Kevin Rooke Self -reliant developer plans that Grayscale has increased the amount up to its bitcoin stockpile to a rate parallel to 150% of the new BTC mined after the halving.

Crypto fund manager Grayscale Investments is gathering Bitcoin at a rate similar to 150% of the new coins developed by miners from the May 11 block reward halving.

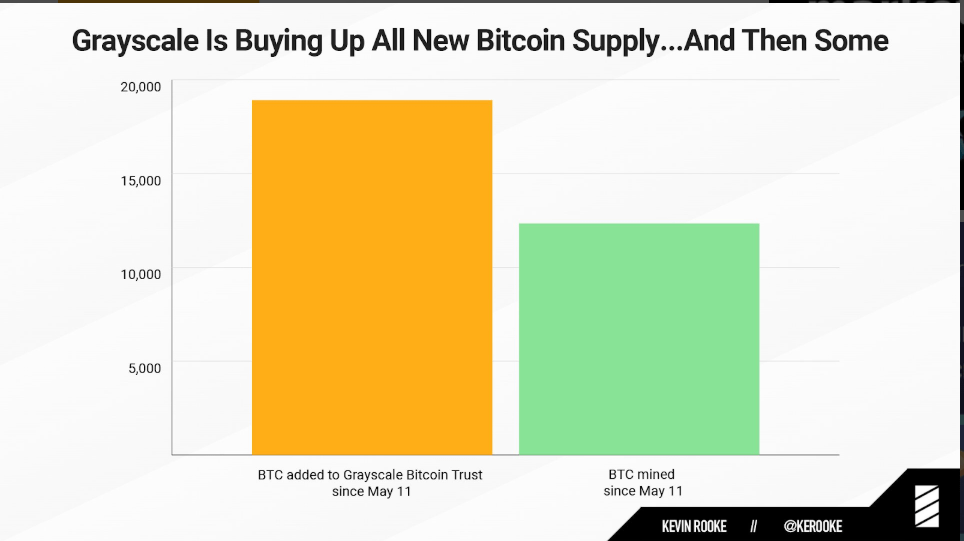

Kevin Rooke, self-reliant Grayscale, released information that Grayscale has added 18,910 BTC to its Bitcoin Investment Trust since the halving, and from 11 May 12,337 Bitcoins have been mined only.

CEO, Changpeng Zhao Binance released the chart again, commenting: “There isn’t enough new supply to go around, even for just one guy”.

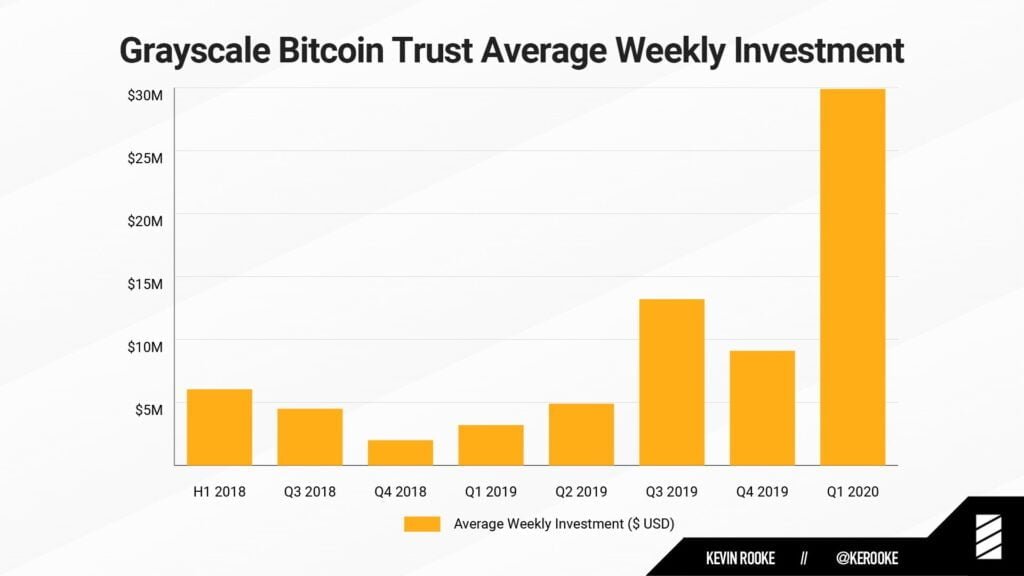

According to Kevin, Grayscale has bought around 34% of the total mined coins in Q1 if 2020. Grayscale accumulated 60762 BTC over days. The average weekly investment in Q1 2020 is $29.9 million that is more than 800% growth over a year.

Kevin latest data shows that Grayscale has increased the buying of bitcoin by 100% as compared to Q1 2020. The average daily buying in Q1 is 607.62 BTC which is now increased to 1112.35 BTC daily.

Grayscale Echos Off On CBDCs

In the latest feedback issued by Grayscale, the company desired to reproof analogies differentiating to central bank-issued digital currencies (CBDC).

“CBDCs are sometimes viewed as synonymous to, or as replacements for, digital currencies like Bitcoin, but they represent a meaningful departure from the decentralized protocols inherent to many cryptocurrencies,” the report stated.

Grayscale added :

“CBDCs attempt to upgrade payment infrastructure while Bitcoin is an attempt to upgrade money. If CBDCs gain traction, they may actually bolster the value proposition for Bitcoin and other digital currencies,”

The report entitled the feeling of economist John Vaz, who just said to Cointelegraph that CBDCs contain “a kind of rearguard action being fought by the central banks because they don’t like cryptocurrency”.

Vaz noticed “Central bank digital currencies are probably more about tracking money than providing benefit.”

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.