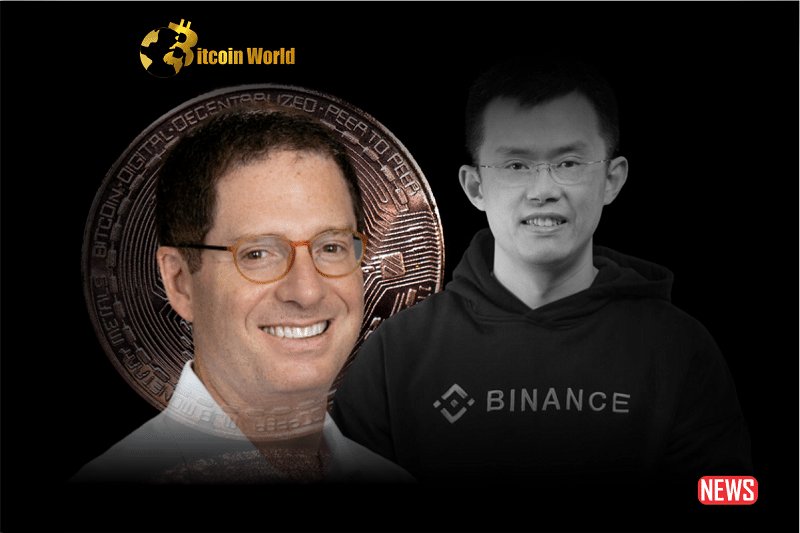

In a recent development, court documents have shed light on the reasons behind Brian Brooks’ departure as the CEO of Binance US. In an interview transcript with the US Securities and Exchange Commission (SEC), Brooks revealed insights into Binance CEO Changpeng Zhao’s role and the discrepancies he encountered during his tenure.

Brian Brooks stated in the court documents that he realized Changpeng Zhao (CZ) was the true CEO of BAM Trading, the entity behind Binance.US, not him. BAM Trading and BAM Management, affiliated with Binance.US, are central to recent enforcement action against Binance. Brooks resigned approximately four months after assuming it, citing differences in vision and decision-making authority.

Before joining Binance.US, Brooks served as the Acting Comptroller of the Currency, a regulatory role within the US Treasury overseeing national banks and federal savings associations. During his SEC interview in 2021, Brooks emphasized the distinction between governance and management, highlighting the CEO’s responsibility in the latter. He expressed being “overruled” in attempts to address certain issues, leading him to realize that he was not the one truly in charge and that the company’s mission differed from his initial expectations.

The SEC’s legal action against Binance and CZ accuses them of a “blatant disregard of the federal securities laws” and includes 13 charges. The crux of the allegations revolves around Binance’s creation of BAM Management and BAM Trading as a scheme to evade US laws. Binance claimed that Binance.US operated independently, but the SEC asserts that Zhao and Binance retained significant control over the US entity. This revelation adds to the mounting legal troubles faced by Binance and its CEO, raising questions about their compliance with regulatory frameworks.

Brian Brooks’ departure from Binance.US, as revealed in court documents, highlights the internal challenges faced by the company and sheds light on the alleged regulatory violations leading to the SEC’s legal action. As the investigation unfolds, it remains to be seen how these revelations will impact Binance, its operations, and the cryptocurrency industry as a whole.