Are you chasing high yields in the crypto world? Then you’ve probably heard of Anchor Protocol (ANC), the Terra-based platform known for its juicy yields on stablecoin deposits. But recently, a proposal to dial down those lucrative rates sparked a heated debate within the ANC community. Let’s dive into what happened and what it means for you.

The Yield Rate Showdown: Why the Fuss?

Anchor Protocol has been turning heads (and attracting deposits!) with its impressive ~20% APY on USDTerra (UST) deposits. That’s significantly higher than what you’d typically find with traditional stablecoins like Tether (USDT), USD Coin (USDC), or Binance USD (BUSD), which offer yields up to 12%. This high yield is a major draw, but some big players in the crypto space, namely Polychain Capital and Arca, raised concerns about its sustainability. They proposed a yield rate cut, aiming for a gradual decrease, potentially reaching as low as 10% for accounts holding over 500,000 UST.

Why the proposed cut?

- Sustainability Concerns: The core issue is the long-term health of the protocol. While high yields attract users, they also need to be funded. Anchor Protocol generates yield by lending out UST and using a yield reserve.

- Reserve Depletion: With deposits outpacing borrowing by a significant margin (deposits are over four times the borrowers!), the yield reserve has been shrinking. This prompted the discussion about adjusting the rates.

- Controlled Reduction: The proposal wasn’t a sudden drop to 10%. It was a gradual reduction, especially targeting larger accounts, to make the system more balanced and sustainable.

The Community Speaks: A Resounding ‘NO’

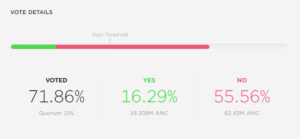

The proposal was put to a vote, and the ANC token holders made their voices heard loud and clear. As of Saturday, with roughly 72% of token holders participating, a significant 55% voted against the yield rate reduction. This demonstrates a strong desire within the community to maintain the current high yields.

Why did the community reject the proposal?

- High Yields are the Attraction: For many users, the 20% APY is the primary reason they use Anchor Protocol. Lowering it could diminish its appeal and potentially lead to an outflow of deposits.

- Complexity Concerns: Some community members on platforms like Twitter voiced concerns that the proposed changes would make the protocol’s programming overly complicated, potentially impacting its stability and user experience.

- Faith in Current Model: A portion of the community likely believes in the current model and its ability to sustain the 20% yield, or they are willing to take the risk for the higher returns.

ANC, which was created by the same people who created Terra, presently has the highest stablecoin yield on the market, at around 20%. In comparison, major stablecoins like Tether, USD Coin, and Binance USD have yields of up to 12%.

What Does This Mean for Anchor Protocol and You?

The ‘no’ vote signifies a strong commitment from the ANC community to prioritize high yields, at least for now. However, it also brings up some important questions and considerations:

Key Takeaways and Potential Impacts:

- Short-Term High Yields: For the immediate future, users can likely continue to enjoy the ~20% APY on UST deposits in Anchor Protocol.

- Long-Term Sustainability Question: The underlying concerns about the yield reserve and long-term sustainability haven’t vanished. The community and developers will need to find other solutions to ensure the protocol’s health.

- Potential Volatility: The uncertainty surrounding the yield rate and the ongoing debate can introduce volatility in the prices of ANC and LUNA. As the article mentions, both tokens saw price dips after the vote.

- Community Governance in Action: This vote is a prime example of decentralized governance in action within the crypto space. ANC token holders have real power to influence the direction of the protocol.

Is Anchor Protocol Still a Good Option?

That depends on your risk tolerance and investment goals. Anchor Protocol offers attractive yields, but it’s crucial to be aware of the potential risks and the ongoing discussions about its sustainability. Like all things in crypto, especially DeFi, it’s essential to do your own research (DYOR) and understand the protocols you are engaging with.

Here’s a quick comparison of stablecoin yields:

| Stablecoin | Platform (Example) | Approximate Yield (APY) |

| USDTerra (UST) | Anchor Protocol | ~20% |

| Tether (USDT) | Various Exchanges/Platforms | Up to 12% (lower on many major platforms) |

| USD Coin (USDC) | Various Exchanges/Platforms | Up to 12% (lower on many major platforms) |

| Binance USD (BUSD) | Various Exchanges/Platforms | Up to 12% (lower on many major platforms) |

Despite the community’s decision, the fluctuating prices of ANC and LUNA highlight the market’s sensitivity to these developments. LUNA, the native token of Terra, dipped by 4.4% in the last 24 hours, moving away from the $100 mark, while ANC saw a larger drop of 11% to $3.42. This illustrates the inherent volatility in the crypto market and the impact of governance decisions on token values.

In Conclusion: Community Wins This Round, But the Conversation Continues

The ANC token holders’ vote is a clear message: they value the high yields offered by Anchor Protocol and are hesitant to see them reduced. While this is a victory for those seeking high returns, the underlying questions about long-term sustainability remain. The crypto community will be watching closely to see how Anchor Protocol navigates these challenges and continues to offer compelling yields in a sustainable manner. Stay tuned for further developments in this evolving space!

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.